The impact of the technology tantrum on US corporate bond valuations

It is fair to say that markets have become more lively of late. One sector in particular has been the epicentre of revived market volatility – Technology.

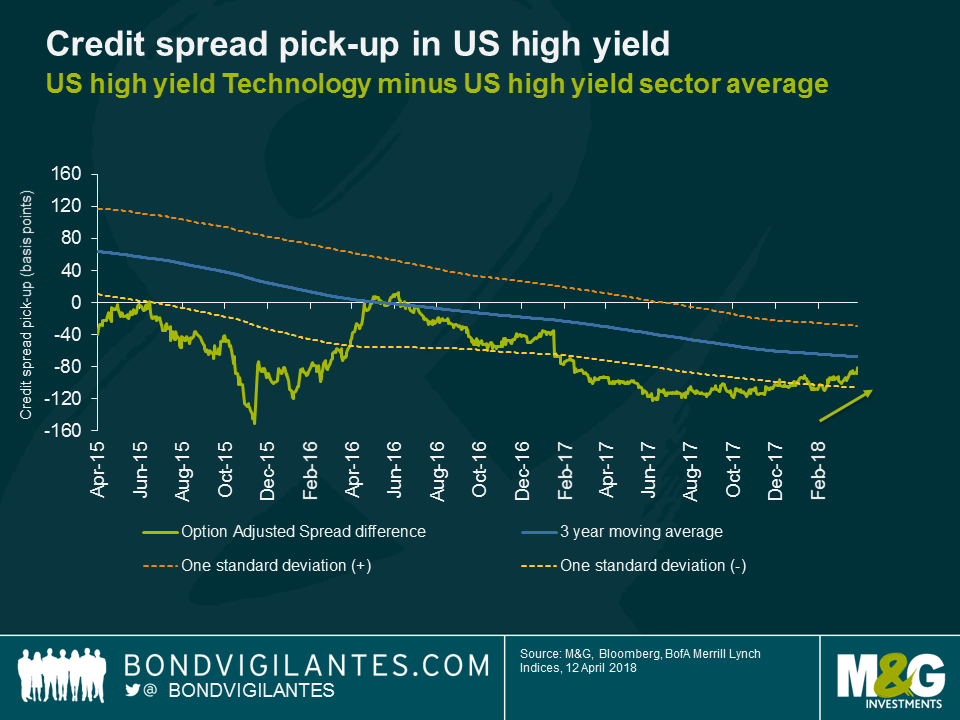

In the US high yield market, the US tech sector has weakened relative to the broader US high yield market. Given higher leveraged balance sheets, high yield bonds tend to be more sensitive to sector specific headwinds.

The chart below shows the spread pick-up for owning the US HY technology sector versus the broader US HY market. Whilst still negative, the credit spread differential has turned less negative, moving from -115bps at the start of December to -81bps. To draw parallels to the equity tech sell-off which was tied to privacy concerns, would be a hasty conclusion. The high yield tech sector had a lot of idiosyncratic stories going on ranging from strategic reviews (Dell), M&A talks (NXP), weaker than expected results (Veritas) to rating downgrades (Lexmark), to mention a few. Despite the recent weakness, US Technology spreads in high yield continue to trade tight relative to the US high yield market over a 3-year period.

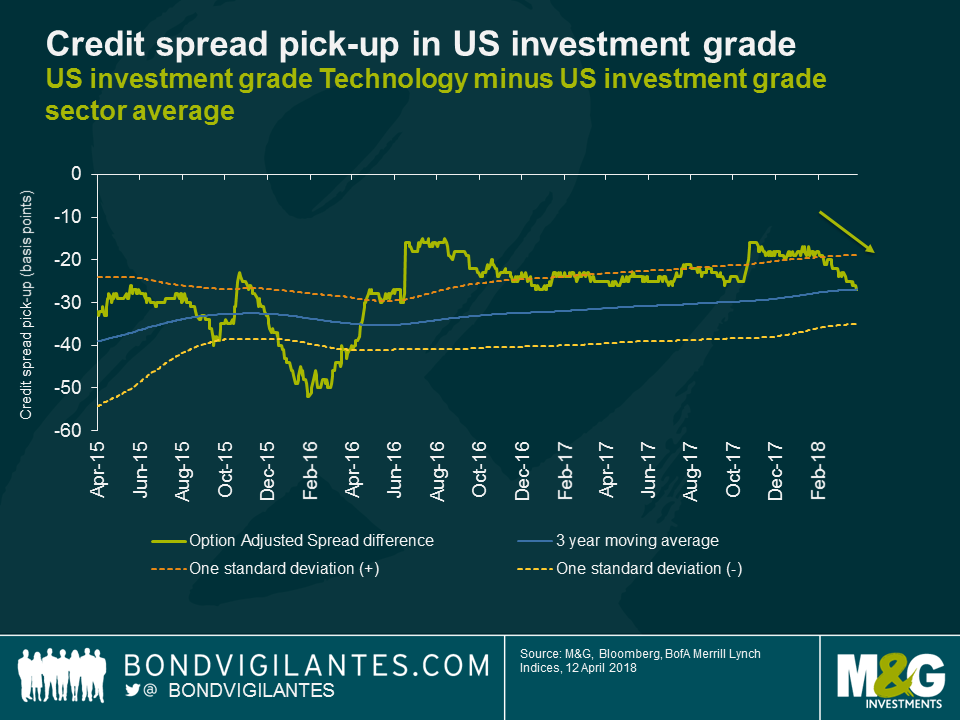

While an escalation of the trade dispute remains a tail risk, China remains an important market for many technology multinationals. This is from both a product components and source of revenue perspective (for example, 30% of Apple’s revenues come from China). Therefore, it would not be a wild assumption to think that credit spreads of investment grade technology issuers would have underperformed the wider investment grade corporate bond market of late.

In reality, the contrary is the case. The US IG technology sector has outperformed during this most recent bout of volatility versus the US IG index, moving from one standard deviation cheap (based on historic spread levels) at the start of 2018 towards the 3-year moving average.

The surprising price action in the US IG technology sector can be explained by looking at the major issuers of corporate bonds. The technology sector is dominated by Apple, Microsoft and Oracle, three major bond issuers with approximately USD 250bn of debt outstanding, accounting for 41% of the technology index. These companies are highly rated names with large cash balances to service their debt. As a result, these high quality names have managed to remain resilient in the face of rising risk aversion which has impacted the wider credit market.

While ample liquidity positions provide comfort to investors over the short to medium term, long term implications are harder to grasp. On the one hand, the sector faces more challenges from stricter data regulations, online taxation reforms and tariffs – with the impact of each hard to quantify for now. On the other hand, Trump’s tax law changes, put into place last December, should give credit investors comfort as higher free cash flow positions can be used to reduce debt piles if required.

As always, a company’s individual credit profile needs to be analysed to assess if such long-term risks are appropriately reflected in the credit spread. While equity markets have responded sharply and reassessed the growth potential of technology companies, credit markets don’t seem to be too worried.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox