The end of the Bank of England’s Term Funding Scheme

The Bank of England’s (BoE) Term Funding Scheme (TFS) came to an end earlier this year. As a brief recap, the scheme offered four year funding at the BoE Base Rate plus a fee to the banks and in turn, the banks were required to lend into the real economy (the fee was dependent upon the net lending of the bank). We previously wrote about the scheme here and here.

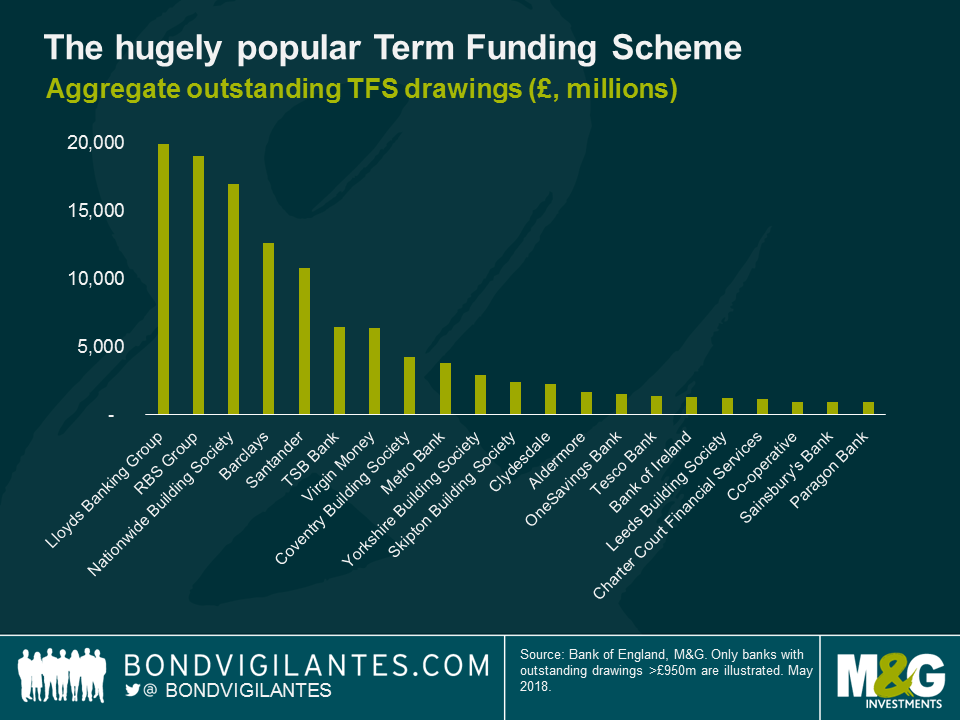

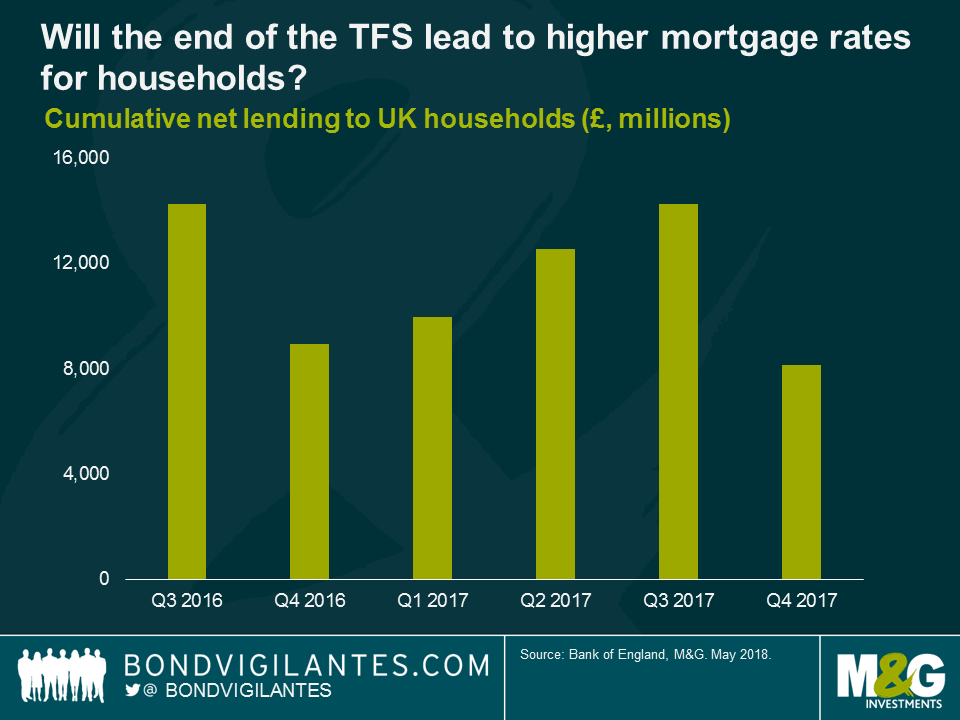

The borrowing scheme has been hugely popular and as of April 2018, aggregate outstanding TFS drawings (cheap loans) made available to banks was £127bn. Net lending as a result of the TFS reached £68bn between September 2016 and December 2017. The largest users of the scheme were Lloyds, RBS, Nationwide and Barclays. Consequently, it wasn’t a surprise that because banks were funding via the TFS, ABS issuance experienced a significant decrease over the last two years, with lenders paying a relatively expensive 35-60 basis points for issuing 3-5 year RMBS senior AAA notes.

With drawdowns for the scheme closing earlier this year and ahead of upcoming TFS maturities, UK domiciled banks have been planning to diversify their funding channels and tap the securitisation markets again. The tenor of the borrowings under the scheme is four years from the drawdown date, and we expect significant re-financing walls in late 2020 and in 2021. Lenders are now trying to get ahead of these walls and have been looking to issue longer maturity RMBS paper. For example, Nationwide had not funded via RMBS markets since 2016 and issued its first RMBS in February, and after a two year hiatus Paragon Bank issued its first Buy-to-Let RMBS in April.

We have seen strong UK RMBS issuance this year to date (circa €4bn) with some forecasts of €13-18bn of further issuance for the year (in both prime and non-prime space). The issuance level is still low compared to pre-scheme days of €30bn issuance annually but we expect the continued re-emergence of lenders back to the market as this dynamic should also contain funding spreads for them.

What are the likely impacts on households and consumers in the near future? Weaning banks off TFS borrowings will likely translate into higher mortgage rates for customers (but on the flip side, higher savings rates). However, funding via covered bond markets remain an alternative wholesale funding channel for banks and building societies where funding costs remain more competitive. This may help to alleviate rising cost pressures.

From an investor standpoint, despite the spread pressures, we continue to like and invest in the asset class. UK RMBS credit performance has been stable in the last few years and there have been zero losses to date on outstanding notes.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox