Six scary charts to keep investors up at night this Halloween

If you are looking for something really scary this Halloween, there is no need to reach out for blockbuster thrillers or monster figures – just look at these six spooktacular financial charts.

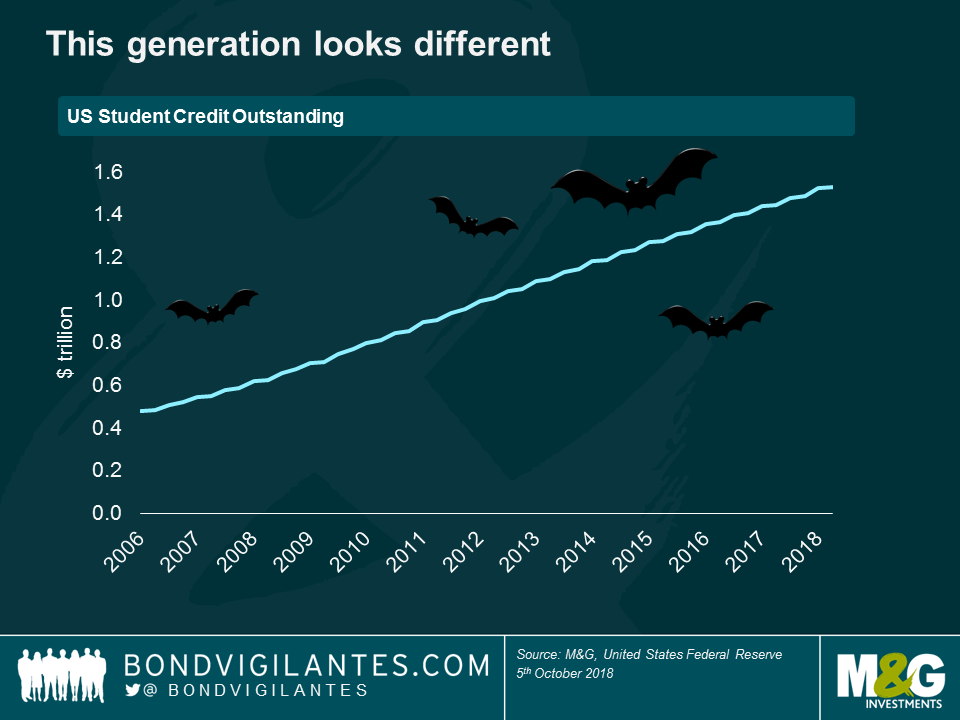

This generation looks different

US Federal Reserve (Fed) Chairman Jerome Powell recently warned about the ever-increasing amount of US student debt outstanding: “You do stand to see longer-term negative effects on people who can’t pay off their student loans. It hurts their credit rating, it impacts the entire half of their economic life.”

Student debt also impacts the overall economy: as graduates seek to repay their loans, they are forced to make concessions to their financial consumption, leading to an ever-growing drag on the economy. They buy fewer goods and services and are delayed in joining the housing ladder, with many choosing (or having) to rent instead. On top of this, student debt sees the highest 90+ day delinquency rate of all US consumer credit.

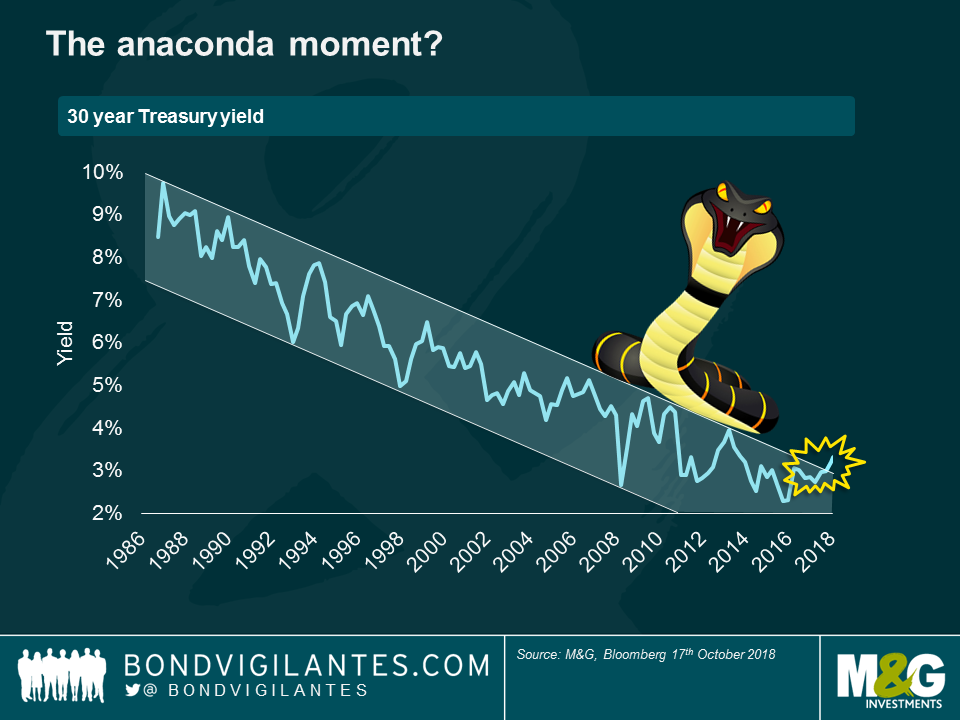

The anaconda moment?

The long-end of the US Treasury market has often been described as a giant anaconda: it draws little attention as it sleeps most of the time, but the minute it wakes up, everybody around shakes. US 30-year bonds don’t bite, but their moves can be as poisonous as they basically determine millions of mortgage rates, as well as the price that governments and companies around the world pay for debt.

The 30-year Treasury yield has remained within the support and resistance level shown for over 30 years, rallying 6% over the period and giving investors a long bull run. Does the recent breach through this level mean that the anaconda is beginning to stir?

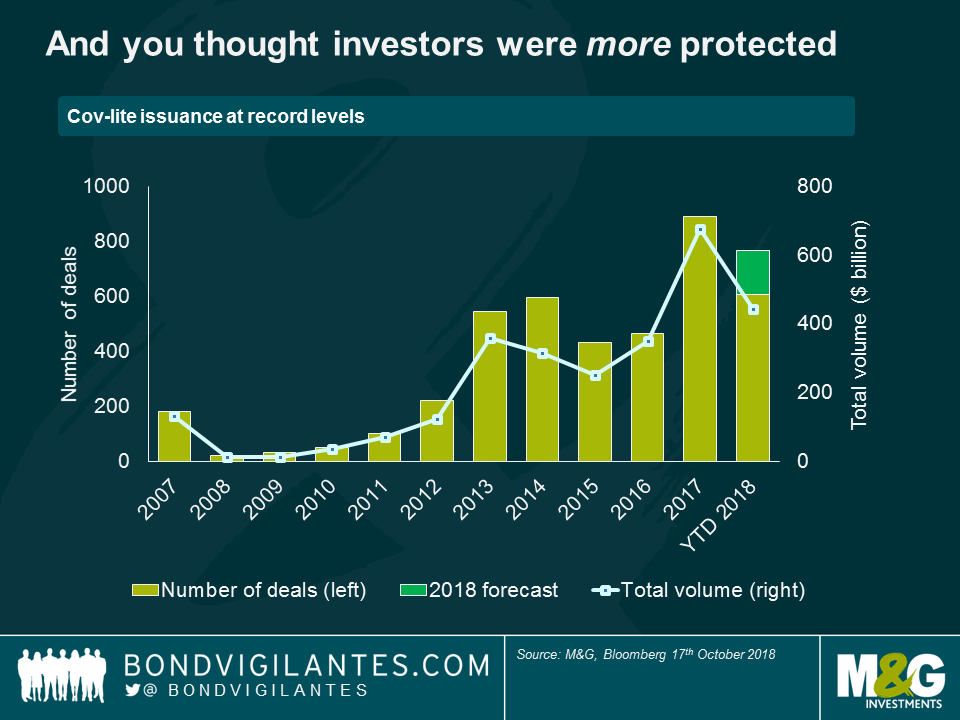

And you thought investors were more protected after the crisis

Investors tend to like debt with strong covenants as it usually protects their interests more by forcing companies to limit their debt levels or dividend payments. This is why they are now increasingly concerned when seeing this chart: covenant-light, or “cov-lite” loan issuance has vastly overtaken the levels seen in the leadup to the financial crisis. Then and now, lighter covenants make it easier for distressed companies to continue issuing secured bonds, potentially eroding the value of higher tier loans and ultimately leading to low recovery rates for investors.

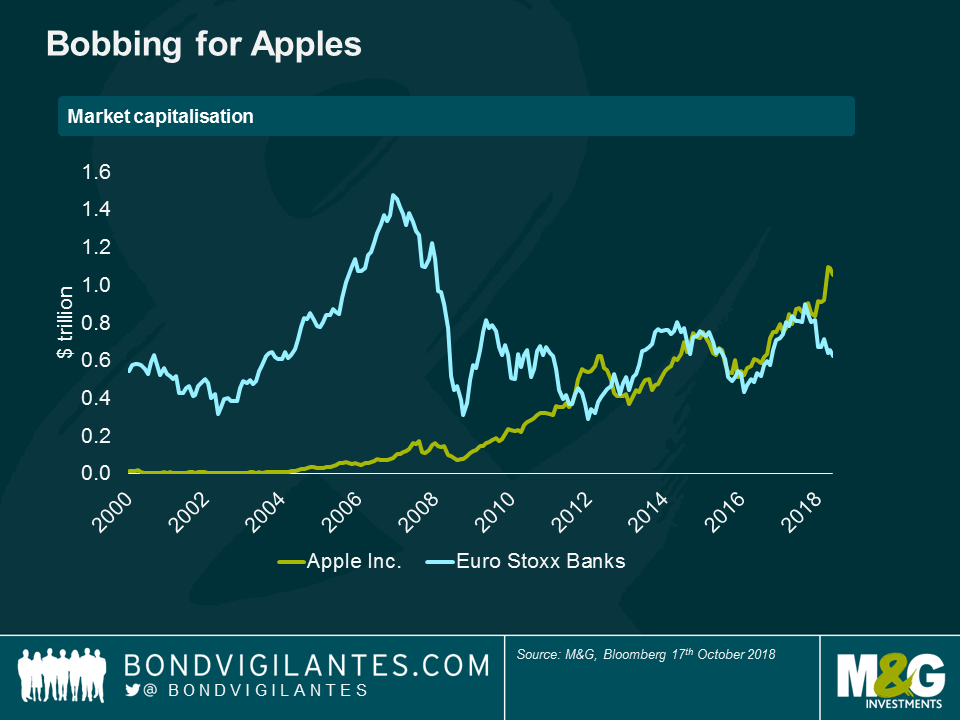

Bobbing for Apples

How scary is this? The Euro Stoxx Banks index market cap is the aggregate of its *26* member banks, including Banco Santander, BNP Paribas, Deutsche Bank and SocGen. At $1 trillion, Apple’s market cap now comfortably exceeds not only this, but also the GDP of countries like Turkey, the Netherlands and Saudi Arabia.

Twenty years ago, Apple was on the brink of collapse—90 days from bankruptcy, the company’s late co-founder Steve Jobs once said. Apple is now the first company in US history to reach the trillion-dollar threshold of market capitalisation (PetroChina was the world’s first, in 2007). Which just goes to show the difficulty investors are faced with bobbing for Apples when they select stocks in the market.

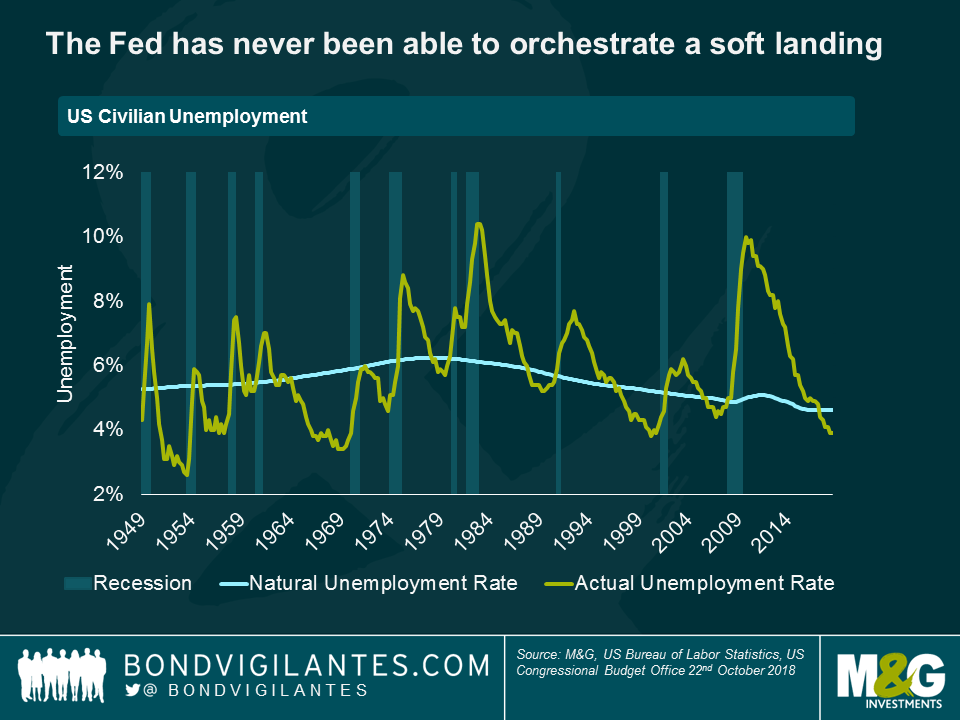

The Fed has never been able to orchestrate a soft landing

With US unemployment at rock-bottom levels and the stock market at near record highs, the Fed has begun hiking rates in an attempt to engineer a soft landing: it wants to slow the economy enough to avoid an overheating, but not so much that it causes a recession.

How many times over the past 70 years has the Fed successfully managed to do this and return unemployment (green line) back up to its natural level (blue line) without a recession ensuing (vertical bars)? You’ll be scared after counting…

And finally…

And finally, our scariest chart this Halloween: how much the US spends on it. Let us know if you’ve ever received a Halloween card… Americans spend $400 million on them, apparently.

Happy Halloween everyone!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox