Watch Your Step: Cliff Edge risk in European High Yield

This has not been a vintage year for total returns in the European High Yield market: wider spreads have led to small capital losses, barely offset by a relatively low income of 3.2%, which has resulted in an anaemic total return of 0.22% year to date. Unexciting and dull? Yes, but only if one looks at the surface. The underlying trends are far more interesting – and relevant for investors.

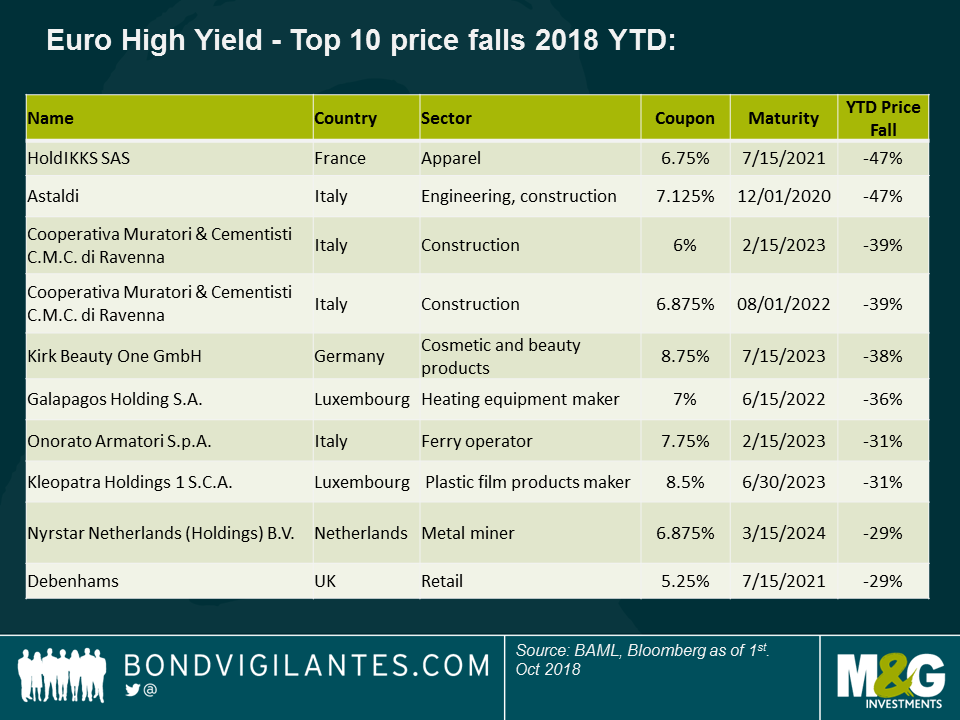

Every year, the High Yield market tends to have some idiosyncratic outliers which experience severe price drops – this is par for the course and avoiding them is a manager’s skill – but it feels like the number of and severity of such moves has increased this year, as you can see in the chart below:

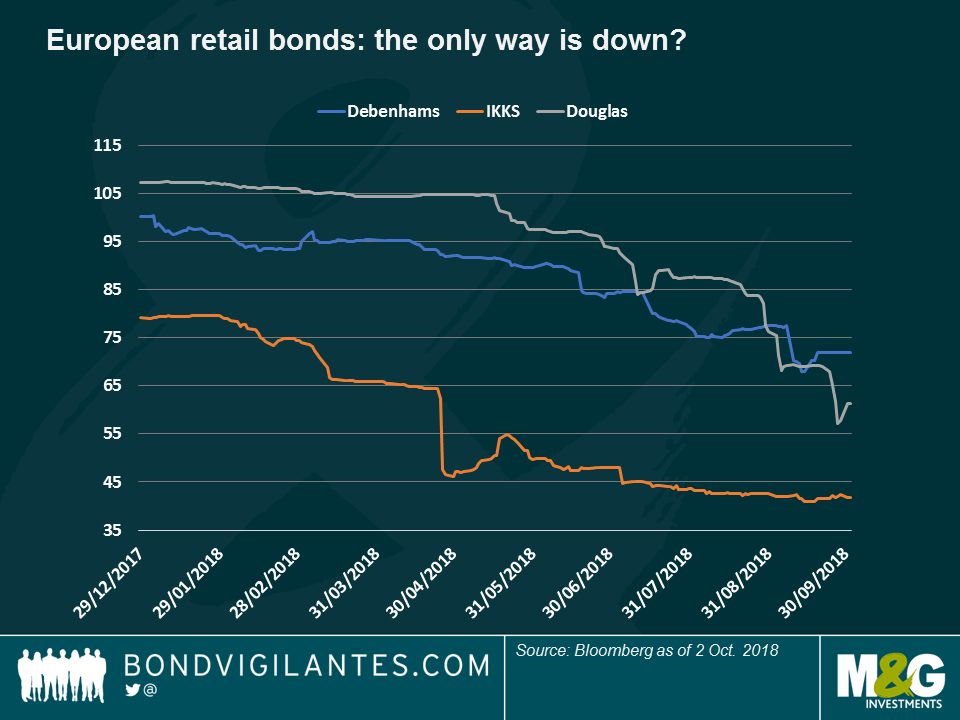

From the table, we see that the Retail and Construction sectors stand out. Starting with the first, the challenges that online shopping are giving retailers are well documented and very much still being felt: the bonds of UK department store chain Debenhams, German cosmetics retailer Douglas and French retailer IKKS have all continued to underperform as more and more shoppers prefer a mouse click than a trip to the store.

This, however, should not raise too many eyebrows as this negative sector trend has been well known for a while and the bond price drops have been more of a slow burn rather than a cliff edge-type decline, as the chart shows. Old habits die hard.

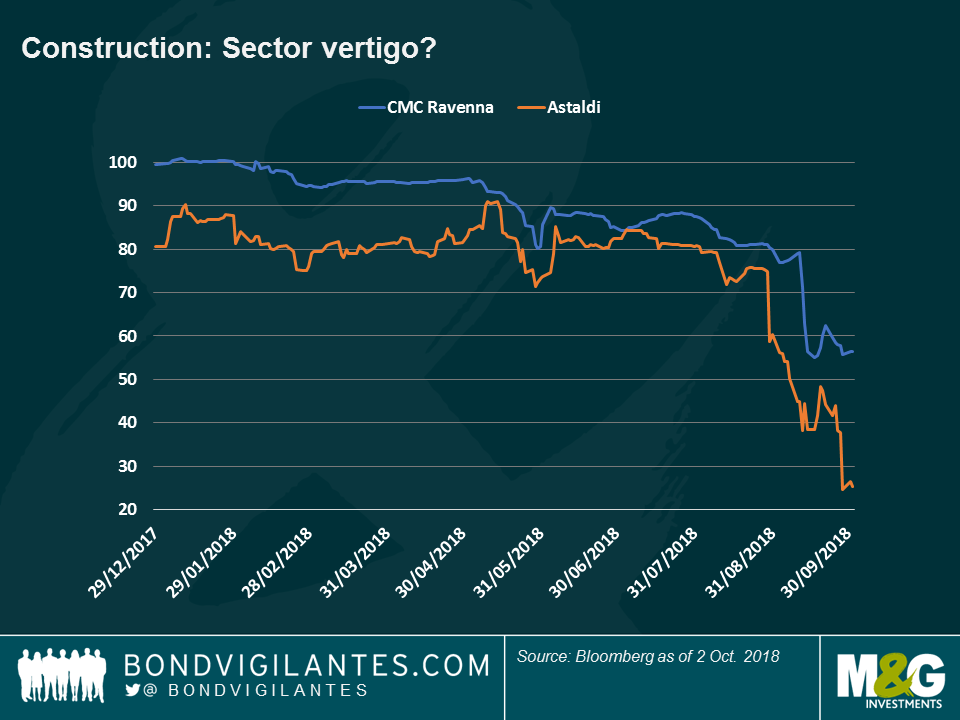

In contrast, the Construction sector has behaved differently: the speed and the severity of the drop in the bonds of Italian construction firms CMC Ravenna and Astaldi have occurred over a much tighter time scale, as seen below. These companies have suffered from poor results and in the case of Astaldi, a failed disposal and capital raise.

Here we can see the “cliff edge” in full force, and it suggests that the precipitous drop is more sudden, so maybe not due to long term fundamental challenges, which tend to brew over an extended period of time. What’s happening? Two thoughts spring to mind:

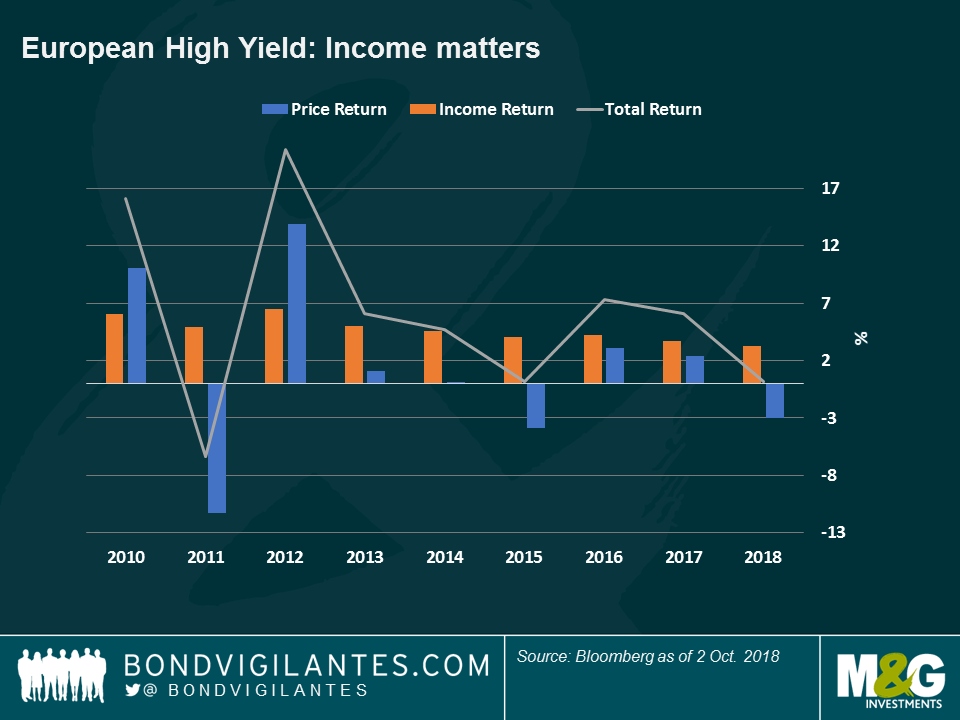

- Small is big: Given the protracted relatively tight credit spreads and low all-in yields, it only takes a small change in the market’s view of a credit to generate a big price fall. In the past, and as shown in the chart below, higher yields and higher coupons helped cushion capital losses as income was a much bigger element of total returns. Conversely, much of today’s market is priced to perfection when it comes to the fundamental outlook, hence when there is a deterioration for any reason, the price drop seems more dramatic.

- All or nothing: The low yield environment also increases the gap risk in another way: most of these bonds may see their prices stabilise when marginal buyers, such as distressed investors, begin to see value. Given that investors tend to see recovery value in a default situation as a valuation floor (rather than yield), the price drop from a low-yielding but performing bond at par to a non-performing bond trading at recovery value can be much bigger.

These situations are telling us that the present low yield, tight spread and slowing-growth European environment is making High Yield bonds behave differently to what we have seen in the past. Because of this, I think European High Yield investors should be even more cognisant of asymmetric risk to the downside than usual. Reaching for an extra 50 – 100 basis points of yield here and there can all too easily be wiped out by a sudden 25% fall in the price of one single holding. As ever, High Yield is a bottom-up market and thorough selection is paramount.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox