Diverging fortunes of inflation expectations in the US and Europe

Inflation expectations in the US and Europe have been diverging lately and it comes as no real surprise, of course. After all, annual GDP growth in the US was running at a healthy rate of 2.6% in real terms in Q4 2018. The unemployment rate has fallen below 4%, putting upward pressure on wages, while economic sentiment indicators, such as PMIs, are in firmly expansionary territory. In stark contrast, the economic outlook for the euro area has darkened considerably over the course of last year. Italy’s economy contracted in Q4 2018 and Germany only just avoided slipping into recession. Consequently, European PMIs have taken a nose dive.

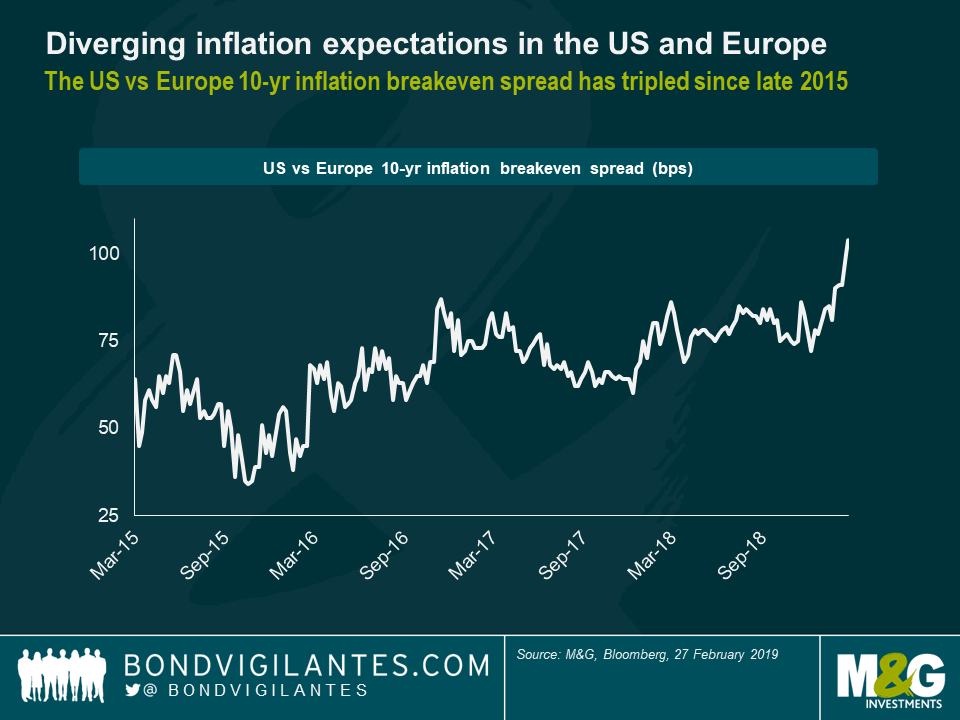

Against this backdrop, the widening spread of US over European inflation expectations makes perfect sense. I would argue, however, that the magnitude of the move has been rather extreme. Comparing 10-year inflation breakeven rates, a market proxy for medium-term inflation expectations, the differential between US Treasury Inflation-Protected Securities (TIPS) and German Bund linkers (which reference euro area inflation) has shot up beyond 100 basis points (bps). To put things into context, the US vs Europe 10-year breakeven spread has more than tripled since late 2015.

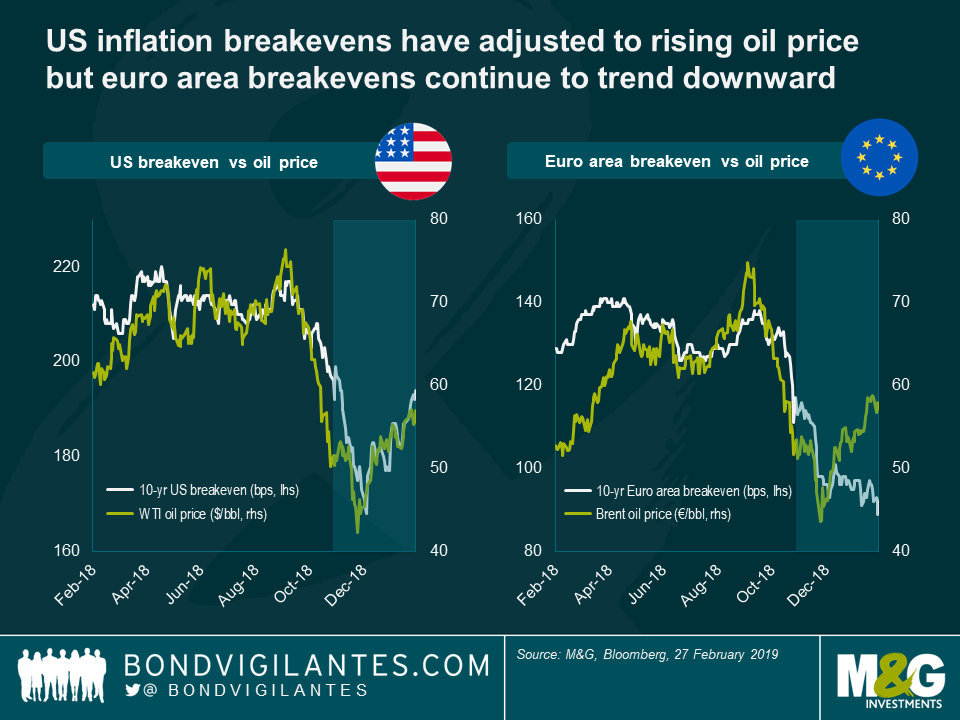

It is also worth noting how differently US and euro area inflation expectations have fared during the recent rebound in the oil price. While 10-year US breakevens have leaped higher this year (+25 bps YTD) pretty much in lockstep with crude oil, 10-year euro area breakevens have been completely unfazed and continued to trend downward (-7 bps YTD). Granted, due to lower fuel duties in the US oil price moves have a more direct impact on US inflation numbers than on European inflation rates, at least over a short time horizon. However, we should think long and hard whether the high degree of correlation between 10-year US breakevens and spot price moves of crude oil is justified. In fact, unless the oil price keeps on rising year after year over the next ten years, basis effects will kick in making the inflationary impact of the recent oil rebound rather short-lived.

Taking both the magnitude of the outperformance vs European inflation-linked bonds and the strong positive reaction to recent oil price moves into account, I don’t think that US TIPS look particularly appealing any more. With the 10-year US breakeven rate close to the Federal Reserve’s inflation target of 2%, valuations seem fair but not terribly exciting. In comparison, depressed inflation breakeven levels in Europe mean that as long as euro area inflation turns out higher than a mere 0.9% on average over the next ten years, Bund linkers will outperform nominal Bunds, all else being equal. This seems to me like a rather low hurdle rate to overcome. In other words, investors can currently buy insurance cover against any upside inflation surprises in the euro area through European inflation-linked bonds at pretty cheap entry levels.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox