The Royal Commission into Misconduct: A Deceptive Smokescreen for Australian Bank Bond Investors?

Last week’s conclusion of the Royal Commission into misconduct in Australia’s financial services sector has rightfully made international headlines. After digesting the 1011-page report, investors breathed a sigh of relief and pushed Australian bank shares sharply higher. The Commission’s findings and recommendations have been well-documented in the popular press, and the debates around them and their implementation will likely continue for months if not years, so we won’t rehash them all here. Instead, we focus on the implications for investors in Australian bank bonds and some important reminders credit investors should take away from the saga. So what are the key takeaways?

- The recommendations should have a positive impact on Australian bank credit in the long-term, despite the prospect of fines and higher costs in the medium term. The Australian Prudential Regulation Authority (APRA) has long had a reputation as a strong regulator, especially with respect to capital requirements, but the regulatory regime in Australia will be rightfully beefed up in the areas of enforcement, inter-agency communication, and oversight. Remediation, fines and increased investment in governance and controls at the banks – already underway for months – will pressure profitability, but these should be more impactful to earnings rather than credit metrics. To put these costs into context, remediation is expected to be a fraction of the over-£30bn incurred by UK banks in the PPI scandal (over 45mm PPI policies were sold in the UK).

- Banks investors need to consider not just individual credits, but the banking system as a whole. There are many examples in which banks act in a herd – from US subprime mortgages in the early 2000s to the UK PPI scandal noted above. Evaluating a bank’s macro and competitive environment is one reason to evaluate banking system strength, but understanding culture and governance is also important as there are often similarities among banks in a particular region. Understanding the regulatory framework is also critical, as any weaknesses in it may be seen as an invitation for misconduct or the build-up of excessive risk. To be clear, the blame for misconduct belongs to the banks themselves, but it’s also true that bond investors are to some extent reliant on regulators supervising institutions to ensure risks are well-managed.

- Governance strength at financial institutions is difficult to assess, but investors must still try. It is notoriously difficult for outsiders to fully understand the strength of governance and risk culture at large, complex financial institutions. But investors can get insights from a firm’s track record, board composition, management experience and disclosure. Perhaps more important is how managements have responded to past instances of misconduct. Meeting management and asking challenging questions can also be beneficial, particularly when comparing responses from different institutions.

Following this report and the likely adoption of its recommendations, Australian banks will have a considerable amount of work to change compliance and remuneration policies, among other things. They will tackle these in time, while facing a stronger regulator. Combined with the Commission’s decision not to force the banks to separate banking, insurance and wealth management divisions, and not to require major changes to lending standards, bond investors should feel positive about the Final Report. More broadly, the scandal should also remind investors of the risks of herd mentality and the importance of good regulation, supervision and governance at financial institutions.

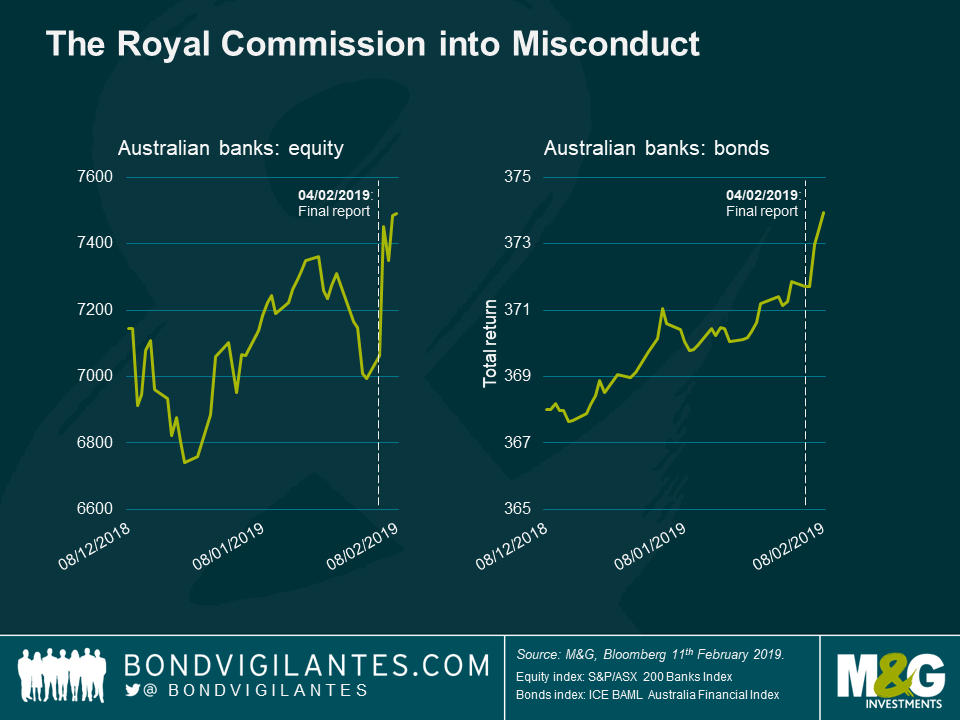

As you can see from the chart below, both bank equity and debt rallied after the findings were released.

This blog post was co-authored by Dave Covey & Patrick Golling.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox