3 shockers from yesterday’s RPI plans

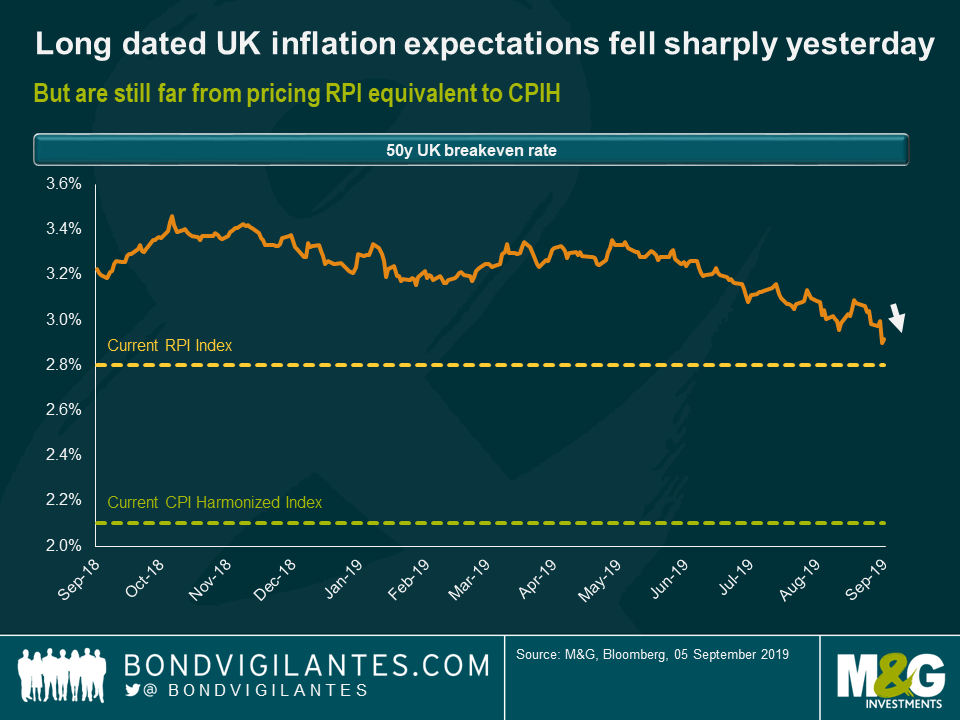

Index-linked markets were sent into a tailspin yesterday as Chancellor Sajid Javid responded to an earlier letter from the UK Statistics Authority (UKSA), which had set out recommendations for the reform of the RPI. The longest-dated linkers (maturing in 2065 and 2068) fell by more than 9% as breakeven rates plummeted.

Javid’s response contained three big shocks for index-linked markets:

- RPI to be aligned with CPIH – while Javid ruled out the possibility of RPI being scrapped, citing the potential disruption for the many users of RPI, he did appear to support the idea of fixing RPI by aligning its methodology with CPIH. Since CPIH is typically around 0.8% lower than RPI, this would of course have a significant impact on the future returns of index-linked gilts.

- Changes could be phased in by 2025 – the letter also revealed that the changes to RPI could be brought forward to as early as 2025, potentially affecting a larger part of the index-linked market and over a longer timeframe than originally envisaged.

- New risks for long-dated linkers – by far the biggest shock was the revelation that once all the old style linkers have matured in 2030, the statisticians are free to make any changes to RPI that they want, and without the prior approval from the Chancellor. While this critical point was stated in the statistician’s letter sent in March, incredibly this was not published. Investors have therefore been buying and continuing to own linkers maturing beyond 2030, completely blind to this fact.

Despite the extent of yesterday’s moves, it’s worth noting that breakeven rates yesterday only fell by between 10-15 bps. The wedge between RPI and CPIH, however, is around 80 bps, which means breakeven rates could potentially fall a lot further if RPI is eventually brought fully in line with CPIH. Following yesterday’s revelations, we now know there is nothing to stop the statistician from doing precisely this from 2030, once the UKTI 4.125% 2030 matures.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox