After FTSE Russell index delay, what’s next for Chinese government bonds?

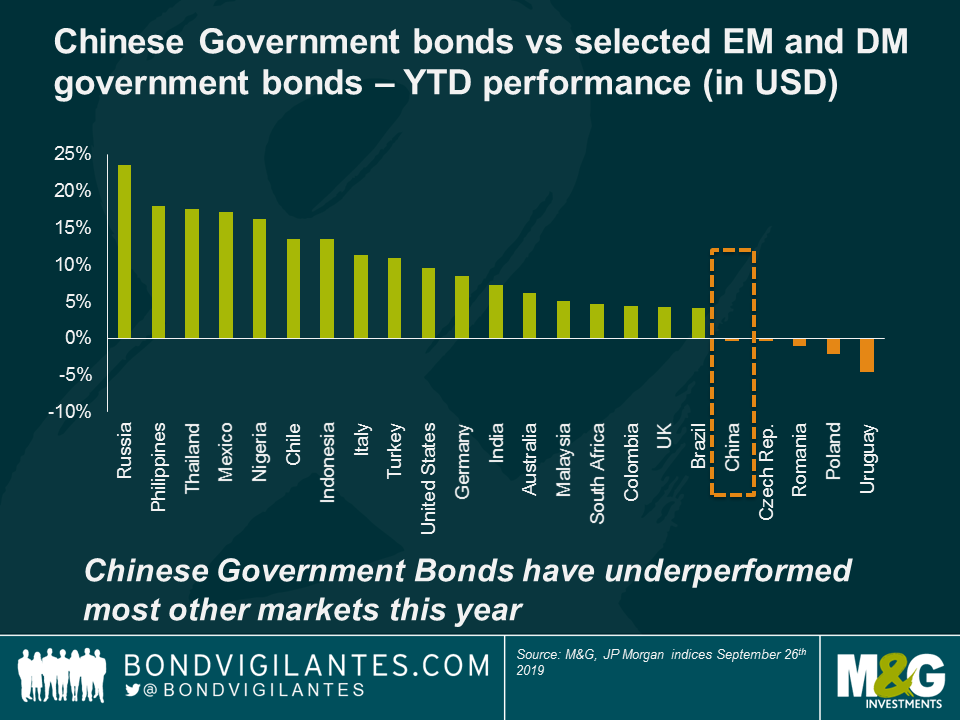

Yesterday evening, FTSE Russell announced that China Government Bonds (CGBs) would not be added to the widely followed FTSE World Government Bond Index, but remain on the watch list for inclusion until further review. This came as a surprise for most investors: Bloomberg Barclays and JP Morgan both recently added CGBs and bank policy bonds to their index suites. In challenging times for the Chinese economy, the delay means that Chinese bond markets will miss out on further inflows of billions of dollars from foreign investors. While in equity markets, China A shares have rebounded quite strongly after last year’s dismal returns, CGBs have posted disappointing results in 2019 (see chart below).

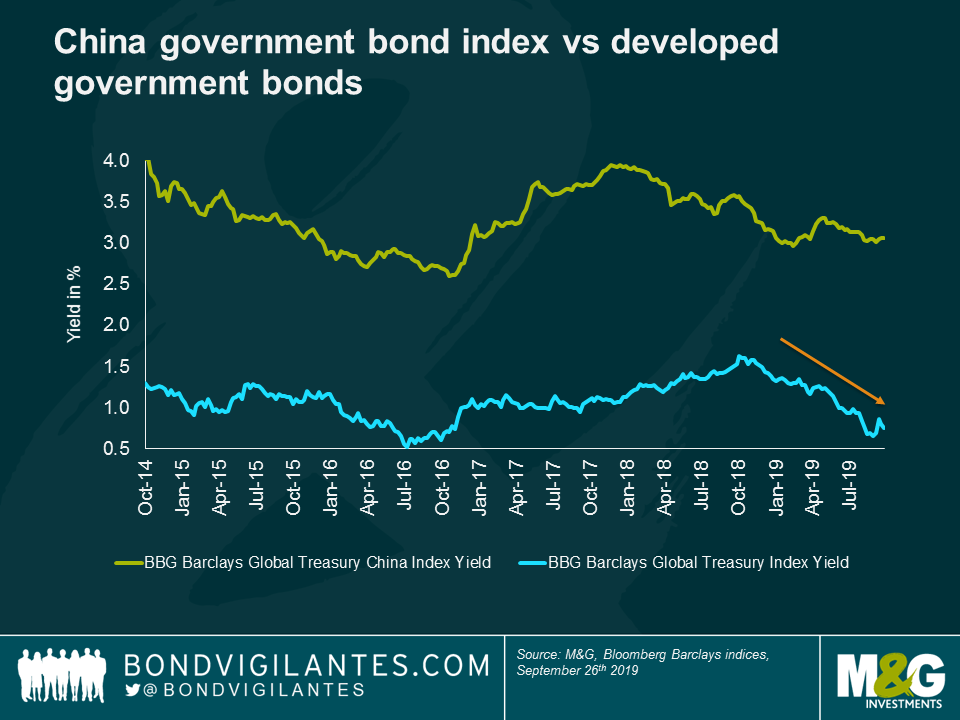

Following this underperformance, CGB yields now look quite attractive when compared to global developed government bonds. While CGBs are probably riskier overall, they represent an alternative source of income for investors in an increasingly yield-deprived world.

However, higher yields do not necessarily translate into higher future returns. With China’s trade dispute with the US still unresolved, the short-term outlook remains uncertain for CGBs. Should the economic situation deteriorate further, it will be interesting to see the reaction of China’s central bank, the PBOC. While many options remain on the table, there are a couple of more obvious levers that the central bank could pull.

Firstly, the PBOC could reduce the Reserve Requirement Ratio (RRR), the amount of cash which banks must hold in reserves. This would free up liquidity for banks to make new loans to corporations and consumers. While the PBOC has already cut the RRR a few times since early 2018, there is still some scope to reduce it further. Based on historical movements, these further cuts would likely lead to lower CGB yields.

Another way in which the PBOC could loosen monetary policy is by cutting interest rates. Having evolved considerably over time, China’s monetary policy is still in a transition phase and the country has a variety of rates it could adjust to loosen monetary policy. These include the 7-day reverse repo rate as well as the medium-term lending facility, tools the PBOC has already used in the past. The recent changes made to the Loan Prime Rate also signal that this mechanism could be employed more extensively going forward. With average rates on loans still close to 6% in China, some measured monetary loosening could certainly be warranted. Reducing these key interest rates could serve as a catalyst to lower CGB yields in the future.

Of course, investing in CGBs does not come without risks. With 70% of all bonds held by local banks which often hold them to maturity, CGBs are less liquid than other, more mature bond markets and therefore tend to react less efficiently to changes in macro-economic, monetary and financial conditions. The difficulty in hedging positions using derivative instruments, as well as regulatory and fiscal uncertainties, present further obstacles for international investors. Finally, with a debt-to-GDP ratio in excess of 300%, China remains one of the most indebted countries in the world. Deleveraging will remain a significant challenge for the country over the long run.

Foreigners investing in CGBs will also be exposed to currency risks. While China’s government has pledged not to use the currency in retaliation to trade war escalation, in reality it has been the main adjustment valve to the ebbing and flowing of trade negotiations. Following President Trump’s recent round of tariff increases in early August, the PBOC let the currency weaken past the psychologically important point of 7 CNY per USD for the first time in over a decade. While it can be expected that the PBOC will intervene to prop up the currency should it start to devalue too quickly, a further contraction of economic activity would likely result in further CNY depreciation, especially against the world’s “safe haven” currencies. On the other hand, should a reprieve or stalemate be reached in the trade negotiations, one would expect the CNY to rally quite significantly given current valuations.

Where does this leave investors? Despite the decision from FTSE Russell and lackluster government bond performance since the beginning of the year, the financial integration of Chinese financial markets – while fraught with danger – remains well under way. Given this, and indeed the many challenges that the Chinese economy faces today, the inaction so far displayed by the PBOC could prove very valuable in the future, especially if the economic backdrop continues to deteriorate. Patience in this case could very well be a virtue.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox