Defaults in European Retailers and US Energy on the rise

2019 has been a pleasant ride so far for high yield investors. Over the past 9 months the global high yield market has delivered a total return of 10.9% and an excess return of 6.4%, in part thanks to the U-turn of major central banks. Despite all the good news, things have occasionally gone wrong.

Recent events have reminded high yield investors that investing doesn’t come without risk. Thomas Cook, the UK tour operator, was grounded after final restructuring negotiations failed. To blame Brexit or the slowdown in global growth for the default would be a hasty conclusion. The business, operating in a structurally challenged industry, had long stretched its financials to the limits. The fragile situation did not go unnoticed by customers, who had stopped booking with the business. As a result of this, 2018 EBITDA (earnings before interest, taxes, depreciation and amortisation) dropped by 14.6% year-on-year which also changed the ability to materially generate positive cash flow. The company produced a negative free cash flow of £148 million in 2018. 2019 half year numbers revealed an even worse picture, with a seasonal outflow of £839 million; £121 million higher than the previous year. Operating with current liabilities that exceeded current assets by £2bn, made the solvency issue even more pressing and, in the end, didn’t allow the company to recover in time. This is a prime example of how quickly things can fall apart if consumers lose trust in a business. With bonds trading currently at 7 cents in the euro, investors only foresee a limited recovery rate for the asset-light business, which is also carrying a large amount of debt structurally senior to the bonds.

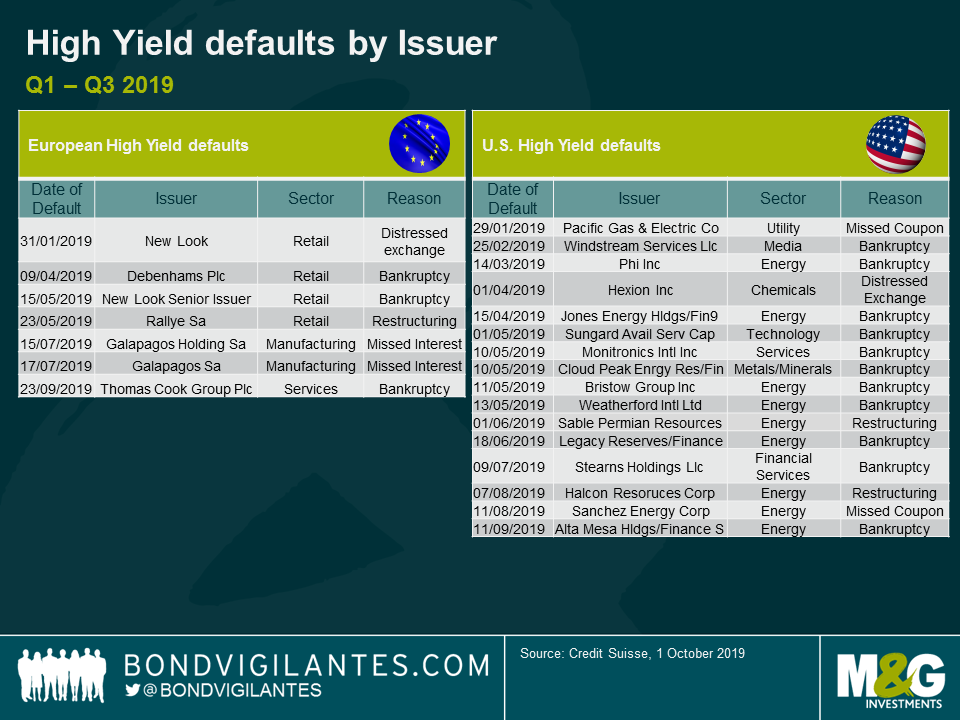

Thankfully, these default cases are the exception rather than the rule and we’ve only seen a handful of defaults in Europe this year. Early on in the year, the Retail space made headlines. It was high street retailer New Look who had to capitulate after net leverage skyrocketed well into the double digit region following weak Christmas trading. Shortly after, UK department store Debenhams announced restructuring after a period of operational underperformance combined with structural issues. Debenhams was disproportionately hit by the structural shift to online shopping, given its long-term rents and large store estate hindered the retailer from adopting quickly to the new shopping behaviour that resulted in less footfall.

Rallye, the holding company that effectively controls French food retailer Casino Guichard-Perrachon SA, pushed the Retail default rate up by one. Having sold most non-core assets over the past several years, the core investment of Rallye has been Casino. Rallye started to look insolvent as the Casino share priced dropped, and Rallye debt is now being restructured. This is an important reminder for bond investors to consider the additional risks of lending to a holding company, particularly if it only has one income stream.

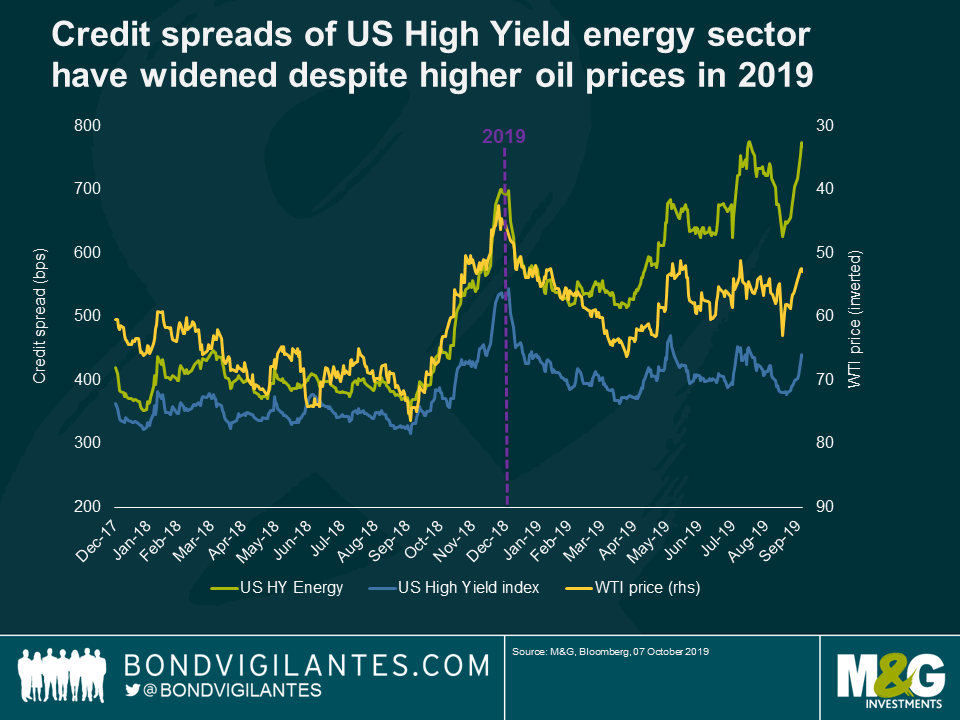

In the US, the Energy sector has been the dominant sector of defaults in 2019, accounting for more than half of the defaulted universe. In fact, the energy sector was the bottom performer in the US high yield market in the first 3 quarters of 2019 delivering an excess return of -2.9%. While the sector is up by 2.5% in total return terms, this makes dull reading compared to the broad US high yield market which generated a return of 11.5% over the same period. In contrast to the wider HY market, credit spreads of the energy sector have actually widened, which might come as a surprise considering that WTI (West Texas Intermediate) is up 17% since the turn of the year, now trading in the mid-50s and above breakeven levels for many oil players. So what is behind the underperformance and defaults in this space?

One part of the answer is execution risk, which was also the source of trouble for Alta Mesa, the recent default victim in the US HY market. The company’s acreage turned out to be less robust than anticipated. In addition, the company was having technical difficulties in drilling their wells, a problem that has already befallen several drillers operating in emerging shale basins across the states. For companies with a single asset exposure, this can be fatal. Bond investors need to carefully weight up whether the low entry costs compared to more established drilling areas such as the Permian basin, are worth the risk of missing production forecasts and consequently the failure to generate the cash flow needed to service its bonds.

As always, a major concern of US Exploration and Production companies is the degree of debt that some players are saddled with, making it impossible to grow into their capital structure should production levels disappoint due to operational issues even when WTI is in the 50’s.

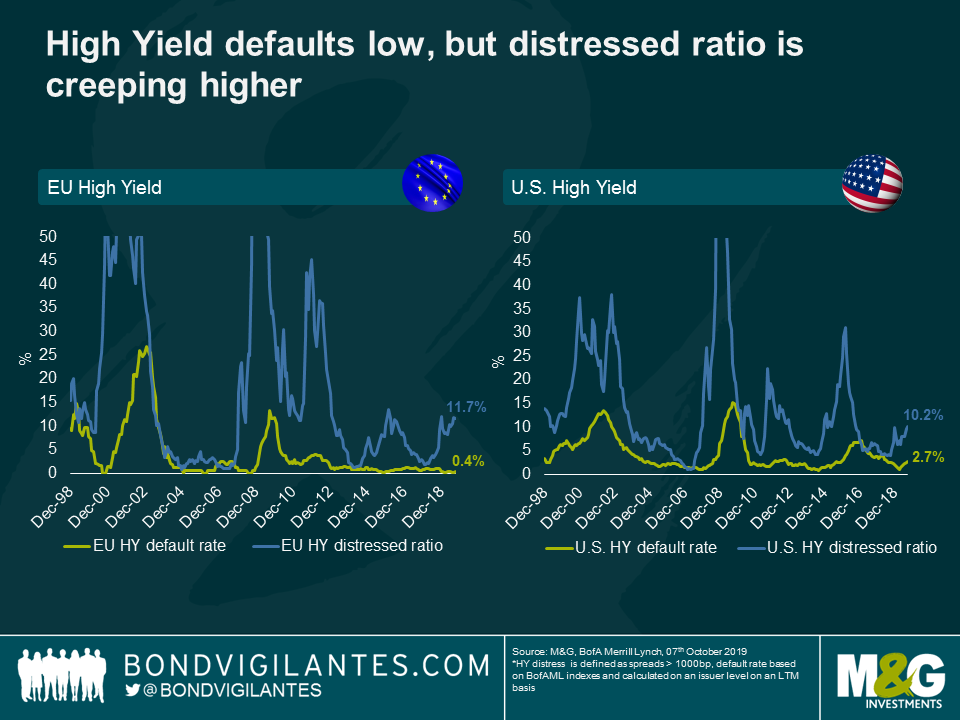

Overall however – particularly outside the Energy and Retail space – defaults remain low in high yield. That being said, the portion of bonds trading at distressed levels, defined by a spread level higher than 1000bps, is on the rise, which tends to be a good leading indicator for future defaults. Therefore, I would expect default rates to increase somewhat from here due to idiosyncratic issues, such as those experienced by Thomas Cook. Bond investors are currently witnessing an increasingly two-tier market. Those that are in favour can borrow cheaply and benefit from the low interest rate environment. Those falling out of favour find themselves locked out of the market with market concerns perpetuating a vicious cycle.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox