2020 Vision

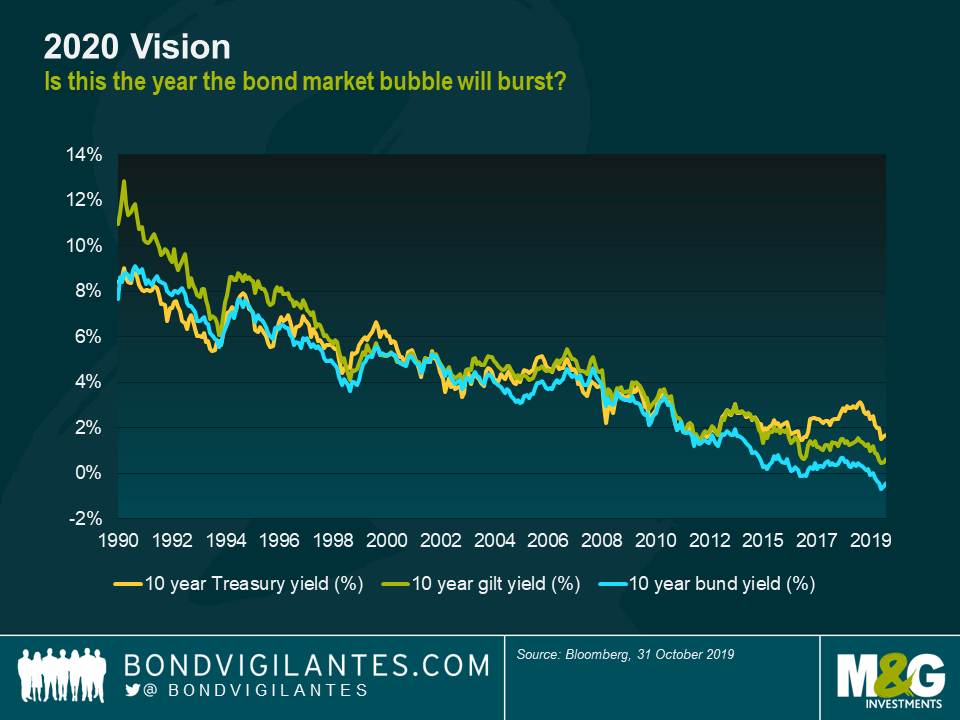

Let me start with two predictions. Firstly that the title “2020 Vision” will be irresistible to all year-ahead outlooks, no matter what publication or industry you work in. This is why I trademarked the idea many months ago, and now expect to retire on the proceeds of all the copyright breaches. My second prediction is that in my industry, bond fortune telling, virtually all of those 2020 outlook pieces will declare that it will be the year that the “bond bubble” bursts. Maybe they’ll be right this year, after a 30-year streak of “sell bonds” predictions. But their track record doesn’t suggest they have an edge in the bubble popping business.

If you do believe that 2020 is the year for bond bears finally to triumph, I think you have to believe that a lot of very long term, established trends are about to come to an end simultaneously. These trends are the Secular Seven. If you think that their powers are at an end, or significantly diminished, then you should join the January anti-bond mob with their pitchforks and flaming torches. Otherwise you’ll probably want to wait to see a conclusive break in the 30-year downtrend in bond yields and inflation before saying goodbye to fixed income.

The Secular Seven

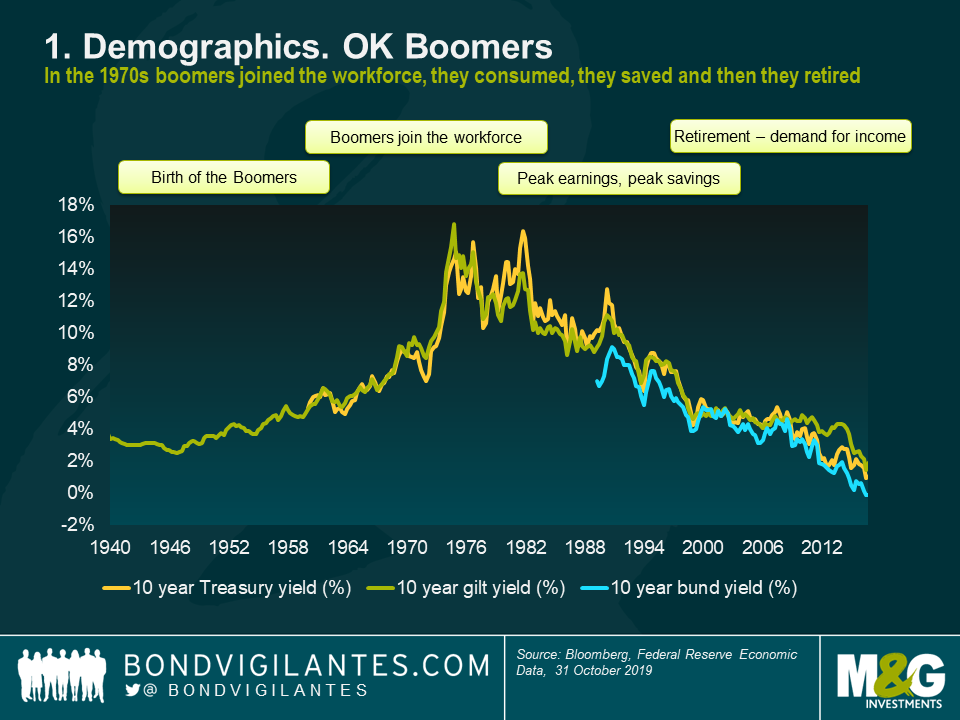

1 – Demographics. OK Boomers. The post-World War 2 baby boom impact on the economics of the developed economies can’t be overstated. In the 1970s and onwards as the Boomers left education and came to dominate the workforce, the labour scarcity that had been a feature of the western economies for a couple of decades started to come to an end. Trade Unions lost their membership and their power, and wage inflation dropped. Economies became more productive, and wealthier. With largely young and healthy populations, pressures on the welfare state (for example pension burdens, and care and healthcare costs for the elderly) were relatively subdued. As the demographic basketball (the Boomers) passed through the snake and reached peak earnings, their desire to save and invest those savings also hit new highs. Demand for income and safe assets grew dramatically – driving bond yields down.

2 – Technology’s impact on inflation. Why can’t we generate consumer or producer price inflation in developed economies despite zero or negative interest rates, “money printing” and periods of growth and low unemployment in the past decade which historically might have generated CPI of at least twice the current common inflation targets of 2%? The dramatic deflation in consumer goods is one answer, and a good part of that has been driven by the collapse in the price of technology. The 1996 Motorola StarTAC mobile phone cost $1000 then; a similar level phone today is about $200. 1996 was probably also the year I stopped hiring a TV (paying monthly) from Radio Rentals and bought one, as they’d become affordable. And it’s not just the cost of the hardware: I used to spend at least £50 a month on music on compact discs (and cassettes before that, which I note are now fashionable with youngsters). Now I pay £12.99 a month for all the music in the world on Spotify. Think also of all the free stuff that the internet provides, from maps to encyclopaedias and news, and perhaps the impact of low inflation is actually understated. The transparency of the internet also allows me to find the cheapest thing in the world whenever I buy something. Awful news for high street retailers, but the deliverer of a huge consumer surplus and disinflation. Finally, we haven’t even discussed the Rise of the Robots yet: what if AI and robotics are finally deployed in the workforce on a massive scale? What does that do to wages? To employment and disposable income? It certainly sounds like a further technological leg down in price inflation is possible.

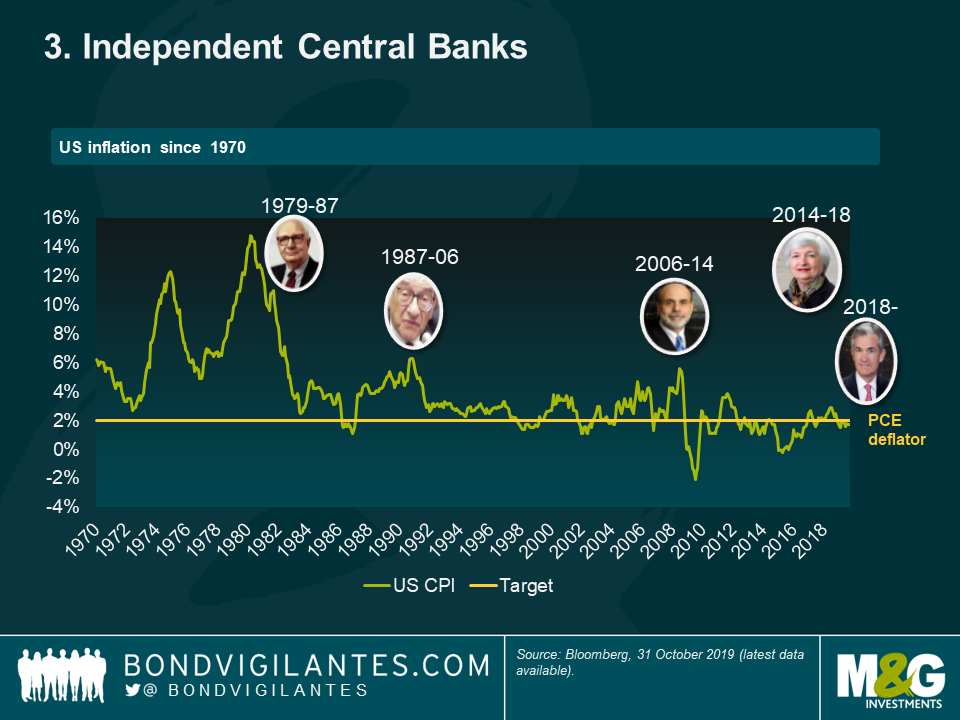

3 – Independent Central Banks. When Paul Volker was appointed Chair of the US Federal Reserve Bank in 1979, inflation in the States was 11.3%, peaking in March 1980 at 14.3%. US Treasury Bonds were thought to be almost uninvestable as yields were eroded by the rise in the cost of living. Volker set the Fed Funds rate above the rate of inflation – at the time a radical idea. Inflation fell steadily through his tenure, and an “inflation fighting central bank” culture was established. This led to explicit inflation targeting around the world, from New Zealand through to Gordon Brown making the Bank of England independent, and on to an ECB which was so wedded to this inflation-fighting mandate that its President, Trichet, hiked rates twice in the midst of the Global Financial Crisis on the grounds that oil prices had risen year on year and had taken eurozone CPI above 2%. Central bankers have certainly taken a lot of the credit for the bond friendly environment we’ve been in for the past couple of decades, but it’s clear that this separation of their powers from elected politicians coincided with some arguably more powerful trends.

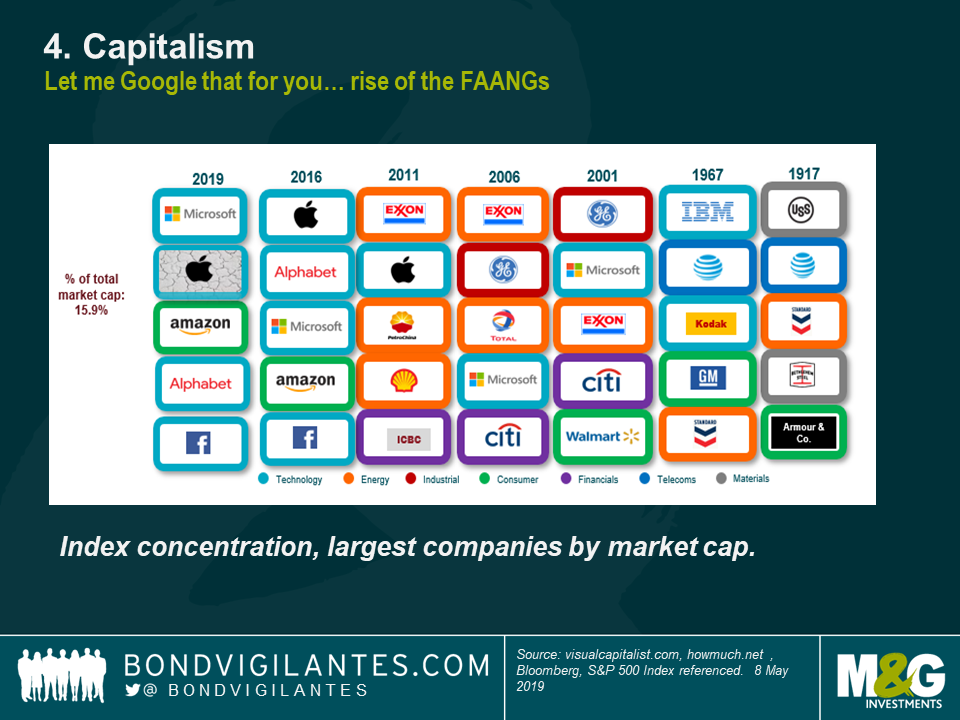

4 – Capitalism. As labour has become less powerful since the entry of the Boomers into the economy, capital gained the upper hand and has taken the bigger share of profits and growth in developed economies for years now. Governments have deregulated financial markets and labour markets (with some notable exceptions like the introduction of the Minimum Wage in the UK), and the emergence of the new tech giants (the FAANGs) has led to both increased competition in some areas (Amazon has delivered massive consumer surplus in its race to acquire market dominance) and monopoly creation in others (Google is a verb as well as an online advertising giant). Capitalism has thus kept wage growth low, and encouraged the growth of a tenuous gig economy landscape. Whilst there are examples of monopolies developing, as the land-grab continues, prices have stayed low. Take a look at some of the bloggers in the US who write about existing on free trial subscriptions (everything from mattresses to groceries) and half price food delivery offers as companies try to buy some market share. I’ve got a 50% off Uber Eats trial in my inbox right now. Burger or pizza?

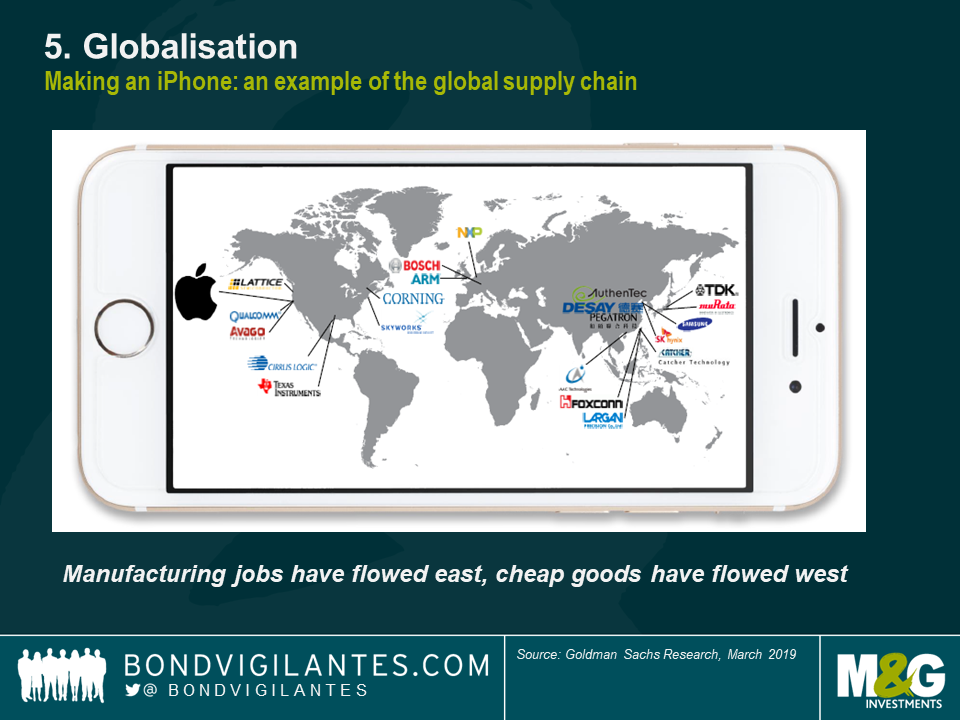

5 – Globalisation. China joining the World Trade Organisation in 2001 didn’t start the process of globalisation, but it did signal that everything had changed, especially for manufacturing companies. The supply chain became a global one, and goods prices collapsed as we all imported cheap stuff made by people earning fractions of western wages. The liberalisation of trade barriers and tariffs, together with advances in the logistics and cost of containerisation and shipping, meant that manufacturing jobs went east and cheap goods flowed west.

6 – The Austerity Meme. I’ve been fascinated by the Reinhart & Rogoff “This Time is Different” book ever since it came out. Flawed in some of its initial calculations, its narrative of higher government borrowing leading to economic disaster nevertheless set the scene for a decade of austerity in many of the economies hit hardest by the Global Financial Crisis. Now the relationship between government borrowing, bond issuance and bond yields is surprisingly weak: you’d think that as governments issued more bonds, prices would fall. This turns out not be true historically, as times when governments borrow more have usually been those times when growth and inflation are weak. Nevertheless, the UK for example has seen relatively low bond issuance since the GFC as the result of the longest period of austerity recorded. Germany is running a budget surplus, despite stagnant eurozone growth. It’s therefore possible that this period of relatively low bond issuance at a time of weak growth has delivered lower bond yields than we’d have normally had.

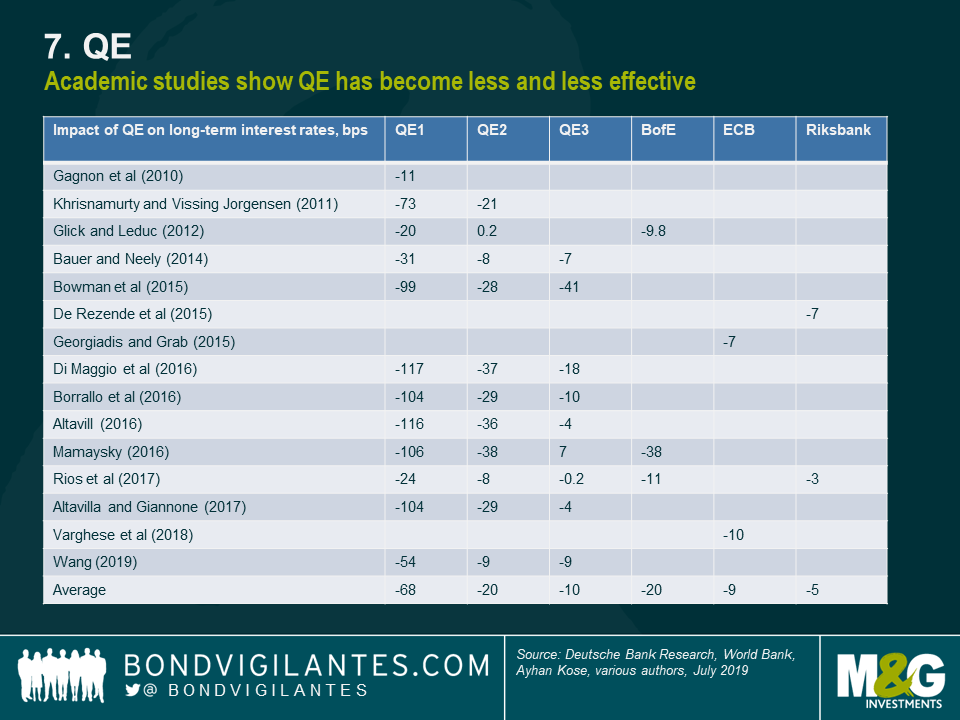

7 – QE. We’ve had 3 rounds of Quantitative Easing from the Fed since the GFC. The Bank of England has also bought both gilts and corporate bonds. The Bank of Japan and the ECB have also massively expanded their balance sheets in bond purchase programmes. And the ECB has just announced endless QE in Mario Draghi’s parting policy announcement. Does QE reduce bond yields? Yes. A study of all the academic papers on the impact of QE around the world showed that on average the three rounds of US QE reduced US Treasury Bond yields by about 70 bps, 20 bps, and 10 bps respectively. Whilst inflation remains below target in most of the developed economies, it’s unlikely that we see any unwinding of the bonds held on central banks’ balance sheets – in fact some of us think that these bonds will never be set back into the wild, and will mature in the dark of those central bank vaults.

So are any of the Secular Seven under threat?

Yes. Many of them look to be less powerful than they were at their peak, although it’s possible that we’ve only so far seen the first stages of technology’s impact on wages and inflation: companies are sitting on cash piles that will be invested in productive technology at the first sign that their flesh and blood robots are achieving higher wages. An example of this in action was the introduction of self-service ordering systems in fast food restaurants after minimum wage increases for workers in those US businesses.

Demographic trends remain in place, although the never ending increases in life expectancy that we’d come to expect have stalled in some demographics, thanks to obesity related illnesses and opioid addiction. There are also some stark differences across the developed world, with birth rates in the US much higher than in parts of Europe, implying higher potential growth rates in America in the future. Japan shows us that even when labour force growth peaks and declines (Japan is a decade ahead of the west demographically), this isn’t enough on its own to combat entrenched deflationary forces.

Have we had enough of independent central banks? Donald Trump certainly has if you read his tweets over the past year. Fed Chair Jay Powell has come under immense pressure to cut rates towards zero again, and if Trump is re-elected in 2020 you have to imagine that Powell is replaced by someone more willing to turbo charge the US economy. In the UK, Mark Carney remains as the Bank of England Governor for the time being, but you could imagine some post-election outcomes that deliver some partisan choices as his replacement. Incidentally, the Bank of England just announced it is changing the title of its Inflation Report. It will now be the Monetary Policy Report which, if Sod’s Law has its way, will mark the return of rampant price rises. Central banks took the credit for the collapse in inflation over the past thirty years – and as I’ve discussed they were just one smallish part of that story – so they shouldn’t be surprised to take the blame now that inflation is too low for comfort, and this will undoubtedly threaten their mandates.

Whether capitalism’s dominance of the economic system continues to the same extent rather depends on a couple of rather important election results. On the electoral front, whilst neither candidate is a bookmaker’s favourite to take office, both Jeremy Corbyn in the UK and Elizabeth Warren in the US have a chance of power, and both have radical agendas which would likely involve higher rates of corporation tax, wealth taxes, financial transaction taxes and higher government spending. Monopolies in the tech space could be broken up, and financial regulation could tighten once more. Nationalisation of some industries couldn’t be ruled out. After a period of right wing populism in the UK (Brexit) and US (MAGA), the pendulum might swing the other way, and the left could take its revenge. Coupled with existing protectionism movements in the US (the trade war with China could be cooling, but has already damaged the global economy) and new European trade barriers post-Brexit, the left’s anti-globalisation philosophy (on the grounds that it produces a race to the bottom in workers’ rights) could exacerbate the stalling on global trade flows.

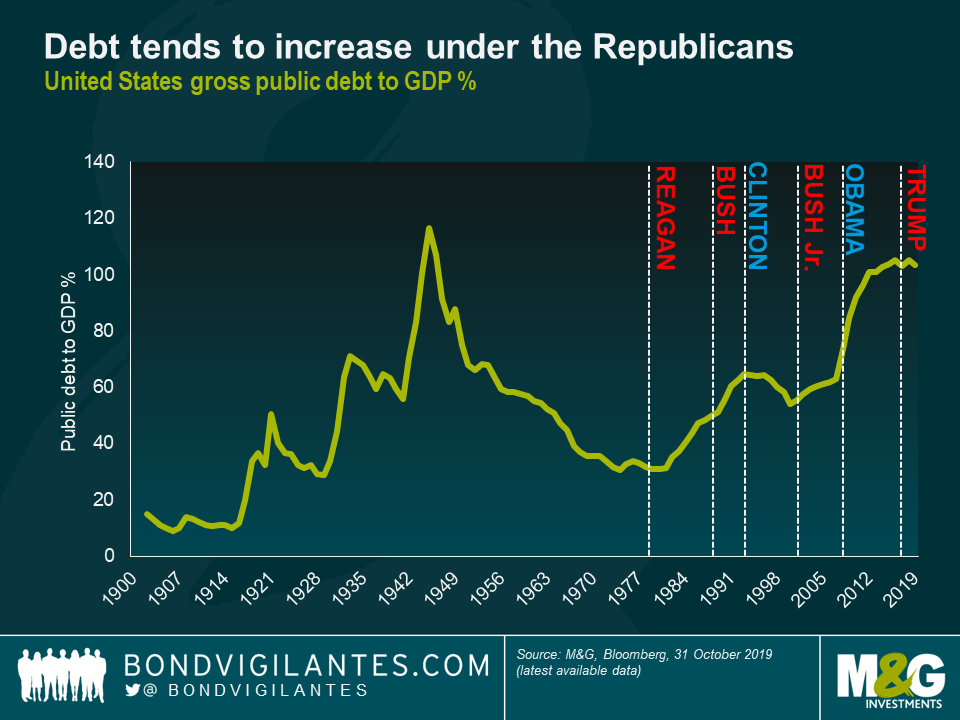

We go into 2020 then with some of the tailwinds for falling bond yields having been diminished, and one in particular – that of the austerity meme – likely to have turned into a headwind, with some potentially large increases in government borrowing in prospect. Also importantly, our starting valuations for “risk free” assets are unattractive, with most developed market government bonds having negative real yields. I don’t believe that a negative real yield is in itself an aberration, and we should come to regard the elevated real yields of the 1980s as the exception rather than the rule (you could get RPI plus 4% when you invested in index-linked gilts for a time), but clearly government bonds are expensive historically.

All of this means that I too will end 2019 with an underweight view on government bonds, expecting yields to move higher next year. But on any significant move up in bond yields, I’d want to buy back my gilts, bunds, Treasuries and JGBs, as many of the Secular Seven trends remain powerful, and there are clearly significant economic and social fragilities in the global system that could trigger further central bank policy moves – both traditional (rate cuts) and extraordinary (rate cuts below zero, more QE) – and a new flight to quality. We ain’t out of the shadow of the GFC just yet, and with more debt in the global system than there was in 2007, rising bond yields themselves could trigger the next big downturn.

Finally, remember that the global government bond market sets the “risk free” rate which is the major input in the valuation of all asset prices – from corporate bonds, to equity, to property. So if you are expecting a bond blood bath, the impact on other asset classes could be even more severe…

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox