Elizabeth Warren has a plan: US investors pay attention

Senator Elizabeth Warren of Massachusetts has big plans. She dislikes the path the United States is on and wants to make fundamental changes to the economy. These plans include much tougher regulation of banks, a breakup of large ‘monopolies’ — her first sight is on technology companies — and also a healthcare system based on a single payer principle. Just under a year from the US Presidential election, the current Democratic front runner has laid out her plan for “Medicare for All.”

The Warren plan estimates federal spending would need to rise $20.5 trillion over 10 years to fund this. To put this number into context the US government’s entire public debt is currently $22 trillion.

Warren has proposed the following targeted tax increases:

- Wealth tax of 2% on individuals with assets more than $50 million

- Wealth tax of 6% on individuals with assets more than $1 billion

- Tobin tax of 0.1% on all financial transactions

- Top 1% of households to pay capital gains on all assets – including unrealized gains

- Stricter tax compliance on foreign earnings – these would be taxed at 35% (equal to a restored 35% US corporate tax rate from 21%)

- A new employer Medicare contribution to raise $8.8 trillion

Ensuring healthcare coverage for all is not an ignoble cause. However, these tax policies would represent a fundamental change in US domestic policy, going back to fiscal policies last seen in the 1960s and 1970s with President Lyndon Johnson’s Great Society plan. The fact that Elizabeth Warren is rising in the polls, while centrists like former Vice President Joe Biden are falling, mean these plans cannot be ignored. Couple this with impeachment hearings that the House of Representatives has just opened on President Trump and we are likely to see a volatile 2020 for US markets.

If Warren gains the nomination (we should know by May 2020, with the first Democratic nominee election at the beginning of February 2020), and if Trump is not polling well into June/July 2020, there is a chance we could start to see investor fright and capital flight from the US.

How likely are these plans to become reality?

The 2020 election will likely keep a Democratic House of Representatives (lower house) and return a Democratic Senate (upper house). This will make it easier for a Democratic President to enact their policies. However, the US Senate is a more conservative chamber (even if Democratically controlled), so these policy ideas would be watered down.

A wealth tax will also likely be challenged as unconstitutional in the US, and likely will make its way to the US Supreme Court which, for the foreseeable future, is likely to keep its conservative tilt.

Healthcare costs in the US remain disproportionately high compared to all other developed nations, so remain cautious on healthcare companies going into an election year. Both parties are likely to try and appease voter concerns.

The road to the White House runs through the Mid-West

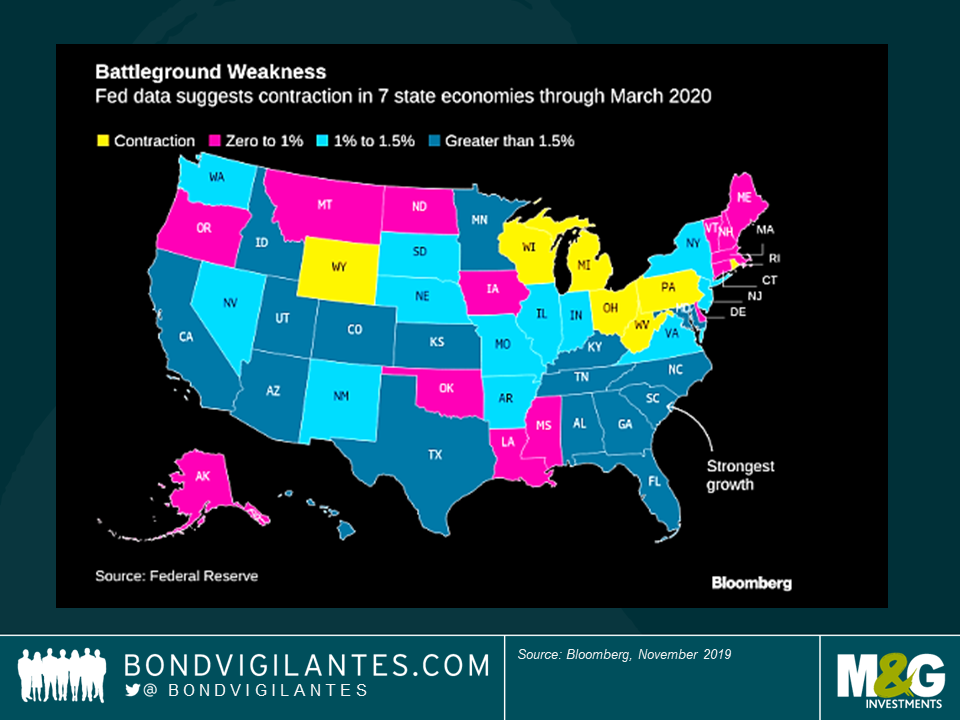

States that swung the election for Donald Trump in 2016 were the rust-belt states of Pennsylvania, Ohio, Wisconsin and Michigan, reliably Democratic states for the past 25 years. In a worrying sign for Donald Trump, these states are among the ones that face economic contraction over the next 6 months according to Federal Reserve data (see chart below), predominantly due to the US-China trade war. Currently, polls show the President has the support of the US electorate in his trade negotiations with China, but should the economic data continue to deteriorate it will be a concern for his re-election chances.

The best predictor in the past of a President’s re-election chances has been US consumer confidence. In the last 40 years, only two Presidents have stumbled at a re-election attempt — Jimmy Carter (1980) and George H.W. Bush (1992) — both of whom faced weakening consumer confidence at home. US consumer confidence has defied the deterioration so far in business investment, but the two do not usually remain in opposite paths for long.

Are the financial markets pricing in a change in policy?

As US equity indices continue to hit all-time highs and US Treasury yields remain near all-time lows, so far the market is not factoring in policy change. Implications for a substantial increase in government spending are not being factored into US government bond yields, and nor is a material increase in the US corporate tax rate into equity markets.

With two new centrist Democrats (Michael Bloomberg and Deval Patrick) looking to enter an already crowded field, the indication is that Democrats are not happy with their current options, while centrists candidates believe they have a chance to clinch the nomination. As we have seen in the UK with the Labour Party, the party membership can differ widely from the views of the mainstream population, so the odds still remain in Elizabeth Warren’s favour to be the Democratic candidate.

The US, which has been a consistent beacon of returns for all investment classes since the financial crisis, is entering a period of increased volatility, where poll ratings will be as important as quarterly GDP figures, Federal Reserve statements and company earnings.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox