Is the ECB pricing investors out of the primary market?

Christmas has come early for Europe, with Mario Draghi’s goodbye present to the market of further quantitative easing (“QE”). The ECB has kicked off its latest round of asset purchases. While this will undoubtedly be supportive for European credit, I feel much of the impact is already priced in to the secondary market. With a large book to fill, a significant part of the ECB’s ammunition is likely to be deployed in the primary market.

The ECB buying will clearly be supportive for corporate bonds, but just how material is the buying going to be? Wolfgang Bauer recently wrote a blog (here) looking at the impact of this latest round of QE. This time, the ECB is buying from a much lower base.

To assess what impact they might have, I think it’s useful to look at the volume of supply we’ve had, and probable ECB participation going forward. Looking at the breakdown by investor type for the recent Daimler new issue (A-rated by Fitch) from 30th Nov as an example, I estimate that around €535m of the €4bn deal was bought by the ECB – a rough exercise admittedly. This is a significant amount of the expected purchases per month (around 10% if we assume higher end of €5bn of purchases per month). And this is 13% of the €4bn deal too.

Shell also issued €3bn on 4th November which priced in line with the existing secondary curve. I estimate ECB participation was around 25% of this deal – a further €750m. If the ECB continues to buy such a significant proportion of issuance, we will likely see investors priced out of new issuance as deals come with zero new issuance premium. This primary participation will be very important dynamic to monitor, and one which investors will be watching for a number of prolific issuers – with VW another likely contender.

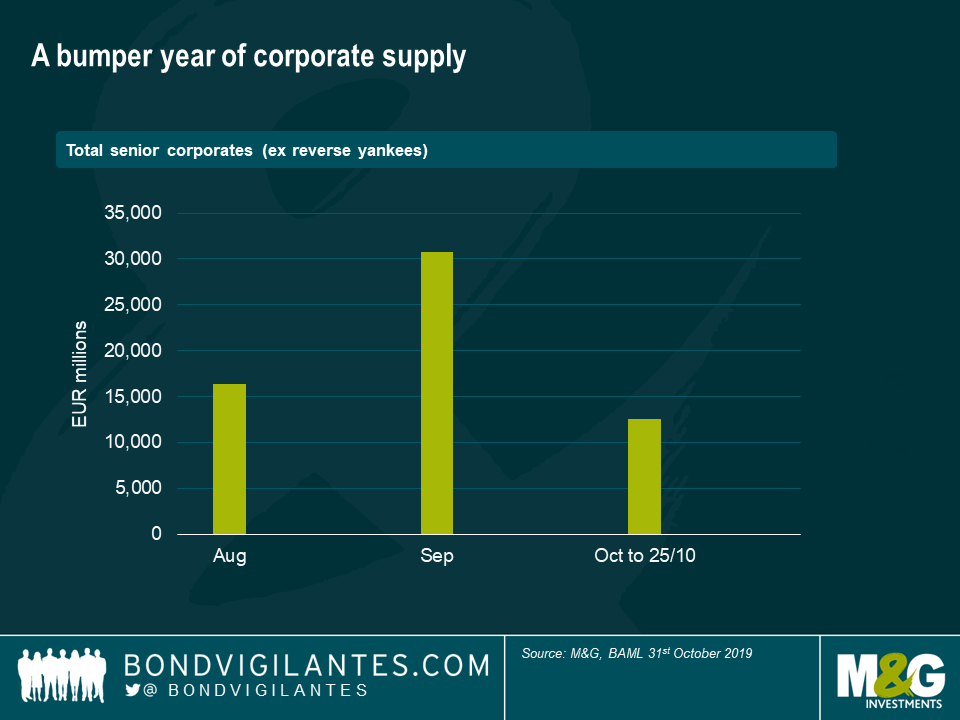

We have had a bumper year of corporate supply, largely due to low financing costs in Europe. A large proportion of this has been ‘reverse yankees’ – US issuers taking advantage of low Euro financing costs. I have excluded these from the analysis as the ECB can only purchase European issues. Still, YTD 2019 issuance has been €476bn (up 27% from last year). The chart below shows the total senior corporate supply, ex reverse yankees, for last three months across all credit ratings.

The practice and velocity of ECB buying will be a supportive factor for spreads in November but, in my opinion, this will be reasonably small in absolute terms. The ECB and its buying boots have undoubtedly boosted market sentiment but, after the initial Dealer inventories of high quality eligible paper have been hoovered up by the central bank, the greater extent of the move will be in its effect on wider BBB eligible names and non-eligible paper – so-called beta compression.

I expect the ECB will come out the traps at a good pace. Expectations for supply in November remain healthy, albeit reducing, so the run-rate is likely to be ahead of the long-term rate in the early phase of the programme. Today will be an interesting date as we will have a summary of ECB purchases from last week – so we can see for ourselves how busy the central banks have been!

ECB purchases are expected to increase in 2020 as redemptions from QE round one roll off. This technical tailwind will therefore increase in strength and undoubtedly continue to be supportive for spreads. However the effect of CSPP crowding out investors, particularly in the primary market, seems far more diminished in the face of declining European growth. Investors are cautious on moving down the capital structure with valuations looking ever more stretched versus fundamentals. As a result, I suspect the most significant effect of the ECB restarting purchases will be to preserve investors’ seemingly already healthy cash balances.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox