Can Africa’s wall of eurobond repayments be dismantled?

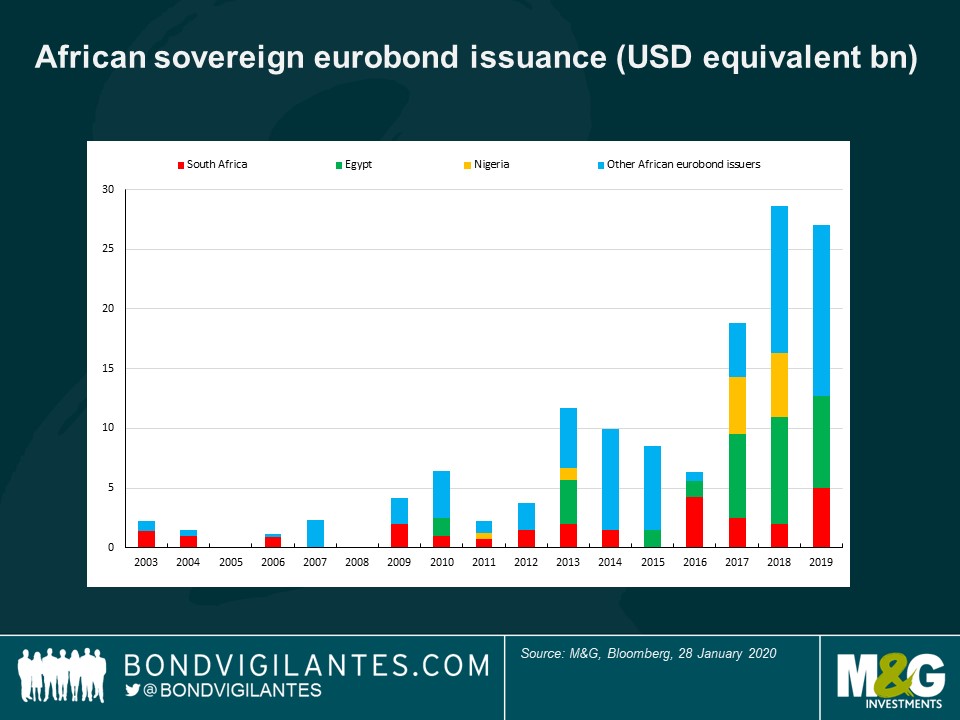

There has been a wave of African eurobond issuance over the past decade. South Africa started the eurobond trend for the continent in 1995, but it has only been since the global financial crisis that push and pull factors have encouraged broader African issuance.

The asset class has grown to 21 African countries with outstanding sovereign eurobonds, totalling $115 billion. This follows a big increase in issuance since 2017, led by the eurobond heavyweights: Egypt, Nigeria and South Africa. The larger economies have been followed by eurobond middle-weights: Ivory Coast, Angola, Kenya and Ghana; who have been extending their curves over the past three years.

The issuance has been mainly in USD, but EUR issuance has become more common since 2018, especially for countries with close trade links to Europe (Morocco and Tunisia) or with currencies pegged to the euro (Ivory Coast, Senegal and Benin). Longer maturities are also becoming more common. Five-years ago most eurobonds were issued with maturities of around 10-years, with a few exceptions from sovereigns who had longer issuance track-records, such as South Africa. But since Nigeria successfully tested the market with 30-year paper in November 2017, Ivory Coast, Ghana, Kenya, Angola, Egypt and Senegal have all come to market with 30-year paper.

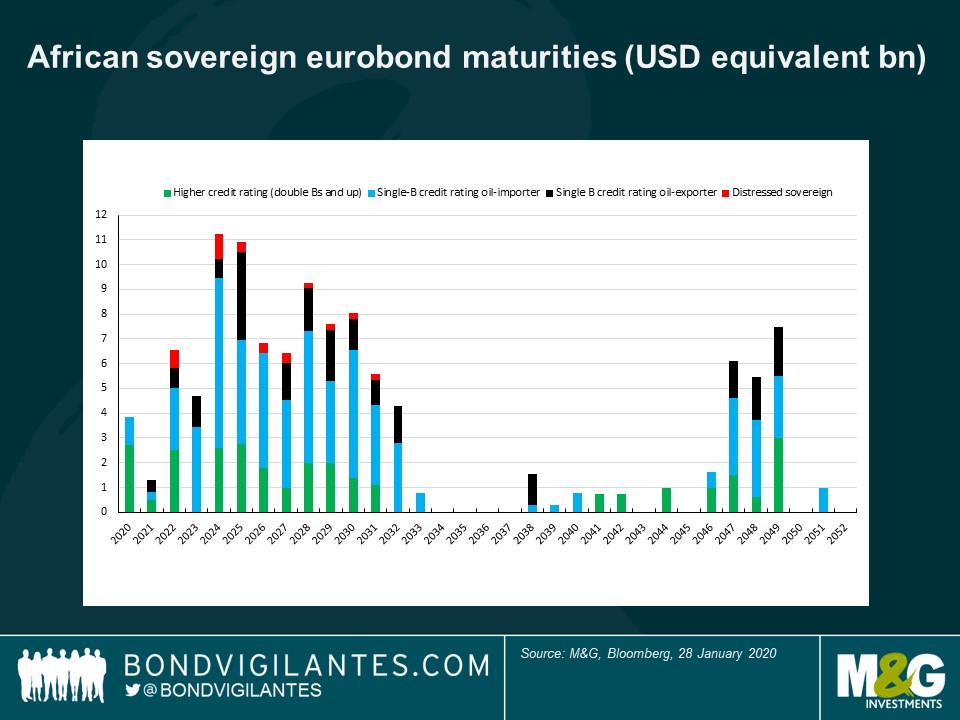

Annual issuance was small before 2013, hence there are not many African eurobonds maturing between now and 2023. But given larger issuance from then, of mainly 10-year paper, there is a spike of maturities coming in 2024 and 2025, creating a wall of sovereign debt repayments.

How worried should we be about this wall of eurobond debt?

African eurobonds and other frontier markets offer higher yields than the emerging market norm, but investors need to be mindful of the increased risks. A specific concern is whether a spike in African maturities in 2024 and 2025 will overwhelm the sovereigns’ ability to refinance their bonds, especially if sentiment towards emerging market is weak in these years.

The wall of repayment is of concern, but three factors suggest there could be more resilience than some of the more gloomy takes on African indebtedness have suggested. First, there is a growing number of African countries who have now repaid eurobonds. Second, there have been few recent events of default. Third, African countries’ debt management is improving. It is becoming less passive and more active.

Growing repayment record

There is a well told story of Africa’s debut eurobond issues of the past 10 years, but less attention is given to a growing record of repayment. South Africa, Morocco, Tunisia, and Egypt each have a growing track-record of repayment. But other countries have also now repaid sovereign eurobonds, including: Gabon, Ghana, Kenya, and Nigeria.

Few eurobond defaults

To date only a few African countries have defaulted on sovereign eurobonds. Including the Seychelles (in 2008) and Mozambique (in 2017), who both later exchanged new eurobonds with bondholders. Also Ivory Coast did not pay coupons in 2011 following post-election violence, but did later reimburse investors for the missed coupons. Since these events, Ivory Coast and Seychelles have developed much better economic and debt management practices. It is hoped Mozambique works to do the same.

It should be noted that the context for the defaults during the African debt crisis of the 1980s and 1990s was very different, as debt stocks were then predominately official. There had been sizeable commercial bank lending to Ivory Coast, Morocco and Nigeria in the 1970s (who like Latin American countries received Brady plan support). But for most African countries, commercial debt was by and large linked to bilateral export credit agreements, later replaced by multilateral lending.

Active debt management

Active debt management is becoming common among African countries. It is important because a $750 million eurobond does not sound large when compared to issuance across emerging markets, but that amount is large relative to the size of many African frontier economies. Further, some African sovereigns are yet to establish a track-record in the markets (this comes with regular repayment and not just regular issuance). Hence there would be concern if some of the African issuers were waiting right until their bonds’ maturities to refinance them. To avoid such heightened repayment risks African countries are increasingly coming back to the market with dual narratives. They are raising money for their budgets and for liquidity management.

Gabon and Ghana came early to the eurobond market in 2007, but ahead of maturities in 2017 they came to the market and tendered some of their debut eurobonds, reducing the repayment risk. More recently Ivory Coast and Senegal followed this trend, reducing some of their shorter dated eurobonds with proceeds from new issuance. Also Kenya repaid one of its debut eurobonds due in 2019 plus syndicated loans, using issuance from earlier that year. Another approach is to save hard currency in a sinking fund, as Namibia has done to prepare for its debut eurobond maturing in 2021.

With this trend of more active debt management it appears like the wall of debt in 2024 and 2025 can be slowly picked apart, with the spikes in maturity being smoothed out. Risks are being spread out over subsequent years and a more positive view of the asset class now makes sense. Debt slips over the next five to seven years appear more likely to be country specific, rather than following a systematic hit to the continent’s debt. This suggests that navigating country-by-country risk is essential.

Monitoring country vulnerabilities

There are a few important things to look out for. First, are build-ups of China’s official lending, as such debt currently falls outside the Paris Club structures for creditor reporting and restructuring (for example Angola, Ethiopia and Kenya among eurobond issuers are particularly exposed). Second, unsustainable debts of state owned enterprises hitting the sovereign balance sheets (for example in South Africa where the electricity utility Eskom is running huge debts). Third, collateralized lending from commodity traders (for example Angola and Republic of Congo have oil-backed debts). And finally where countries are complacent and ignoring the debt alarm bells (Zambia sits in this camp).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox