Are EM Bank Bonds a Defensive Play?

Emerging market (EM) banks appear to be a defensive asset class – who’d have thought it? It certainly goes against everything we learned in the Great Financial Crisis (GFC). Surely banks are pro-cyclical beasts whose performance surges in times of economic plenty and struggles in more recessionary periods? In the world of Emerging Markets credit, however, things seem different. At least for senior bonds, much EM bank paper today behaves much as its developed market (DM) cousins did before the GFC, trading tight to other sectors due largely to assumptions of sovereign support. The key difference is that, while developed markets did indeed support their banks in 2009, the size of the sector relative to GDP meant that the cost was so high that the western world has vowed never to repeat the experience. Emerging Market banking sectors, by contrast, are generally smaller relative to GDP, are often state-owned and/or central to delivering government policy. While idiosyncratic stories will create exceptions to this rule, I generally agree that the propensity of sovereigns to protect banks is higher today in EM than in DM, which is one factor that explains the low-beta nature of the Financials component of our index. We must grasp this simple truth to avoid underperforming in a sector that accounts for around half of the face value of outstanding benchmark bonds in the EM universe.

The JP Morgan CEMBI BD index is one of the most widely-used indices for EM corporate bonds. It has grown tremendously over the past decade and now contains $2.4tn of hard-currency corporate paper. Financials make up 30% of the index, though the face value of outstanding financial paper is closer to 50% of the total if we exclude index country weightings. State-owned banks make up 57% of total financial bonds. Looking across the regions, Asia accounts for 37% of the CEMBI, with LatAm at 28% and the Middle East at 17%. The CEMBI is a relatively high-quality index 57% of the index is Investment Grade, with just 43% of bonds in the High Yield category.

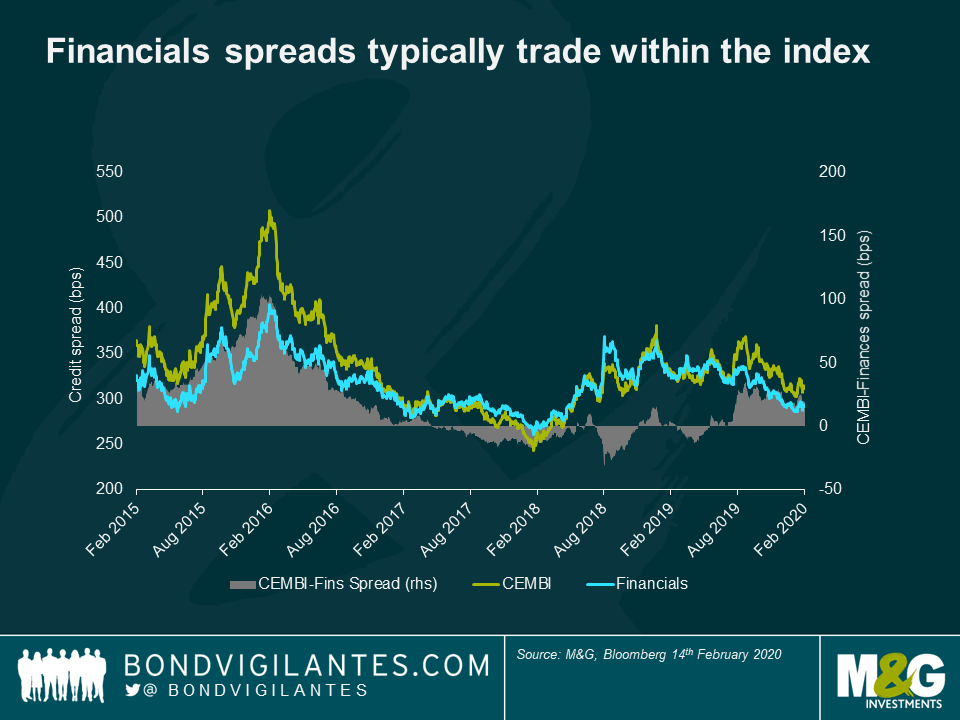

The Financials part of the CEMBI is a low-beta play. However, there are two important caveats: banks whose sovereign is distressed typically underperform that sovereign considerably, while subordinated debt is far more volatile than senior. I believe that investing in positive sovereign stories and avoiding sovereign distress scenarios is the primary consideration. The chart below makes this point quite nicely. Over the past five years, Financials have generally traded tighter than the EM corporate bonds index (CEMBI). The most pronounced risk-off period was the oil sell-off from summer 2015 to 1Q16, where banks performed significantly less badly than the overall corporate or sovereign indices. They also underperformed in the subsequent rally in 2016-17.

The next risk-off period began in February 2018 and lasted about a year. In this instance, Financials traded more in line with the index because the generic risk-off environment (driven by the emergence of the US-China trade war) was complemented by the financial crisis in Turkey. Turkish banks are the third-largest financial debt issuers in the index, meaning that their bonds’ underperformance had enough weight to move the whole index wider. This can be seen most clearly in the spike in Financial spreads in August 2018, which was caused by the Turkish Lira crisis. This sovereign event caused significant underperformance in Turkish bank bonds. As the crisis faded, normal service was resumed, with Financials now trading tight to the index again following the rally in 2H19. It is notable that during the volatile period over the past couple of weeks, Financial spreads have hardly moved. We also observe that there have not been many periods over the past five years where Financials have traded wide to the index.

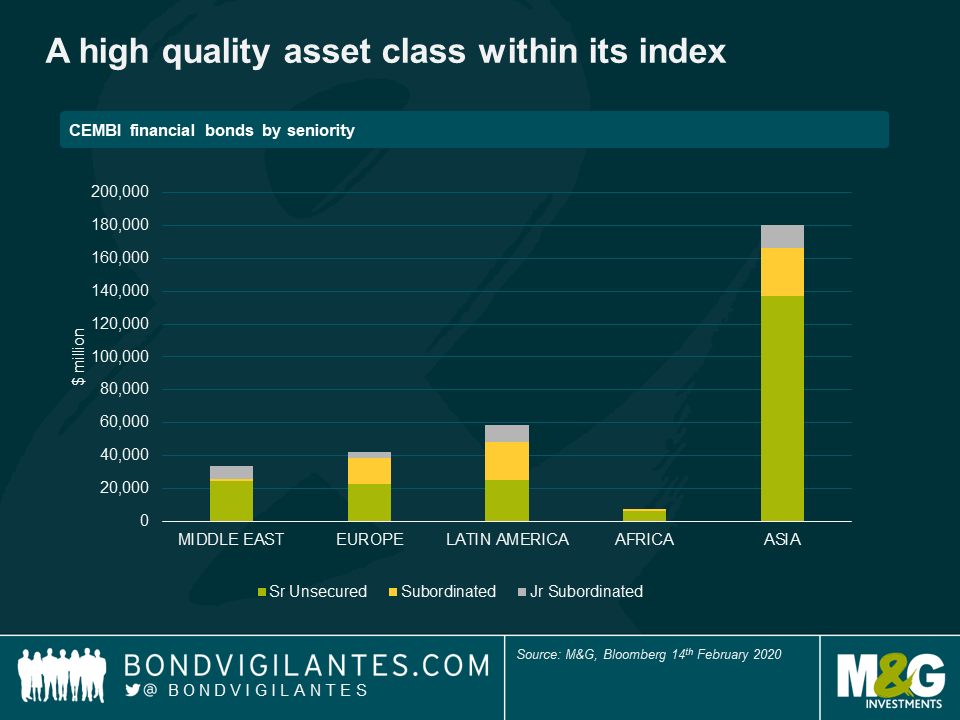

So what explains the generic defensiveness of an asset class whose constituents remain volatile in times of individual sovereign stress? A glance at the make-up of the universe goes some way to explaining why. The charts below show that, of the $323bn of financial bonds outstanding, $180bn is Asian, of which $148bn comes from China, Hong Kong, Korea and Singapore – all high-quality jurisdictions. Moreover, $137bn of this Asian paper is senior unsecured. A large proportion of financial debt, then, is senior and issued by investment grade entities. It is a high quality asset class in the context of its index.

Let us now turn to the issue of assumptions of sovereign support. Developed market investors have got used to the idea that banks will (theoretically) not benefit from further government bail-outs in times of stress. Taxpayer money must never again be put at risk as it was in 2009, an idea that has gained credibility as Western banks have issued more and more bonds that can be bailed in – so-called Additional Tier 1 bonds (AT1s), Tier 2 bonds (T2s) and even non-preferred senior bonds. Such buffers are still under construction in most of EM, where regulatory advances have been varied. For instance, while most LatAm jurisdictions now comply fully with Basel III, Vietnam is just leaving the world of Basel I. This goes some way to explaining why around half the stock of bank bonds in Emerging Europe and LatAm is subordinated, which is necessary to fulfil bail-in requirements, while the Asian banks universe (56% of total financial bonds outstanding) is still dominated by senior unsecured paper (see Chart 1 above). As most financial issuers are either sovereign-owned or systemically important, it is unthinkable that governments will voluntarily allow senior bonds to default. This assumption underpins a huge amount of the investable universe, explaining why bank exposures are generically defensive.

There are two caveats to this – sovereign stress and subordinated debt. These make sense, since sovereign support must be questioned if the sovereign is struggling (will it be able to help its banks?) or there is subordinated debt available that could be bailed in relatively uncontroversially (should the sovereign save these bonds?). The best recent example of sovereign stress causing volatility in bank bonds spreads in Turkey, whose currency crisis in August 2018 caused significant underperformance in otherwise strong banks. The chart below shows the TCZIRA (Ziraat Bank) 23s rising to a spread of 400bp over the sovereign from around 100bp beforehand, which equated to a cash price of 85.

Meanwhile Turkish bank subordinated debt fell to a cash price of around 55, even in the case of the strongest banks like AKBNK (Akbank). The greater volatility is justified because of additional fears of bail-in for subordinated debt. While I think there is greater resistance to bail-in of sub debt in EM than there is in the developed world (e.g. subordinated debt may not have conversion triggers, or very low ones, and in many cases there are a number of prescribed steps to be taken before bail-in is allowed, such as recapitalisation and/or liquidity assistance), it is nonetheless universally true that bank rescues globally have seen all subordinated debt sacrificed (a recent example in DM would be Portugal’s Banco Espirito Santo, while in EM we have Russia’s Otkritie).

We should add one important point here: when bail-in occurs, all subordinated debt tends to be wiped out, regardless of whether it is technically part of the bail-in regime or not. The Otkritie bonds in question were issued in 2012 before the advent of bail-in debt but were sacrificed nonetheless. This is an important point because “old style” (i.e. non-bail-in) bonds have tended to trade tight to “new style” (bail-in) bonds. To me, the risks of bail-in are identical, so I would avoid any subordinated debt that trades tight on this basis.

Unsurprisingly, Middle Eastern and Asian banks are the most defensive names, due to strong fundamentals and high ratings. I think that we are paid much better for taking AT1 risk in the Middle East than is the case in Asia (see chart), where defensively minded investors could consider looking at senior paper. Likewise, I do not believe that we are rewarded for venturing down the capital stack in LatAm banks, though I should stress that some subordinated and high-yield opportunities still exist in this area, particularly in Mexico. For those of a more bullish mindset who do not share my cautious view on Turkey, Emerging European sub debt offers a good pick-up over senior.

Or, better yet, bulls should just buy corporates in sovereigns they like. And that’s coming from a banks analyst.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox