Cheerio credit, not good bye

We started 2019 with credit at levels we perceived to be pretty cheap. The run since then has been remarkable, with spreads today close to all-time lows. What should one be doing with credit risk at this point?

There are reasons to remain bullish on credit, and fully invested. First, we remain in a goldilocks economic environment for bonds, with low growth and low inflation. These economic climes tend to be the very ones in which credit, particularly investment grade credit, performs well. Likewise, fears of imminent recession appear to be declining in the US and UK, while in many other parts of the world economic growth continues relatively unthreatened. The onset of recession tends to see credit spreads widen.

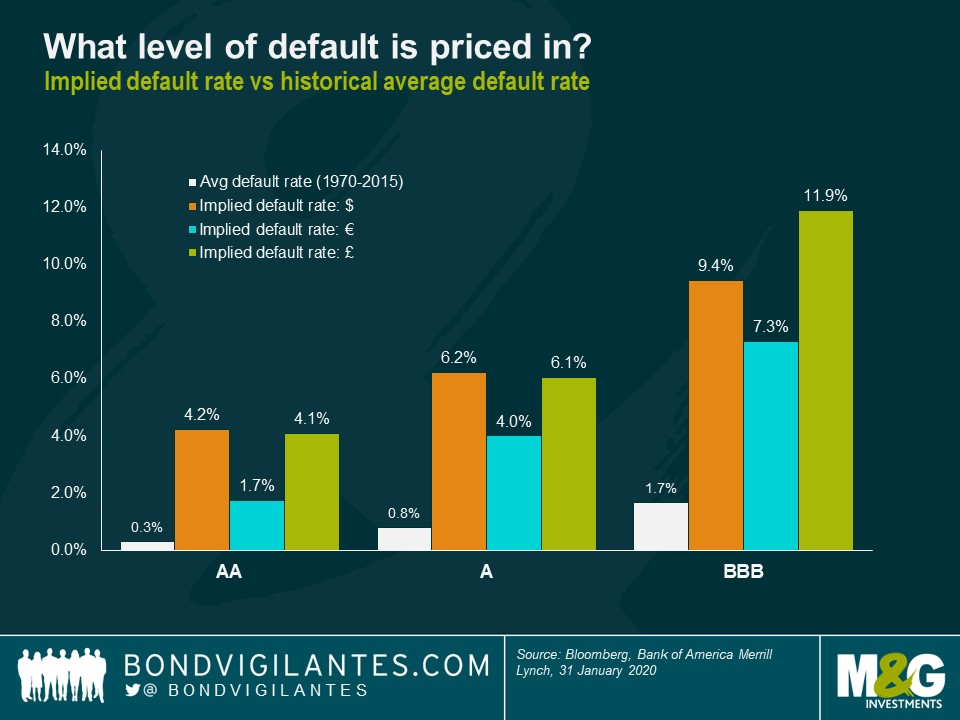

In investment grade credit, investors are overpaid structurally in spread based on historical default rates, and this remains true today (see chart below). Demographics and other factors have combined to mean that the bond market is in rude health technically, with a continuous wall of cash still finding its way into fixed income. Central bankers, contrary to the expectations of many (including the writer), have started 2020 once again on the dovish front foot, with policymakers at the Fed, ECB and BoE all talking about how much capacity they have to stimulate from today’s starting point of ultra-low rates and large back books of QE.

In terms of valuations, I guess one could say that spreads have been tighter, albeit only in very different circumstances many years ago and very briefly earlier this year and in Q1 2018. But the chart below shows where spreads are relative to their medians since 2006: Euro IG, GBP high quality (AA and A rated), and HY and IG CDS indices are all in the tightest 20% of their historical ranges. At the other end of things, the list of opportunities in which spreads are wider than their long-term medians has shrunk to US CCC HY, frontier market hard currency government bonds, and dollar denominated long dated BBBs. In the investment grade universe in which I am qualified to comment, we still see a number of attractive opportunities in long US BBB credit, even after the last few months of exceptional spread performance.

All in all, from this point I will be watching the credit market largely from the sidelines. I have watched spreads give up all their cheapness over the last 12 months and have sold bonds and names as I have thought they have become rich. Whilst I recognise the goldilocks economy we live in, and have reasonable confidence in the durability of this low inflation environment, I do not have as strong a view on growth on either side. There are reasons to be positive on the possibility that we see higher global growth, requiring policy tightening: we are seeing a bounce back in confidence after the UK election, and this may continue with any tailing off in the rate of spread of the coronavirus, the US election cycle, wage gains in much of the developed world, and an end to austerity (most presently in the UK). Then again, the virus’ spread has not yet reached plateau, Brexit uncertainty still looms large (and will do all year), ‘populist’ parties are still ascendant all over Europe, and central banks surely do not have huge flexibility to act on any of these growth-harming issues from here (which is presumably why they are all engaged in telling us how much room they have to loosen anyway).

To my mind, with spreads at these levels and economic conviction low, I am concerned about a problem primarily of valuation. The last time spreads were at these levels, we spent the rest of the year wishing we had sold more risk (2018) and we never got rising defaults or an economic recession. We just had a valuation rejection. Yes, investment grade credit spreads still overcompensate significantly relative to defaults, and with a wall of money coming into the market (another echo of 2018’s early weeks), we may well see spreads grind tighter for some months yet. But with the level of compensation on offer now so near all-time tights, and with so much uncertainty and noise around, I have said cheerio for now. There will surely be better opportunities to come.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox