In times of crisis, can the yen still leave you feeling zen?

This week has seen risk-off sentiment back with a vengeance as the Coronavirus outbreak dominates news headlines globally. Thus, investors are flocking to historically safe assets like low beta currencies, government bonds or investment grade corporate bonds with low default risks. However, can Japanese assets like the yen, nominal government bonds (JGBs) and inflation-linked government bonds (JGBIs) still be considered safe havens?

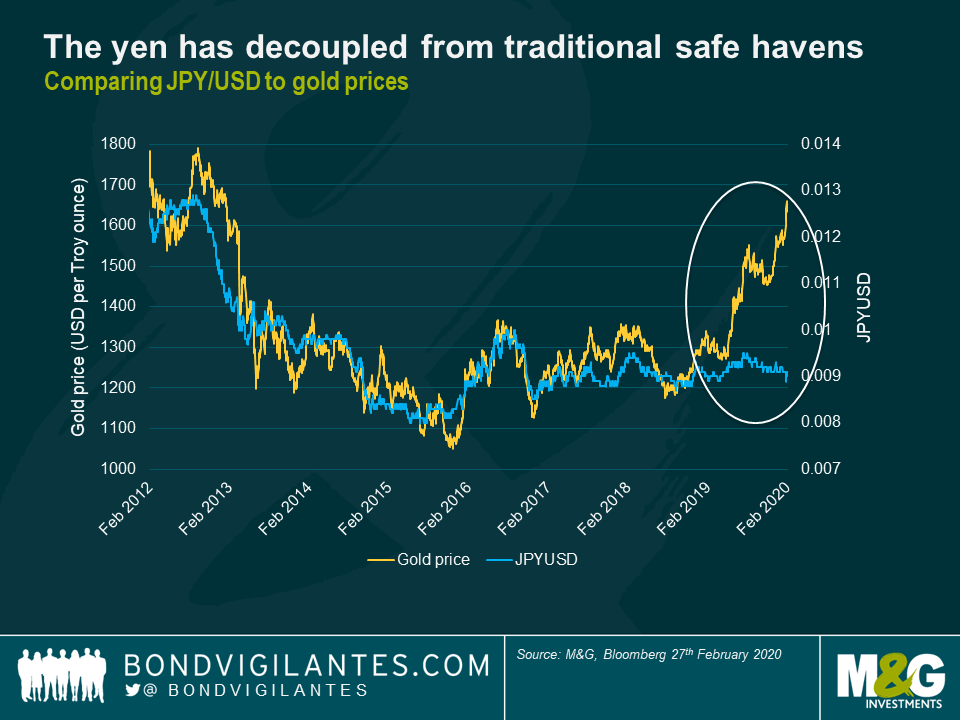

Looking firstly at the yen, the currency rallied during last year’s tensions in the middle east but has since reversed its gains against the dollar and USD/JPY recently hit new lows since 2017, despite the Coronavirus outbreak theoretically boosting the case for haven flows. Whilst this may be partly due to Japan’s proximity to the virus origin point, there are also a number of indicators that highlight that the yen is less correlated with traditional safe havens than it used to be. The chart below highlights how JPY/USD cross currency used to follow gold prices, an indicator of the health of the global economy, very closely until the end of 2018. 2019, however, saw a significant decoupling of this trend as the yen seems perpetually reluctant to converge back to its theoretical fair value.

Historically, both gold and the yen have been driven by the rush to safe haven assets, as well as real interest rate expectations. In the current global low rate environment, along with extensive quantitative easing in Japan and structural changes in the yen market, the yen has lost considerable purchasing power over time, whereas gold has the reputation of being the only form of money to protect purchasing power over long periods of time. Importantly, when the Bank of Japan (BoJ) embarked upon their ambitious monetary stimulus campaign two decades ago, Japan was one of the few low-rate markets, meaning that risk-on moods used to spur investors to engage in the yen-carry trade. These positions would then be closed out when geopolitical risks or weak economic data encouraged investors to de-risk portfolios. Thus, the yen was likely being ‘over-traded’ in line with market sentiment. Nowadays, with global rates having fallen in line with Japan (so called ‘Japanification’), less active currency carry trades are taking place, likely leading to the yen trading within a narrower band of fluctuation than in the past.

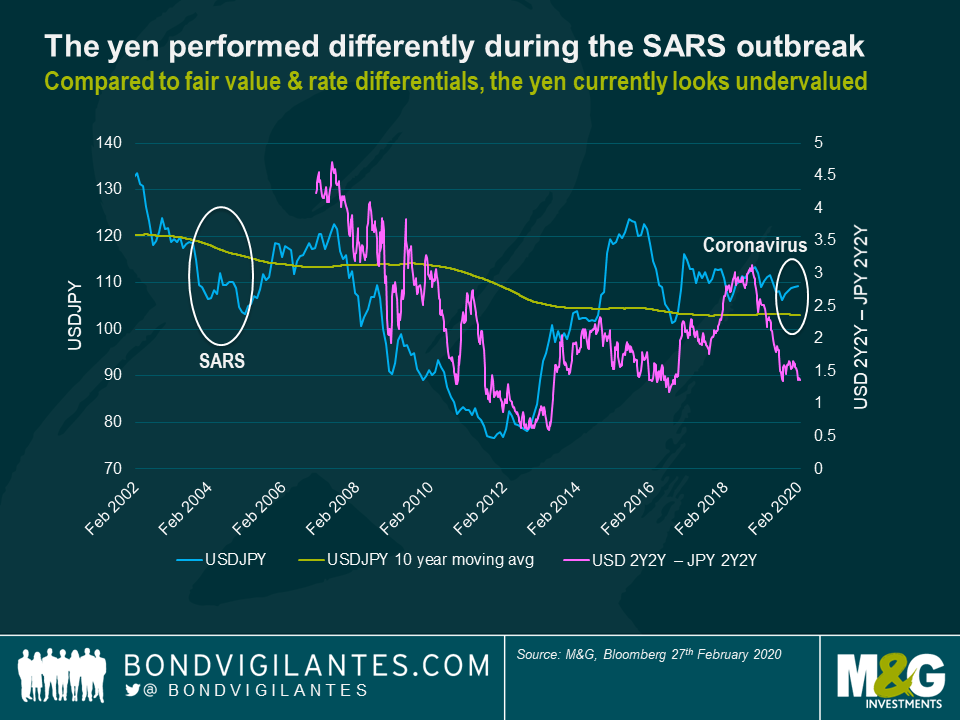

Comparing current USD/JPY moves to the period covering the SARS pandemic (2002-2004) in particular, the turnaround in the behaviour of the yen could be partly linked to how other developed market currencies like USD & EUR are less risky relative to the yen than they used to be. The dollar is currently offering higher liquidity and yield, presenting a more practical option as a safe haven currency to many investors. This is coupled with the fact that the Japanese economy is now struggling, showcased by a 6.3% economic contraction in the last quarter of 2019. The political situation is increasingly fragile as the decision to hike sales tax rates at a time when Japan may be on the brink of recession has come under fierce criticism. Fears are also growing that Prime Minister Abe’s poor handling has expanded infection of the virus, particularly with respect to his decision to keep thousands of passengers and crew confined on a cruise ship. It is no surprise that three surveys last week found that the approval rating of his cabinet has dropped, which could negatively impact the yen as the political outlook looks increasingly uncertain. Speculation that the BoJ may announce further monetary stimulus, only a couple of months after the previous round, has inevitably grown. Additional BoJ stimulus undoubtedly has negative implications for the yen and further highlights the attractiveness of a positively yielding dollar. Conversely, from a valuation perspective, compared to (two year) rate differentials the yen sell off may be overstated against the dollar, with potential room to revert, although the relationship between the cross currency and yield differentials seems to have loosened in recent years.

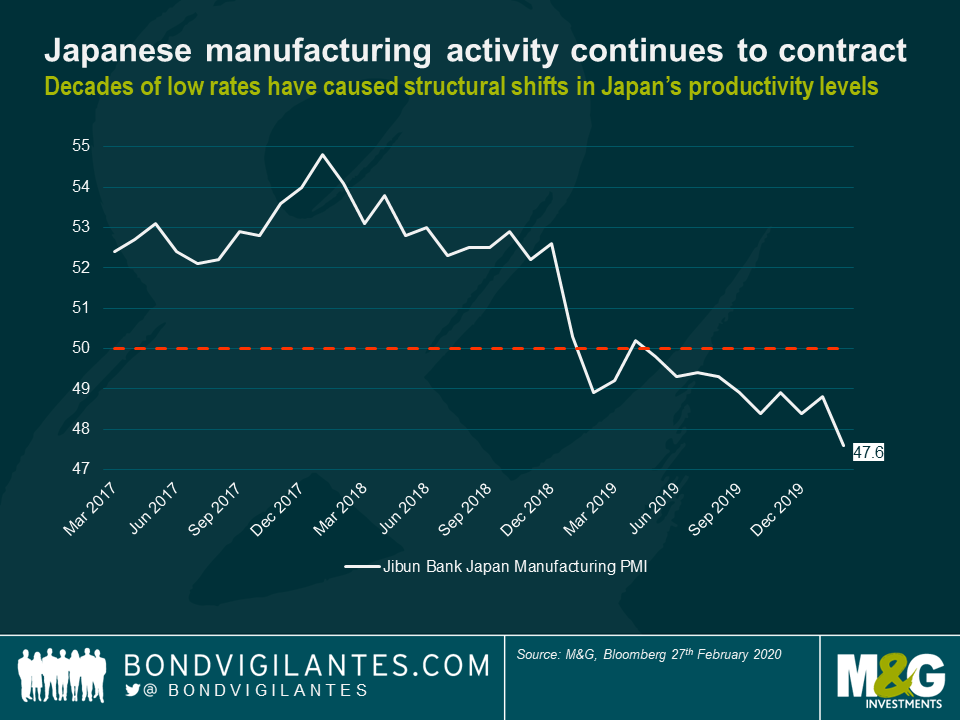

Speaking of rates, it is important to understand how extended monetary stimulus is structurally changing the economic fundamentals that underpin the yen. Years of low interest rates have kept a lid on the currency, benefiting exporters and allowing the hugely indebted Japanese government to continue to borrow inexpensively. On the other hand, it has also meant that cheap loans have kept unproductive companies alive, slowing efforts to revitalise an economy struggling with slowing growth, very low inflation, lacklustre productivity gains and an ageing population. Along with weak manufacturing PMI numbers as Japanese economic activity is being hit by the coronavirus, it is perhaps no surprise that the yen is not performing in line with expectations, despite the current risk-off environment. While Japan’s healthy current account surplus suggests that it could reclaim its safe haven status once the virus crisis has ebbed, strong US fundamentals and the dollar being seen as the current safe haven of choice could continue putting pressure on USD/JPY as we progress through the year.

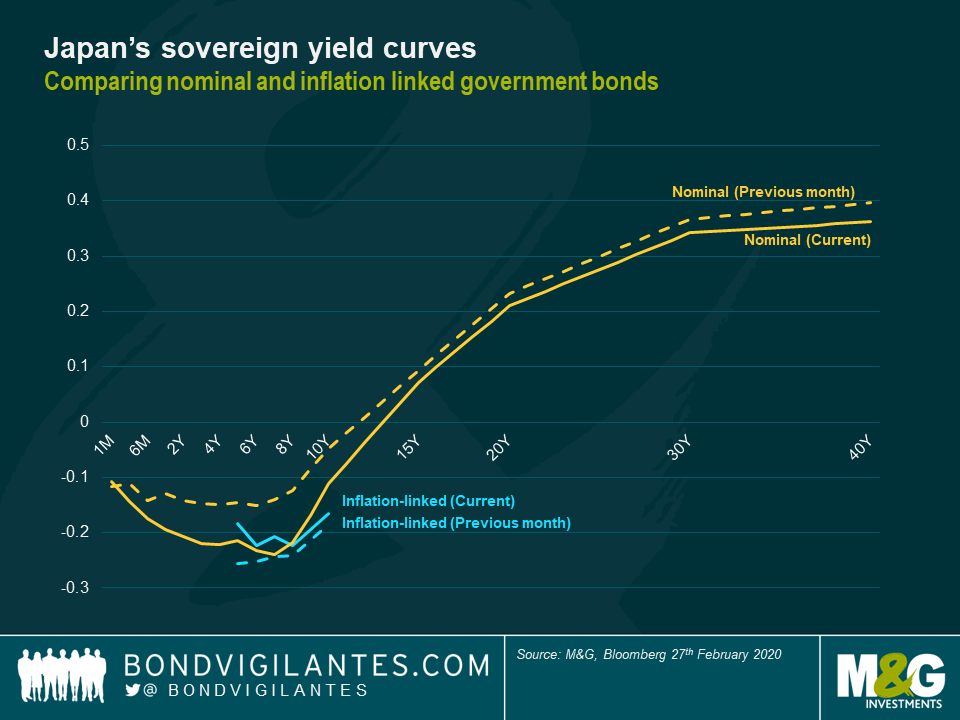

While yen depreciation may keep the market complacent about a potential rate cut, economic fundamentals are undoubtedly deteriorating and Japan may fall into a technical recession if the negative impacts from the virus outbreak persist. What is interesting is how the yen, and other currency moves since the outbreak, seem to be pricing in the macro risks significantly more than government bonds and credit spreads. As investors seem deterred from Japan as a whole, we would expect JGB yields to have widened along with other sovereign bonds that are linked to China (Malaysia, Indonesia etc). Contrastingly, almost every position of the yield curve has tightened compared to last month, with the belly of the curve in particular coming in around 10 basis points. Furthermore, the 8-10 year part of the curve has steepened slightly so 10Y or even 15Y paper currently shows some value in terms of roll. Comparing the nominal curve to the linker curve, breakevens are currently near zero and yields on JGBIs have barely moved compared to the last month, with the 7Y nominals actually trading through the linkers at the time of writing. This potentially shows how their illiquidity prevents them from following the movement of nominal yields. Further stimulus could push JGB yields down even further, but breakevens are already so low that to stop the nominal curve trading through the linker curve, natural market correction could spur demand for the linkers. Once the hunt for alternative safe havens other than the dollar resumes, investors may look at JGBIs as offering the most attractive option (vs nominals and the yen), although the negative carry trade at all parts of the curve could deter yield-hunters. Historically, yen depreciation has boosted buying flows for JGBIs, although so have rising oil prices, so the current plummet of oil could explain why the linkers haven’t really moved.

To conclude, can Japanese assets still be seen as safe havens in risk-off environments? It will be interesting to see how the yen behaves during a macro shock that is not centralised in Asia and thus not directly linked to Japanese growth. In general, markets don’t seem to have fully written off the yen, as it currently seems to be reversing its initial losses. It is likely that it will retain its safe haven status from a macro level purely due to the fact that trading fluctuations compared to history are significantly narrower. There probably needs to be a significant recession on a microeconomic level (rather than a technical one) to feed through to investors selling out of JGBs as a place to park their cash. The currency situation is very fluid and it seems that the short term outlook does have some upside, whereby the yen will likely continue reverting back to pre-virus levels once the initial shock of the outbreak ebbs. Even if the epidemic gets significantly worse, the yen could do well if pressure is taken off Asia as cases increase worldwide. If the risk-off sentiment continues, investors could also reach full allocation to USD/be deterred from buying treasuries when yields are at record lows. They may thus be forced to buy yen-denominated assets as an alternative haven, especially as it is now even cheaper on valuation, rather than add risk back into their portfolios. The bottom line: we think it might be slightly premature to stockpile food and only buy the dollar (or gold), as Japanese assets still have room to revert back to their traditional safe haven status.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox