Beyond Dividend Cuts – Crisis Implications for Bank Debt Investors

In the last two weeks, both the ECB and the PRA effectively demanded that banks stop paying shareholder dividends and buying back stock for at least six months. The announcements, even though they were leaked in the press well before official confirmation, sent bank share prices plummeting, as investors saw what had been improving income streams in recent years come to an abrupt halt. It also threw a spanner in the works of the market for bank capital securities. Are the banks in so much potential trouble that they required this unprecedented, capital-conserving move? Are regulators still trying to punish the banks a decade after the Great Financial Crisis (GFC) of 2008-09? Are other bank capital instruments next in line for a blanket payment restriction? The answers to these questions are no, no, and no.

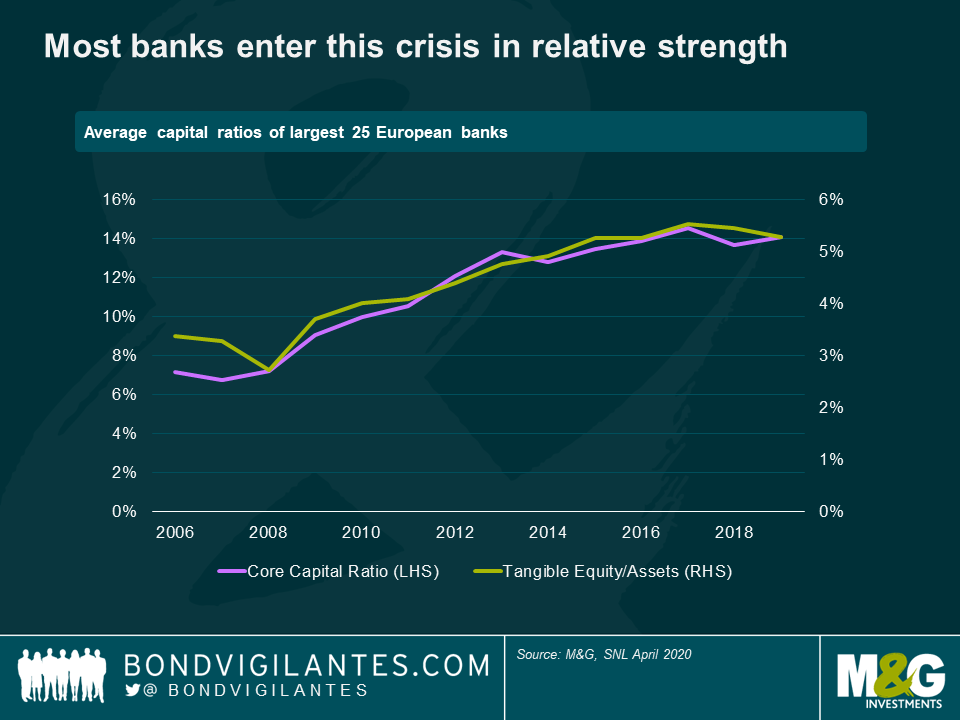

There is little doubt that loan losses at banks will rise considerably as a result of the Great Coronavirus Crisis (GCC). And depending on its longevity and severity, some or most banks may see capital levels drop meaningfully. But most banks are coming into this crisis from a position of relative strength (see chart below), and these capital-conserving moves by the regulators should be taken in the context of other measures to combat the economic fallout from the global lockdown. When considered in this light, one can appreciate that the banks have become, at least temporarily, a key transmission mechanism for governments’ efforts to mitigate economic decline. This has important implications for debt investors, as the risk profiles of bank debt have changed.

Government and central bank support measures have been numerous, swift and sizeable. In addition to dividend restrictions and a massive expansion of unemployment benefits, these measures include:

- Reductions in bank capital and liquidity requirements to keep credit flowing to the real economy (the ECB estimates their decision to ease certain capital requirements will free up €1.8tn in additional lending capacity at Eurozone banks);

- Central bank funding for new lending, including the new SME Term Funding Scheme in the UK and more favourable TLTRO3 terms in the Eurozone;

- Moratoriums on consumer debt payments;

- Government loans and loan guarantees for SMEs and larger corporate borrowers;

- Guidance for banks to refrain from classifying borrowers who request payment holidays as non-performing, or otherwise negatively affecting their credit scores; and

- Guidance to banks to limit early recognition of loan losses for borrowers using government schemes or deferring payments as a result of COVID-19.

These actions will be effective only if there are banks around to implement them, and do so willingly (though perhaps begrudgingly in some cases). Regulators are therefore keen to keep banks alive and functioning as long as the crisis continues and well into the recovery, and keep their access to capital markets open. In this light, the decision to halt dividends was a rational, precautionary move, designed to protect the authorities’ transmission tool (the banks) in a highly uncertain environment. Guidance around loan loss recognition has a similar purpose – to give banks the ability to lend in the near-term by “flattening the loss curve”, just as countries try to flatten the coronavirus infection curve. It’s the same for the softening of capital requirements, and the provision of liquidity.

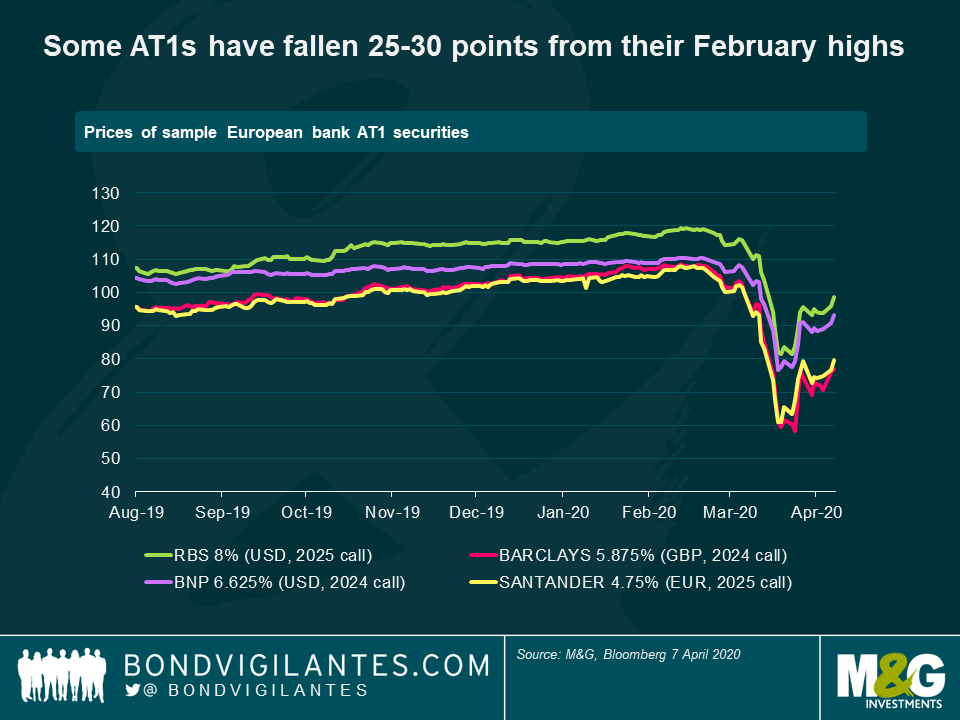

So what does this mean for bank investors? Different things for different parts of the capital structure. Consider Additional Tier 1 (AT1), the perpetual, callable hybrid securities that sit just above equity. These pay a regular, fixed amount to investors that would automatically be halted if prescribed capital “buffers” are not met, or could otherwise be halted at the whim of regulators. Prices on UK & European AT1 fell 2-4 points when the shareholder dividend restrictions were announced, even though these were clearly out of scope of the regulatory decrees. In fact, the regulator demonstrated respect for banks’ capital hierarchies by not restricting AT1 coupon payments, and later confirmed they expected AT1 payment restrictions to be determined by existing triggers (e.g., capital levels falling below pre-set buffer levels). This too is a rational, reasonable approach, since a bank can always pay out a restricted shareholder dividend at a later date, but can’t do so with cancelled (or “skipped”) AT1 distributions. Nonetheless, some AT1 instruments are still 25-30 points off their February highs, reflecting both payment and extension risks (see chart below).

There should be little doubt that AT1s are risky instruments, particularly so in the current environment. In addition to coupon skips, they could be written down or converted into equity in the case of severe capital shortfalls. Coupon skips are certainly possible if there is a protracted downturn – some banks may see their capital fall below required buffer levels as losses mount – but what about writedown risk? AT1 writedowns are supposed to be triggered when regulators consider a bank to be “non-viable” (in theory it would also happen when the bank’s core capital ratio falls below a pre-set level, usually no higher than 7.0%, but historically the non-viability designation has happened before capital has fallen that low). But a non-viable bank is also a bank that can’t help enact government policy, so letting banks go that low on capital doesn’t sound like good policy at the moment. It’s therefore our view that AT1 writedowns, at least at systemically important banks, are considerably less likely than coupon skips during this crisis.

Unlike AT1s, senior and subordinated bank debt are “must-pay” instruments, but these too are affected by the use of banks as policy transmission tools. Regulators across Europe have lowered so-called counter-cyclical capital buffers to zero, told banks they can breach capital conservation buffers, and are also permitting temporary breaches of liquidity requirements, all so banks can continue to lend to the real economy. These measures give banks additional cushions against regulatory intervention, which should benefit bank senior and subordinated debt, all else equal, at least in the near-to-medium term.

There is of course a downside to all these actions. We must not forget that while governments and regulators will likely be eager to support both banks and banking systems to soften the economic impact of the crisis, the flexibility they are giving banks now on capital and loss recognition creates transparency and credit risks down the road. And all the while, lower-for-longer rates will continue to drag on bank profitability. But if policymakers are successful in supporting a post-crisis recovery, those risks are much more attractive than the alternative of letting banks flounder now. In the GFC, the banks were in bad shape and needed their governments. In the GCC, it may be more accurate to say the governments need the banks.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox