China’s bond markets once again prove resilient amidst COVID-19 crisis

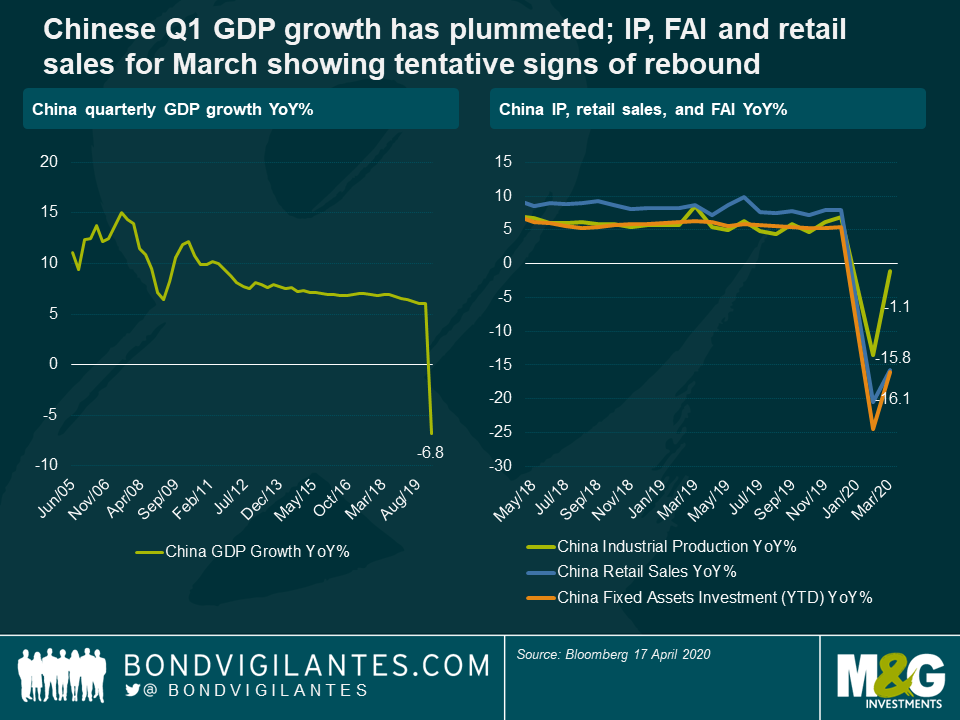

Earlier this week, China’s Central Bank (the PBoC) announced a further cut to the 1 year loan prime rate, one of its key interest rates, from 4.05% to 3.85%. This further loosening of monetary policy demonstrates that, as China attempts to extricate itself from the COVID-19 crisis, the domestic and international pressures on the world’s second largest economy remain severe, and the outlook highly uncertain. Last week’s publication of Q1 GDP growth numbers, industrial production, fixed assets investments and retail sales were illustrative of this state of affairs: some investors saw in the data signs of an economy starting to turn the corner, others a confirmation that global demand remains depressed and that the attempted re-opening of the Chinese economy post lock-down will be a slow and gradual process.

To get some clarity on what the future holds, it can be useful to look at the performance of Chinese financial markets. From an equities perspective, my colleague Rob Secker gave his views on Chinese equities in a recent blog (link here).

In terms of fixed income, given the segmentation of Chinese bond markets and the huge range of assets available, naturally there have been strong divergences in returns.

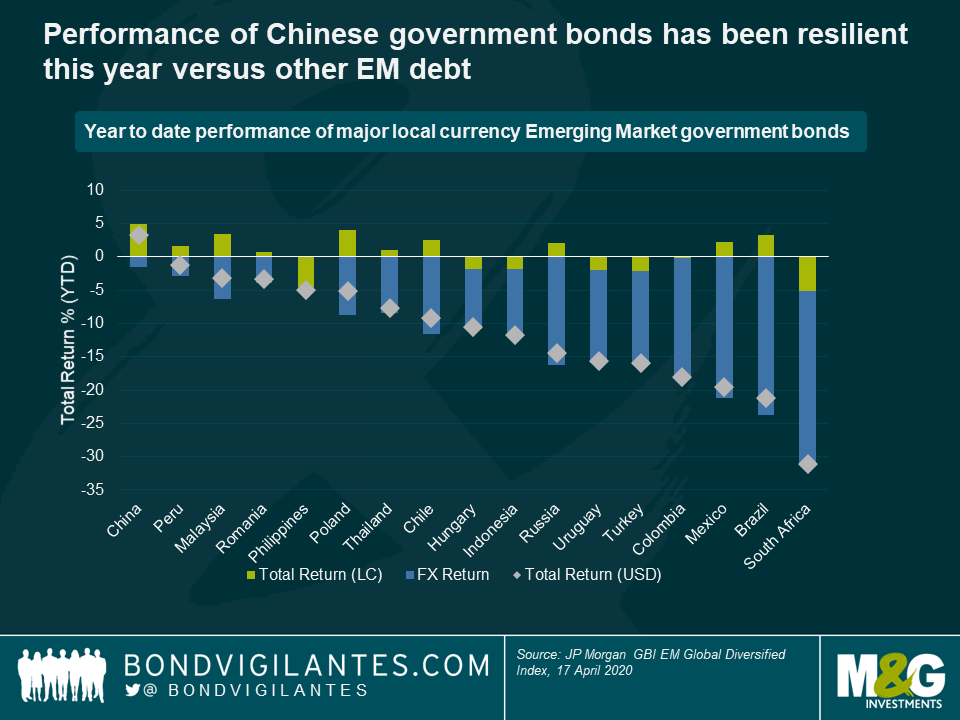

Renminbi denominated government bonds (CGBs) have fared on the whole relatively well this year, supported by the PBoC’s reductions notably to the 1 year and 5 year Loan Prime Rates (LPR), the 1 year Medium term lending Facility (MLF), and the 7 day and 14 day reverse repo rates. In addition, the PBoC has also directly injected trillions of renminbi into the banking system, through its outright monetary operations and by reducing reserve requirement ratios for banks.

Despite these moves, the PBoC has been relatively measured in its approach to the COVID-19 crisis, and therefore still has space to loosen monetary policy further should the crisis get worse. This should prove supportive for Chinese government bonds in the near term, especially as CGB yields remain more elevated than for example US Treasuries (currently 5 year CNY CGB yields are 2.0% and 10 year 2.6%). That being said, despite these higher yields in relative terms, the much reduced liquidity of CGBs versus US Treasuries, and the lingering restrictions around capital flows in China, mean that global investors will probably remain reluctant to increase significantly their participation in CNY denominated Chinese government bonds in the near term.

As for the renminbi, it has been one of the standout performers this year, especially when compared to other emerging market currencies. Because of this, on a year to date basis, CGBs are one of the best performing government bonds within the JP Morgan emerging markets local currency index (when calculated in US Dollars).

As a result of this outperformance, when compared to other emerging market currencies (especially those that have fallen sharply this year), the CNY arguably looks expensive, and is likely to underperform should sentiment around global demand and the COVID-19 crisis improve materially.

Versus the US Dollar, the CNY has on the whole weakened this year, and recently broke through the 7 CNY per USD mark once again. In my opinion, this has more to do with recent USD strength than fundamental CNY weakness, and the outlook for the CNY remains relatively robust. In addition, the PBoC has often stated that it does not purposely intend to devalue the CNY to boost growth, and that it aims to keep the CNY stable over the long term. Because of this, with the CNY now trading very close to multi-year lows versus the USD, the currency’s downside versus the USD looks to some extent capped. On the other hand, should USD valuations normalize, there is likely to be some decent upside potential for the CNY versus the USD.

Turning our attention now to credit, China’s deeply segmented markets have once again led to some quite large discrepancies in performances this year. The renminbi onshore market, despite the elevated debt levels of many state owned enterprises, has remained broadly resilient throughout this crisis and even posted small but positive returns (according to the S&P China Corporate Bond Index, a very broad measure of credit in China). This positive performance can in part be attributed to the fact that many investors in CNY credit tend to be buy and hold investors, and therefore the asset class did not suffer from the same forced selling pressures and USD funding stresses that wreaked havoc in financial markets in March. Many CNY credits also benefit to some extent from an implicit state guarantee, which makes the market generally more resilient, although of course there are some exceptions.

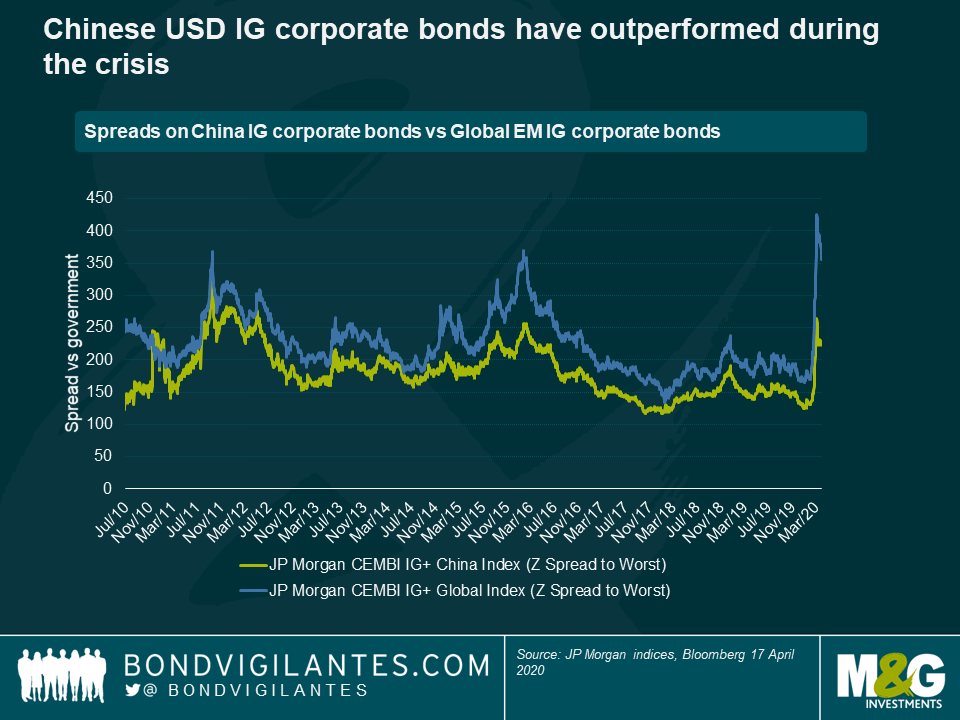

As for USD denominated corporate bonds of Chinese companies, spreads widened on the whole throughout the risk spectrum. Within investment grade, the spread widening has been relatively measured, Chinese corporate bonds outperforming the broader EM corporate IG index by over 100 basis points in spread terms this year. Some of that outperformance is probably justified by sector and quality discrepancies between China IG bonds and the wider EM index, as well as the general historical resilience of Chinese credits. But on the whole it means that, from a purely valuation perspective, there are now more compelling buying opportunities for EM investors outside of China today. This relative richness of Chinese IG credit is also exacerbated by the lack of transparency of some Chinese corporations, as well as lower levels of liquidity.

As for Chinese USD high yield bonds, after selling off massively and spreads rising to over 1,100 basis points in March, they have now retraced some of those gains and are trading around 850 basis points on average (JP Morgan CEMBI+ indices). Most of these bonds are from highly levered real estate companies that have been directly impacted by the virus outbreak, so they are not without risks. But if one focuses on those companies with stronger balance sheets, lower liquidity requirements and access to onshore funding, there are likely to be some interesting investment opportunities, on a selective basis.

Ultimately, while the COVID-19 crisis is unprecedented and has rocked financial markets, investors can be reassured by the resilience this year of Chinese government bonds and the CNY currency. As for USD denominated Chinese credit, there may be some attractive opportunities on a case by case basis, especially in the more speculative high yield space. Of course, investing in China is not without its risks. The country remains under fire internationally for its apparent initial handling of the crisis, and it is likely that the trade tensions that emerged last year will probably come back to the fore at some point. It also remains unclear at this stage whether the virus can be contained purely through social distancing measures, mass testing and isolations. Without a proper cure or vaccine readily available there could still be a second wave of infections.

Whatever your view, as the first country to be impacted by the virus and having now been able to curb the spread (at least momentarily), it is important to continue to look to China as it pursues its course towards normalization and the re-opening of its economy.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox