Switzerland has discovered the lower bound. Will other central banks follow?

While it is certainly too early fully to understand the impact of COVID-19 on economies around the globe, one thing is for sure: the shock to economic activity is going to be enormous in the short run as sectors of the economy simply shut down. Having experienced one of the biggest corrections in history last month, financial markets have started to be somewhat more upbeat of late. Market participants have welcomed the robust and coordinated response from policy-makers around the world. Central banks of major economies have stepped up their game, using a whole repertoire of unconventional measures to ensure markets continue functioning. Just last week, the Fed went beyond what any central bank has done before, by expanding its purchases to include high yield exchange traded funds and fallen angels. This will undoubtedly give a confidence boost to high yield investors and the BBB-rated segment of the IG market.

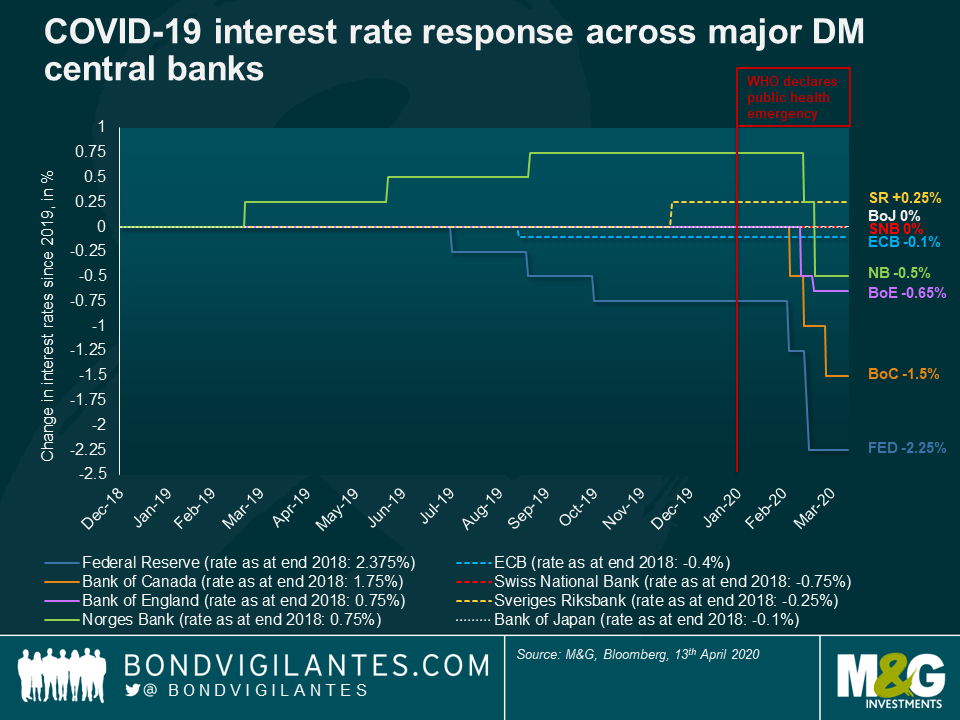

We have also seen a conventional policy response from central bankers in the form of interest rate cuts but, interestingly, these actions have been very different across the developed world. In fact, we can witness a two-tier response: that in economic areas with positive policy rates, and that in those with zero/negative policy rates. The chart below shows the change in interest rates of eight central banks since the start of 2019. While large interest cuts followed swiftly when the virus started to spread in those areas with positive interest rates, central banks with zero or negative rates (dotted lines) have refrained from cutting any further. This, despite all countries having to prepare for a severe economic downturn.

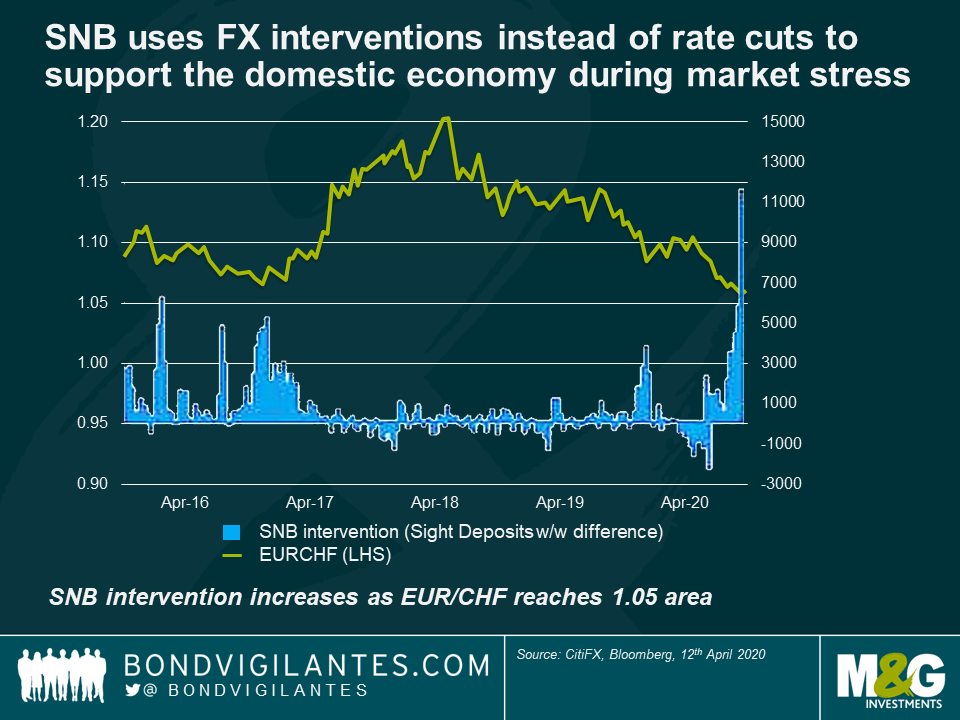

Amongst those not willing to cut, Switzerland belongs to the countries hardest hit by the virus, even surpassing Italy in infection rate per capita. The country’s policy rate is set at -0.75%, the lowest around the globe. For a long time, the Swiss National Bank (SNB) used to move in lockstep with the ECB to keep the EUR/CHF exchange rate range bound. This is important given that two thirds of Swiss exports go to the EU. However, in September 2019, the SNB changed its strategy. The ECB cut rates but the SNB didn’t, despite having cut its growth forecast in half from 1.5% to 0.75% at the same meeting. Maybe this meeting marked the turning point when the SNB silently acknowledged that the side effects of negative rates, which do hit bank profits and pensions hard, had started to outweigh the benefits.

Not cutting rates further last month while the country has gone into complete lockdown adds further evidence that the deeply negative policy rate is outside the SNB’s comfort zone. To compensate for the lack of rate action, we have witnessed more unconventional policy measures from the Swiss National Bank in the form of more aggressive deposit tiering to support banks (exemptions for banks from negative rates currently applies up to 30 times their minimum reserve requirement!), as well as FX interventions to prevent the EUR/CHF from falling below 1.05.

The example of the Swiss National Bank is certainly the most extreme, but the bank is not alone in questioning negative rates. Back in December last year, the Riksbank lifted the repo rate by 25bp returning it to 0.0%, notably at a time when the Swedish central bank’s own projections of inflation over the next three years remained below the 2% target. And just days ago amidst the corona crisis, Fed chair Jerome Powell told reporters in an interview that negative policy rates are unlikely to be an appropriate policy response in the United States.

Let’s take this one step further. If it is indeed true that we are close to, or in certain circumstances have reached, the lower bound in interest rates, this has important implications for fixed income portfolios. With limited room to cut rates further, the ability of such risk-free assets to act as a shock absorber in economic downturns has been reduced meaningfully. The chart below shows that the correlation between the Swiss Market index and Swiss government bond yields has been much lower during the COVID-19 sell-off compared to previous crises.

There is a reasonable chance that we will look back one day and say that it was the COVID-19 crisis which uncovered the limits of conventional monetary policy. Maybe we are just witnessing the first severe economic crisis in which major central banks in the developed world—in the absence of inflation—refuse to cut rates.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox