Primary market volumes are a double-edged sword

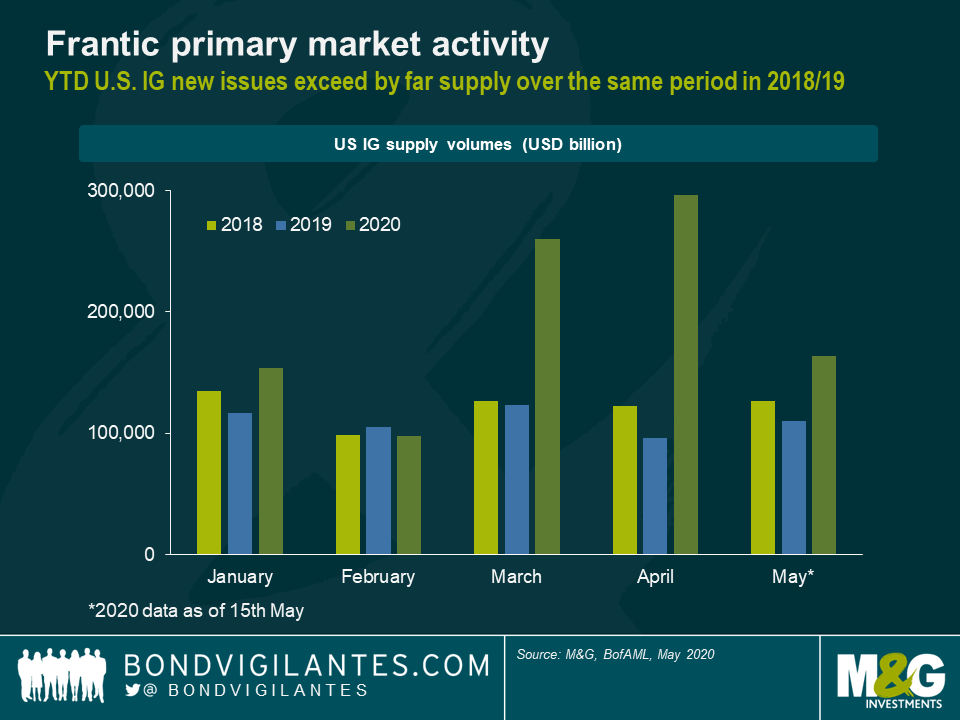

One of the main topics in the investment grade (IG) corporate bond space over the past weeks has been frantic primary market activity. Every single day, with very few exceptions, there has been a relentless flood of new corporate bond issues. Year-to-date supply has risen to around $970 billion and c. €310 billion in U.S. and European IG primary markets, respectively, thus exceeding by far new issue volumes over the same period in prior years.

From a bond investor’s perspective, roaring primary markets are both a blessing and a curse. On the one hand, as an incentive to buy, issuers offer their new bonds typically at more attractive valuations than their outstanding bonds. This new issue premium (NIP) can be substantial, particularly during times of market distress. Broker research reports have estimated the average NIP in March this year for U.S. and European IG markets at 25-40 basis points, which is a significant concession in the IG space. On the other hand, more attractive valuations in primary markets put considerable upward pressure on credit spreads in the secondary market, which hurts existing corporate bond holders, thus highlighting the double-edged nature of the new issue deluge.

Away from bond valuations, it is genuinely worrying for credit investors that so many companies are currently bingeing on gluttonous amounts of debt. Conventional wisdom has it that a bond issuer, when adding financial leverage through debt-financing, becomes more vulnerable, which in turn increases the riskiness of its debt instruments and puts downward pressure on its credit rating.

The new issue glut is also a profoundly bearish signal. What companies are effectively telling us is that they need to borrow money to boost their liquidity profile to compensate for precipitous revenue declines due to COVID-19. Needless to say, this is not a sustainable business model that can go on forever.

But elevated levels of primary market activity are not all bad news. In fact, I’d argue that the new issue frenzy is again a double-edged sword. Compared to ‘peak panic’ in the first half of March, when primary markets were essentially shut, the situation has undoubtedly improved. A functioning primary market, which is open for business and allows companies to raise capital to fund operating expenses and refinance existing debt, is a necessary condition to overcome the current crisis and the looming global recession. It is encouraging that even companies that are facing severe COVID-19 headwinds can tap into the primary bond markets to meet their current funding needs. Aircraft maker Boeing is the prime example, raising $25bn in the U.S. primary bond market at the end of April.

Ultimately, it all comes down to time horizons in my view. Over the short-term, high new issue volumes are a sign of market resilience. Primary markets are throwing companies a liquidity lifeline, which helps to keep default rates in the IG universe at very low levels and thus prevents a further escalation of the crisis. Over the medium- to long-term, however, many companies will emerge with significantly higher debt burdens. Some will be able to capture the economic post-crisis rebound and reduce leverage swiftly. Others will struggle with debilitating debt levels, though. Interest payments will absorb a fair amount of their future revenues, thus stifling their growth potential.

From a macroeconomic viewpoint, it also brings up the question of how many companies that would have otherwise disappeared given their weak balance sheets and poor productivity will survive based on readily available debt financing, thus circumventing Schumpeter’s famous ‘creative destruction’ principle. Is this a trend that is going to continue? That would mean lower innovative strength and subdued potential growth rates for developed economies going forward, which in turn could lead to difficulties to service debt burdens at some point down the line. It is always our job as active corporate bond fund managers to identify good and bad debtors, winners and losers, but in the post-COVID-19 era, this task seems set to become even more crucial.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox