What does the CDS basis mean for credit investors?

Financial markets are generally considered to be efficient, particularly in the long run. However, in the short term inefficiencies might emerge, especially in times of severe market stress conditions such as the one we are currently experiencing. This can give active investors an opportunity to take advantage of these dislocations until the market corrects itself.

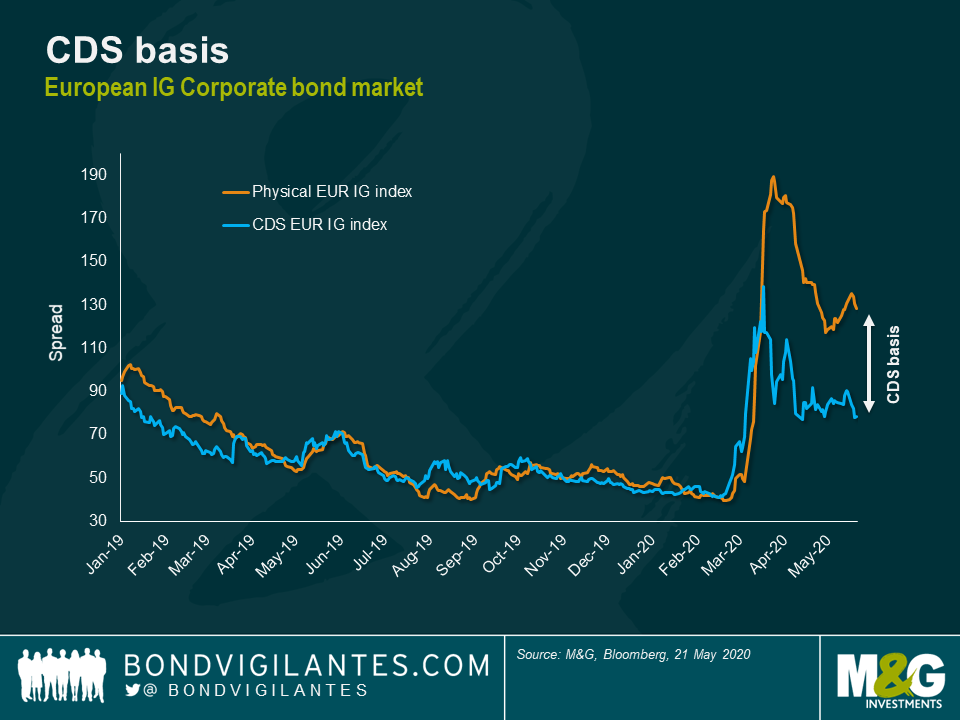

Today amongst various dislocations observable in financial markets, one which is worth highlighting is the so called “CDS basis”. The CDS basis is simply the difference between the spread an investor receives when owning a physical corporate bond, and the Credit Default Swap (CDS) of the same bond. In relatively stable market conditions, the CDS instrument and the spread received by investors should be very similar as they both reflect market perception of the credit risk. However sometimes they can differ and this generates the CDS basis. The basis is defined as negative when the CDS trades tighter than the physical bond spread for the same maturity. When the basis is negative investors could earn near riskless return by buying a physical bond and writing protection on that same bond using a CDS with equal maturity.

Many factors can contribute to drive these differences, but the most important ones are liquidity and demand/supply dynamics. Especially at time of market stress, these two factors can have an higher impact on leading the CDS basis to extreme territories. This is exactly what is happening today: due to the coronavirus crisis, liquidity in the market has deteriorated and this is reflected mainly in physical bonds as opposed to CDS indices which are usually far more liquid. In addition, the exceptionally large primary market activity (see latest blog written by Wolfgang) has further penalised physical markets which had to absorb this exceptionally large supply.

The result is that the CDS basis today is extremely negative: as you can see from the chart below, the spread you can earn from owning a physical bond has increased significantly more than the credit risk priced in the CDS market. With primary market activity now slowing down and liquidity gradually coming back towards more normal levels, this dislocation should continue to close down. Furthermore central banks’ Quantitative Easing programmes should contribute reducing the gap even more as they are buying physical bonds and not CDS instruments.

Investors could take advantage of this dislocation by buying physical corporate bonds and writing protection on CDS indices with similar maturity. Also, for investors which already own physical corporate bonds but want to reduce their credit risk in light of the recent rally in spreads, it could be more efficient to do so using CDS indices as opposed to sell physical corporate bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox