The U.S. labour market is back with a vengeance

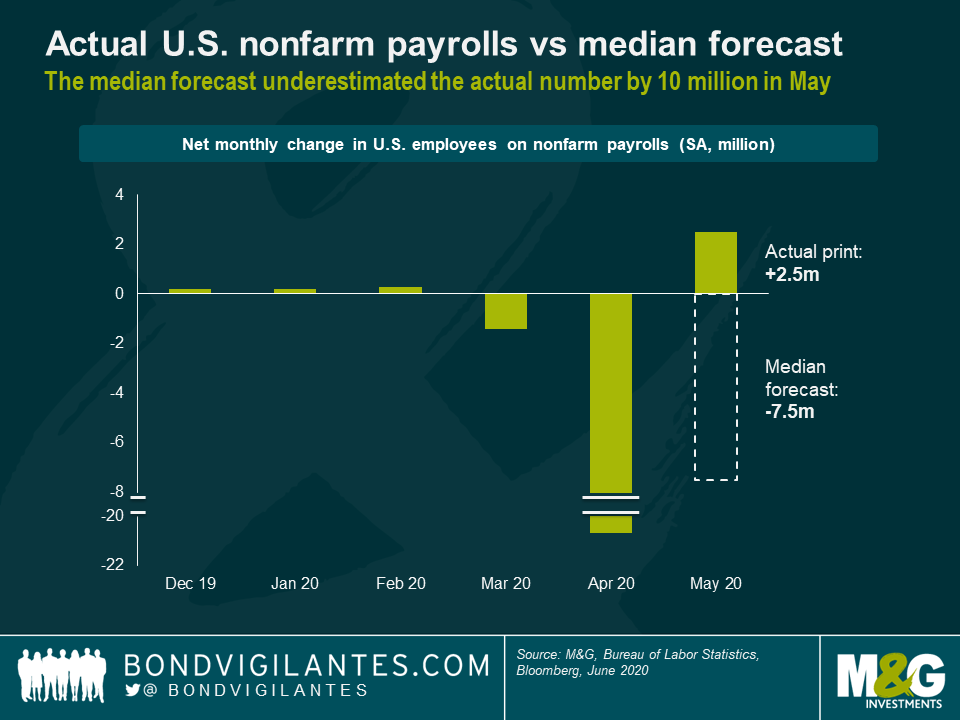

Wowsers, the U.S. labour market never ceases to amaze bond investors. After the cataclysmic April U.S. employment report—nonfarm payrolls (NFP) had dropped by 20.7 million and the unemployment rate had shot up to 14.7%—there was broad agreement amongst market observers that May would prove to be another challenging month. In a Bloomberg survey of 78 economists, the most bullish forecast was a NFP decline of 800,000. The median NFP projection indicated a loss of 7.5 million jobs, while the unemployment rate was predicted to approach Great Depression levels of around 20%.

But—surprise, surprise—the unemployment rate actually fell to 13.3% as the U.S. labour market added a record 2.5 million jobs in May. This means that the median NFP survey forecast was off by a whopping 10 million, a truly spectacular miscalculation. How could this happen? How could so many esteemed economists fail to predict the resurgence of the U.S. job market? Pundits were quick to point to misleading jobless claims data and an underappreciation of the effects of the U.S. government’s relief measures. But I think the real issue is more fundamental. The COVID-19 induced economic downturn is in many ways uncharted territory. The unprecedented nature of the crisis calls into question the applicability of standard economic models.

As bond investors we therefore have to come to terms with elevated levels of uncertainty. Friday’s U.S. employment report wasn’t the first macroeconomic surprise of late—albeit the most remarkable one—and in all likelihood it won’t be the last. Needless to say, unexpected economic data points do move markets. On Friday, driven by U.S. job data, the 10-year U.S. Treasury yield jumped up by nearly 10 basis points (bps) while the spread level of CDX HY, a bellwether of U.S. high yield credit risk, collapsed by nearly 50 bps. This increases the risk of investors being caught on the wrong foot. Considering the ultra-low levels of core government bond yields and the strong recovery in credit markets over the past two months, the margin of safety isn’t particularly generous. Hence, in my view, it is prudent to avoid an overly directional portfolio positioning and balance risk exposures instead.

Furthermore, while Friday’s employment report was certainly a highly encouraging testament to the resilience of the U.S. labour market, investors should be careful not to give the all-clear prematurely. There are still 21 million unemployed persons in the U.S., plus another 9 million not in the labour force who currently want a job. A further 10.6 million classify themselves as employed part time for economic reasons. It will take time for the U.S. labour market to shake off the devastations of COVID-19. There is a risk that investors get overly optimistic, pricing in a frictionless V-shaped recovery, which could lead to disappointment and adverse market reactions. And while markets are fixated on COVID-19, we shouldn’t forget that it is not the only obstacle to economic growth. Trade tensions between the U.S. and China—the bogeyman of 2018—have been building up in the background. Further escalation might damp the speed of economic recovery.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox