High yield case study: McLaren – a car crash averted

Covid-19 has taken lives, dramatically reshaped the way we live and work, and challenged our view of a safe and stable world. Those of us who work in investment management, especially high yield fund managers like myself, have seen the pandemic put many businesses under severe financial stress. British high-end sports car maker McLaren was one of them. The company’s activities have been badly disrupted and the company’s liquidity came under extreme pressure. It urgently needed to raise hundreds of millions of pounds of cash, despite having recently launched a strategic cost cutting and capex reduction plan.

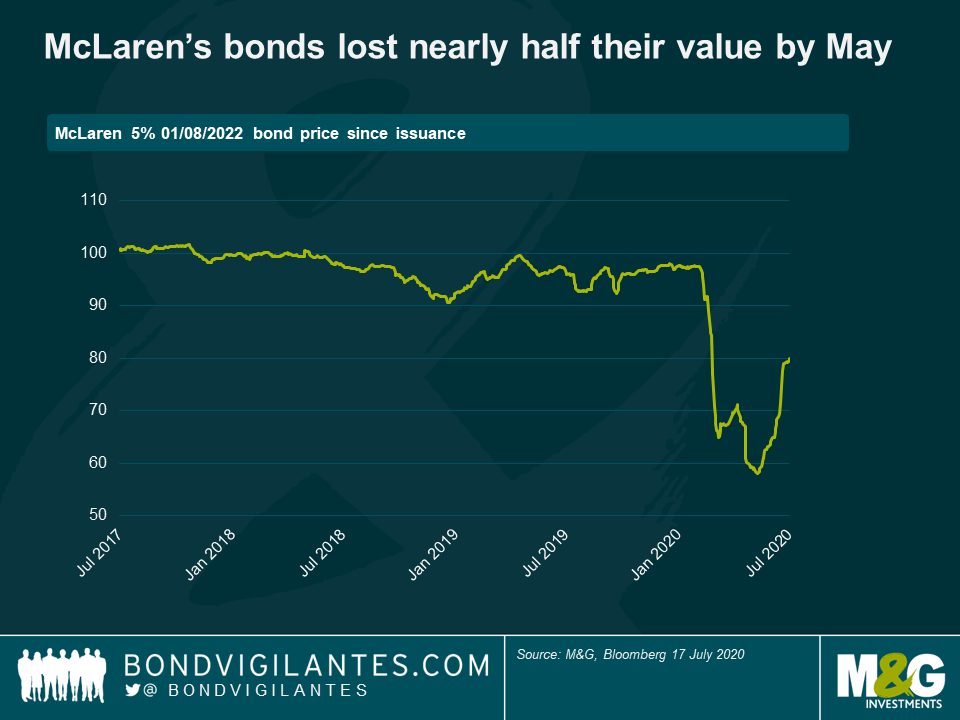

What can a company do when it needs to raise this much cash? It can sell assets, borrow more, or raise more equity. McLaren has an all secured capital structure. This means that all of its debt is backed by a pool of the company’s assets or collateral, from the physical assets like its headquarter buildings in Surrey and its collection of heritage cars, to intangible assets such as its world-famous brand. McLaren’s secured bonds were trading in the mid-50s cash price in May and yielding more than 30%, implying serious concerns about the viability of the company and whether bondholders would get their money back. With the company unable to sell its secured assets and the owners unwilling to put more equity into the business, McLaren decided to explore loopholes in the bonds’ covenants in order to borrow more debt, and at a cheaper rate than its existing bonds. It proposed to transfer the headquarter properties and heritage car collection into a new “unrestricted subsidiary” outside the existing “restricted” borrower group. It would then raise fresh debt secured on the assets transferred to this subsidiary. This is known as a “J.Crew style transaction”, after the US retailer’s 2016 debt restructuring in which it put its brand and other intellectual property into a new entity outside the restricted group of existing debt, and used the entity to borrow more debt. Secured bond holders were now facing a dilemma: if they agreed, they would lose a valuable part of their collateral; if they didn’t, then the company would imminently run out of cash and they might lose all their money, unless they stepped in and funded the shortfall themselves.

But how could McLaren do this when the existing bonds were secured on those assets? McLaren took the bond trustee to the UK High Court, arguing that this was matter related to the “intercreditor agreement” that governs relationships between different borrowers. This falls under English Law, unlike the bond indenture which is under New York Law. Their hope was that the English court would be less capable of interpreting a New York Law indenture. Meanwhile, a group of more than 70% of the existing bondholders was quickly formed and they hired a law firm to push back against the newly proposed fundraising. With the company only submitting hypothetical transactions, the High Court required a specific new fundraising plan. Ultimately, McLaren backed down and called off the lawsuit, instead opting to raise a £150m shareholder loan from the National Bank of Bahrain (McLaren’s majority shareholder is Bahraini sovereign wealth fund, Mumtalakat). In exchange, bondholders agreed to amend and loosen some of the bond covenants to allow the sale of or a portion of the heritage car collection (provided at least £150m worth of vehicles was retained in the collection), and the sale of headquarters properties (provided that the first £85m of proceeds were used to repay the bond at par). The amended covenants also prohibit the transfer or sale of intellectual property.

The outcome of the McLaren case can be deemed a success for bondholders. We avoided a “J.Crew style” transaction, the business now has the much needed £150m extra cash cushion, and the bonds’ price has significantly recovered (see below). Despite the Covid crisis, June was a record month for high yield issuance and we’ve seen numerous deals with a trend to weaker covenants as investors prioritise yield over protection. In this environment, an ability to analyse, understand, and indeed enforce bond covenants is more important than ever.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.