Why corporate QE is now conventional monetary policy

One common theme in market commentary of late has been the unprecedented use of the word unprecedented! One thing that used to be unprecedented and is now commonplace is central banks buying corporate bonds. Now this seems to have become conventional monetary policy, it is worth asking “why?” and “is this appropriate?”.

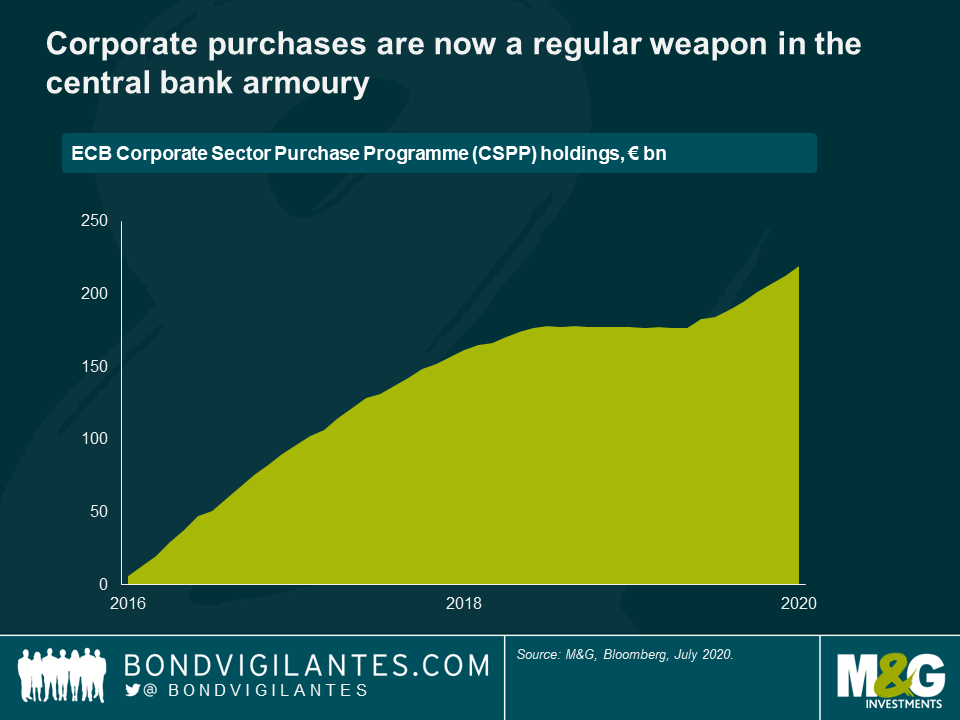

We first wrote about corporate bond purchases in 2009. Back then, it was a new and unprecedented tool. Now it is a regular weapon in the central bank armoury (see chart above), and even the Fed has joined in this time around. One of the consequences of the great financial crisis was a change in how the authorities ran the financial system. The main engine of economic liquidity at the time was the banking sector. It borrowed short and lent long, recycling capital; this is an important economic mechanism and was powered by monetary policy. This mismatch of term risk was mitigated by capital regulations, financial supervision and the back stop bid of central banks and governments, respectively as lenders and guarantors of last resort.

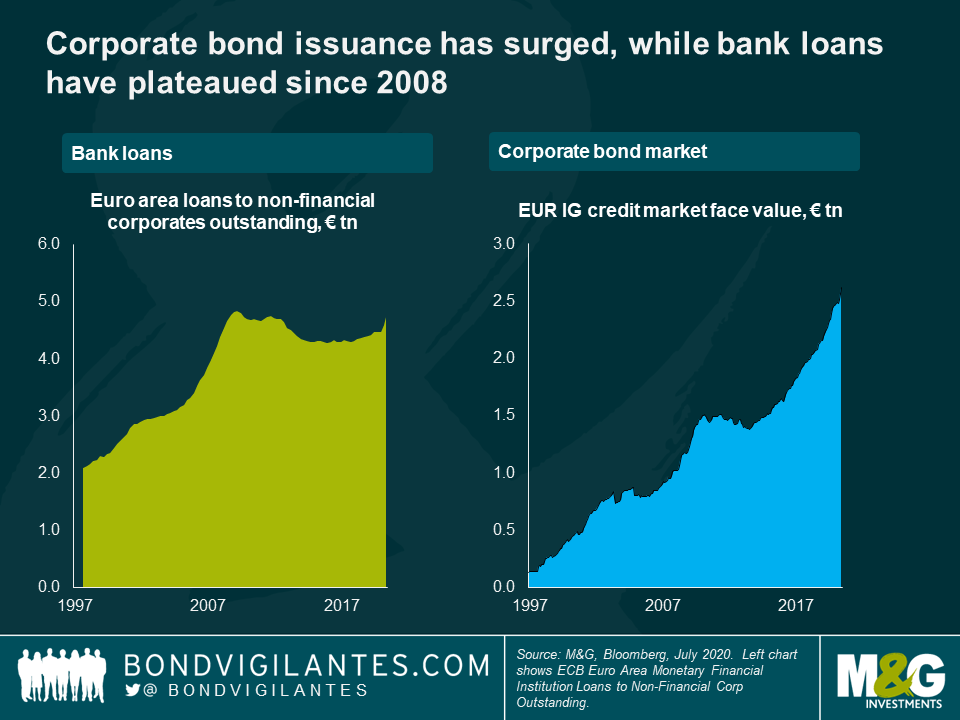

The financial crisis showed the vulnerability of this system which we and others have regularly commented on. A new system was required. Banks were discouraged from lending and have adjusted accordingly: their vulnerable function in the cycling and recycling of capital has been supplemented/replaced in part by the development of a term matched funding model. This is clear from the huge explosion of corporate bond debt outstanding, while credit extended to businesses and consumers has plateaued (see chart above). The effects of this transition, replacing short term bank debt with long term capital, are twofold:

- There is less liquidity around as it is harder for issuers to borrow money. The corporate bond market is a more laborious, and potentially expensive, route to financing than the established banking market. This results in growth being dampened as the capital markets are less dynamic in nature. A negative.

- The economic cycle becomes more stable as it is harder to create the booms and busts that come with a rampant banking market. A positive.

These two effects have been observable since the great financial crisis. Growth has been slow and steady, not high and volatile.

We are now facing a significant economic slowdown in response to public health needs. The governments and central banks of the world needed to respond rapidly in response to this historic event. In any crisis, it is the function of central banks to act as lender of last resort. The more stable financial market structure since the great financial crisis also needs to be part of the traditional crisis backdrop. Therefore, corporate bond quantitative buying programmes to stabilise markets by enabling the corporate bond market to function is appropriate, and a normal policy action.

The new buyer on the block is the Fed. It has been limited in the past in its intervention in the capital markets, but has now become comfortable in supporting the matched funding that the corporate bond market provides. Though new to corporate market purchasing, the Fed has a history of heavily intervening in the private credit markets with previous substantial MBS buying programmes. Its recent actions are an extension of the need to support term-matched funding markets, like is has done historically in the US housing market.

Though the post financial crisis system has evolved into a more stable one, it still needs supporting in times of crisis. Corporate bond buying is a natural function of central banks to support the capital markets functioning as an efficient recycler of capital.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox