This time is different: bust to boom — the t-shaped recession explained

The 2020 recession is a direct result of global government policy aimed at protecting populations from the virus outbreak. This has curtailed global growth dramatically, though in a very different way to previous recessions. In this blog we will explore the continuing implications of this and look forward to 2021.

This time is different

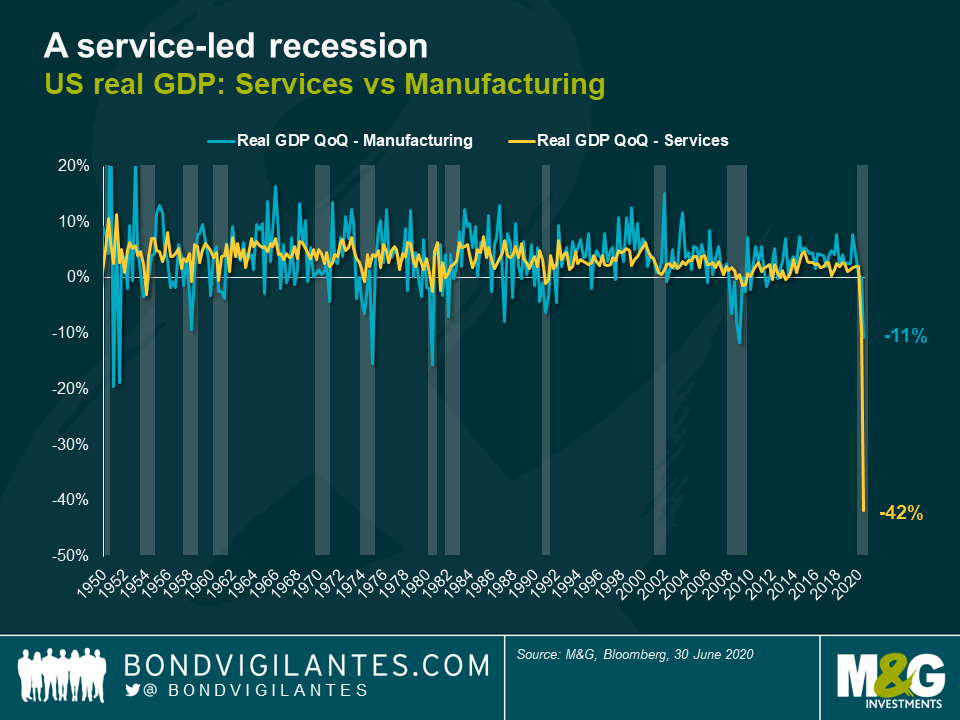

This recession is primarily a service-led recession: looking at the collapse in services versus manufacturing, it is clear how unique it is in nature (see chart below). This is not surprising. Service consumption requires human interaction, and this is currently discouraged. In economic textbook terms, this would be categorised as a recession caused by trade barriers: service sector trade has been barred or discouraged, and this barrier to trade has caused a recession.

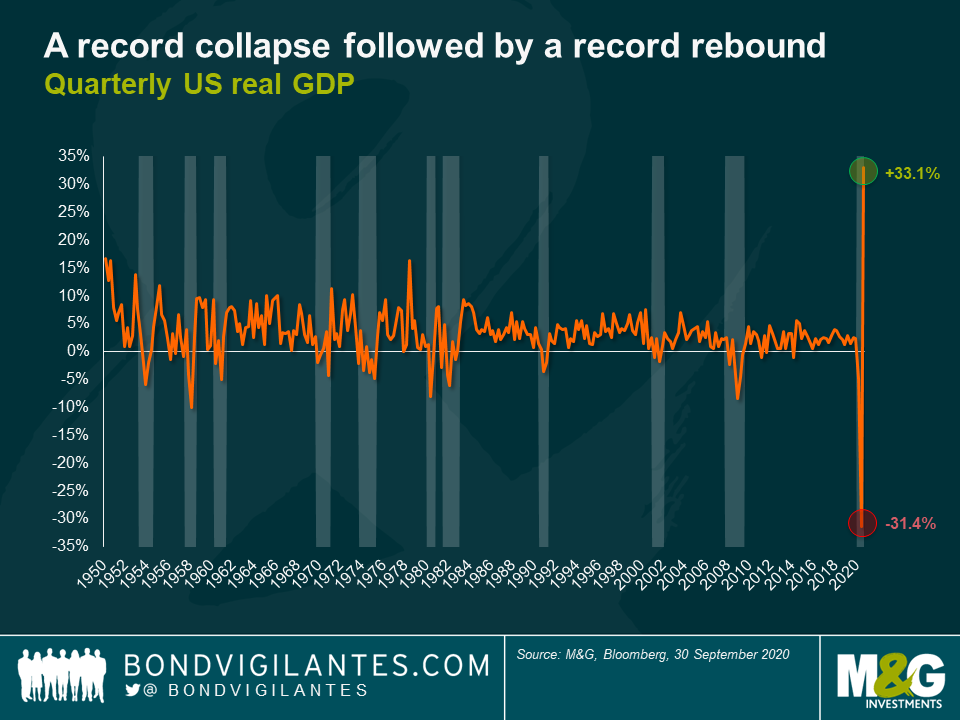

The magnitude and unique nature of this slowdown is evident in total US GDP output: we see a record collapse and now the start of record rebound (see chart below). This bungee-jump economy is something I have touched on before (here and here).

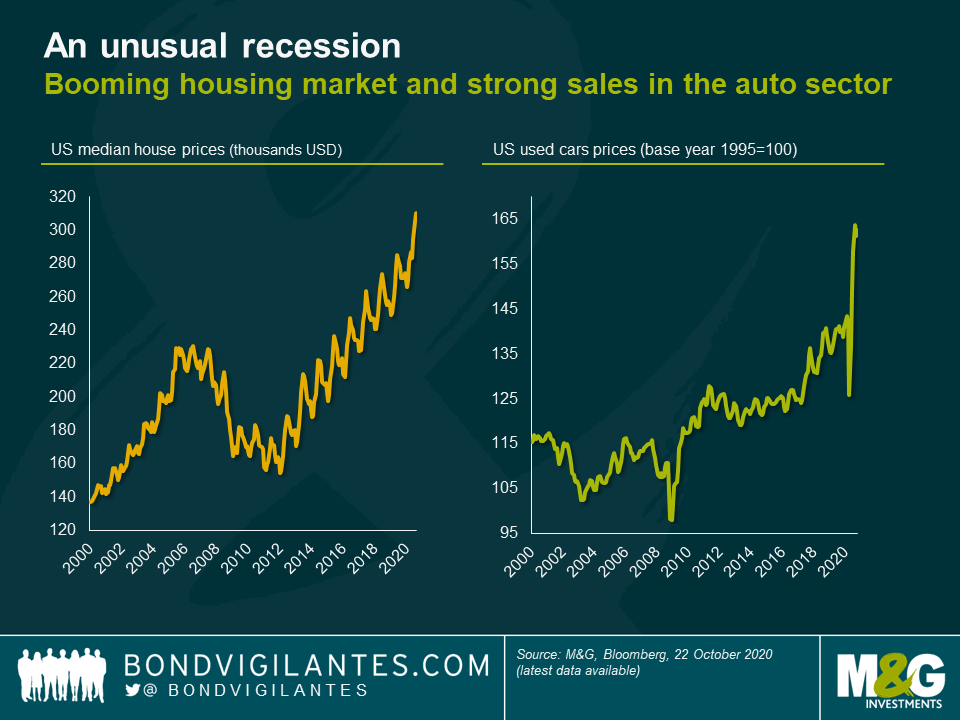

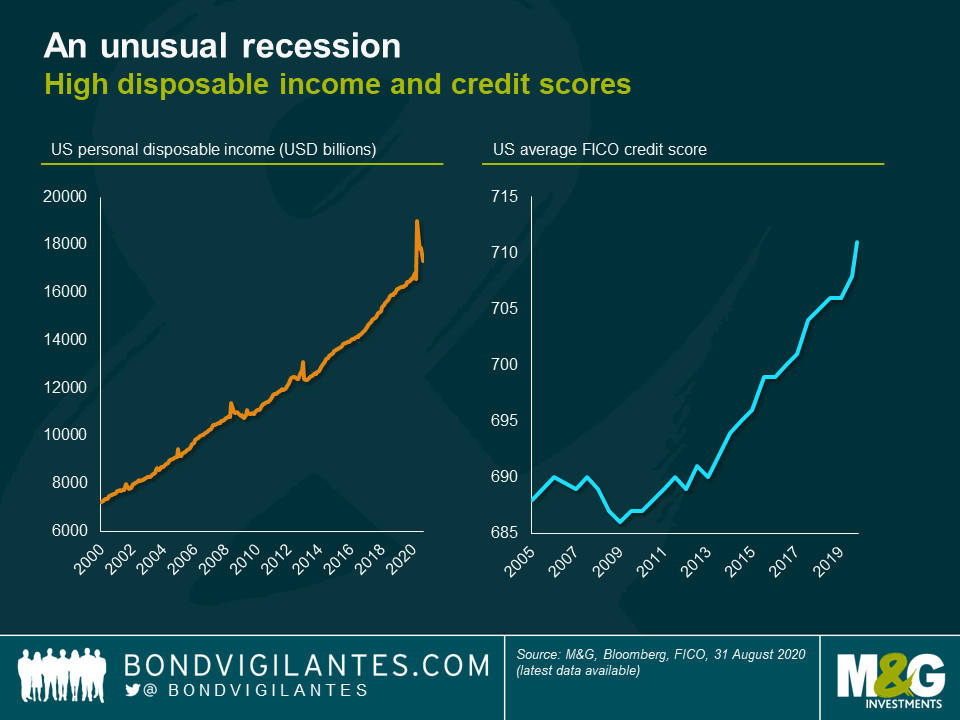

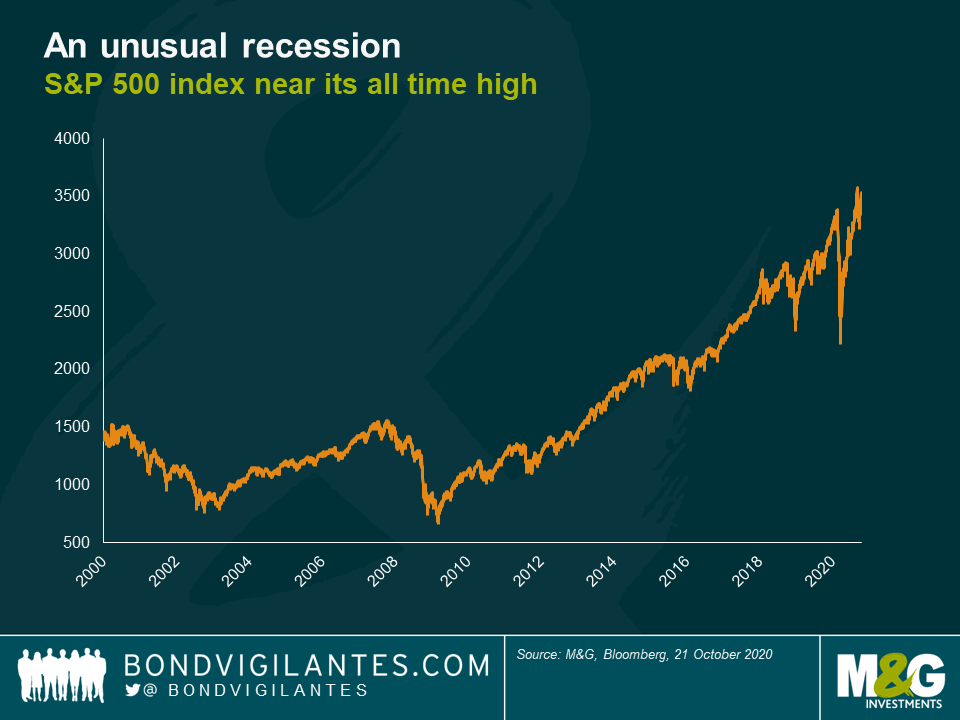

These trade barriers to services are hugely effective in reducing GDP. Fortunately, the response of governments around the world to this recession has been phenomenal. This has resulted in a huge transfer of wealth from the public to the private sector. These two factors make this recession very different from previous episodes. Looking at the following charts, would you be able to identify that we were in a recession?

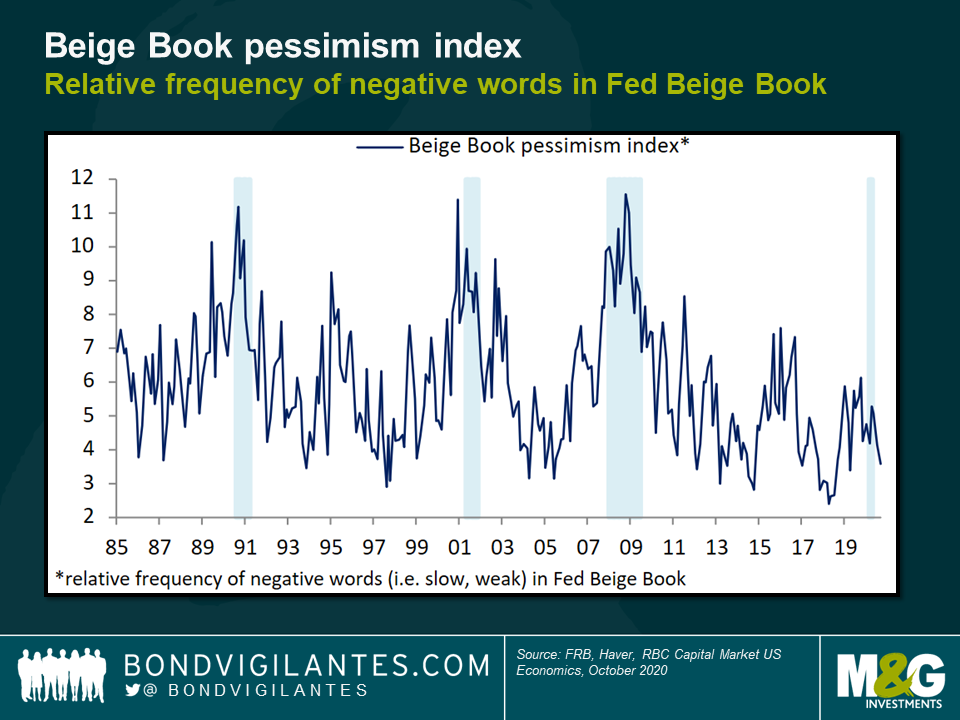

All of these charts show the effectiveness of the public sector in mitigating the economic impact of the virus policy. The Fed’s characterisation of the economy has also remained optimistic compared with previous recessions, based on its biquarterly “beige book” commentary (more formally called the Summary of Commentary on Current Economic Conditions). The chart below plots the relative frequency of negative words (e.g. “slow”, “weak”) in the Fed’s reports, which is much lower than in past downturns.

Recession or depression?

The collapse in GDP this year has been phenomenal. Its sheer scale means that maybe we should be talking about a depression rather than a recession. A depression is generally accepted to be a collapse in GDP of at least ten percent over two years. We have already seen GDP collapse by more than ten percent on an annualised basis so far this year. Looking over a longer horizon, are we in a depression?

The probability of depression is simple to diagnose: it is a function of the tapering of public policy intervention on the service industry. The timing of this is likely to be driven by vaccine development, hospital care, seasonal effects and the virus’s potency. Progress is being made on the first two while, like other similar events in the past, it is reasonable to assume that the virus will eventually come to a natural end aided by human intervention to mitigate and control it. What kind of economy will we have post virus?

The post-Covid economy

I think it is reasonable to believe that the economy will boom as restricted activities become permitted. Unlike in previous recessions, the general consumer’s balance sheet has not been as damaged as one might expect. In fact it has improved in some cases as a result of government income support (see chart below). As we enter 2021, not only will the previous year’s GDP collapse work its way out of the numbers but also governments will hopefully remove the trade barriers that they imposed this year. Additionally, with huge debt burdens and little appetite for austerity, it seems unlikely that governments and central banks will seek to tighten financial conditions, or be as concerned with controlling fiscal deficits and inflation as they have been in the past. This, combined with a surprisingly robust private sector that has large savings and a desire to consume, will result in what looks like a large economic boom in the short term. Therefore a depression is unlikely.

One interesting question is whether actual real GDP will get back to where it was before the recession. I think that in the first six months after the eventual changes in public policy it will. Excess savings, a liberated consumer and governments in no hurry to impose austerity all point to an outcome of high growth and record consumption.

Over the last few years there has been a desire to eradicate the boom and bust economy. This time round, let’s hope the cycle goes from bust to boom: a t-shaped recession.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox