RPI reform: result as expected – market reaction not

The background to Wednesday’s announcement

In line with market consensus, on Wednesday the government announced that RPI would be made into CPIH, a lower number. This is not being done for political reasons by the Chancellor, but for statistical ones.

As I have written about previously the national statistician has made clear for years that it does not like RPI, and that it has been frustrated at being unable to reform the methodology around its calculations (to make it a lower, more accurate reflection of inflation) because of the need to get approval from the Chancellor. It is worth remembering that the statistician consulted on abolishing RPI in 2012, and has since de-recognised it as a national statistic as it does not see it as fit for purpose. The statistician gets control of the issue when the UK 4.125% 2030 linker matures. In this way the government can present the decision as a passive one, made by the statistician and not the Chancellor.

The decision

This announcement makes clear, at long last, that RPI will be the same number as CPIH from 2030 onwards. This number will be approximately 0.8 percentage points lower over the medium term than it is in under its present calculation. If we assume that nominal gilt yields are unaffected by this, it means that RPI breakevens will need to fall by around this amount from 2030 onwards. That means that real yields need to rise, and breakevens to fall, by around 0.8 from 2030 onwards. The government announcement says in bold “The government will not offer compensation to the holders of index-linked gilts”.

Market impact

Given that the market expected this outcome by and large, why did we see meaningful moves in linkers and breakevens on Wednesday? And are they moving as we would expect, given the above?

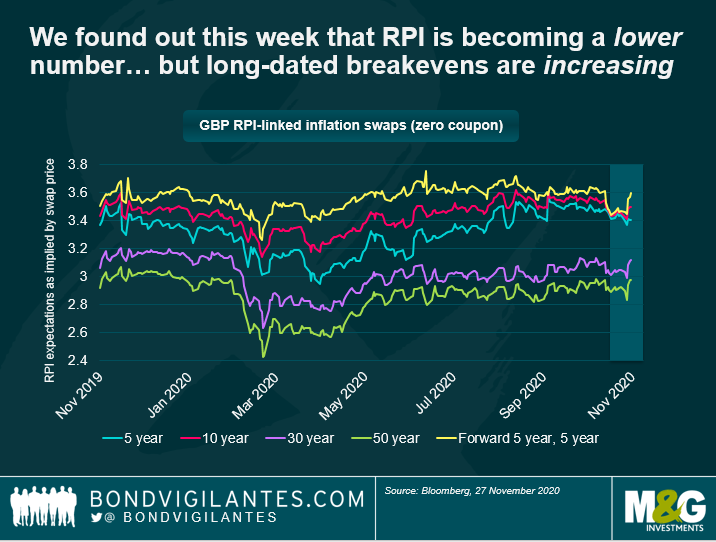

The biggest increases in breakevens are being seen in the 5y to 10yr part of the curve (yellow line below). This is because there was significant nervousness that, given the huge borrowing brought on by the pandemic and the dire state of the fiscal deficit, the Chancellor might be prepared to make this reform political and accelerate its implementation date to 2025. On Wednesday he announced he would not do that, and so the bonds in this part of the curve are rallying.

Secondly, and most striking to me: longer dated breakevens and real yield are not selling off massively but are in fact rallying. The fact that the market was expecting this outcome, with breakevens having started to move somewhat lower in recent times to reflect this, does not even start to explain this: the market is moving in a counter-intuitive way and counter to what I would expect. Breakevens shouldn’t be moving significantly higher, but should be moving lower, perhaps by 50bps to 70bps. Clearly there’s a long time left before the longer-dated bonds mature, with lots of inflation cycles and potentially much higher inflation to come in the future, maybe even with CPIH being between 2.75% and 3%. But given Wednesday’s news, and the disinflationary spot we still find ourselves in, the pricing of breakevens now looks on the expensive side to me.

Maybe some think that they will be able to claim compensation for the change from the government? We found out on Wednesday that none will be paid. Perhaps some will try to litigate? Given the changes are statistical, not political, I think this is a pipe dream too. Perhaps the market was waiting for a weak day to buy inflation protection and lots of traders pressed the button on Wednesday? There is plenty of appetite for linkers from pension funds, and those which were underhedged on inflation will have seen their funding ratios increase. Perhaps that is the best explanation for the rally: with limited inflation-linked issuance, they have not hung around. And there may be plenty of less-price-sensitive, liability-driven funds too which were short of breakevens and, with the RPI uncertainty removed, have now moved in. Still, I would not have expected this demand to come so early: I anticipated a significant downward repricing first.

There is also the possibility that the market is pricing in a more bullish view on the housing market, which is currently very strong, and that this is leading to a higher outlook for CPIH. Even so, the moves on Wednesday were surprising and make UK breakevens look on the expensive side for now – that is, until it becomes clear that we are in a cyclical upturn, with loose monetary policy and continued loose fiscal policy, and perhaps a new average inflation targeting regime.

So, the changes to make RPI a lower number have been approved, to come into effect as anticipated by most in 2030. This should, fundamentally, lead to higher real yields and lower breakevens post implementation. In the long end, I would have anticipated fairly significant moves on Wednesday, in the exact opposite direction from those which we saw.

Inflation valuations

There are plenty of factors in the mix to make me bullish on a medium-term reflation scenario in the UK: this time round, we have fiscal and monetary policy working together to stimulate the economy (unlike in the aftermath of the GFC, when policies of austerity led to a fiscal tightening); given the country’s debt burden, it seems reasonable to expect central banks to allow inflation to run a little hot; and the risk of a weaker sterling after Brexit brings the possibility of further imported inflation. Fundamentally though, it feels to me like inflation expectations both in swaps and in breakevens are on the rich side of fair value given that inflation is running low for now, and that the pandemic leaves us all in a more disinflationary spot than anything else, at least in the next 6 to 12 months. There is also a possibility of the return of austerity in 2021, which would risk a more persistent disinflation than the one we are in today.

I expect breakevens to cheapen up in the not too distant future, particularly if we see further linker supply in the next quarter, but anticipate some volatility. Based on these valuations, I think there will be better opportunities to enter into the reflation trade then.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox