ESG integration – what about sovereigns?

In an increasingly sustainability-conscious world, many investors are turning to environmental, social and governance (ESG) driven funds. As well as offering a useful framework to analyse financially-material risks, for investors who object to coal-mining and oil-refining, or to alcohol and gambling, it makes sense not to finance companies which engage in these activities through their investments. So far, so simple. What about financing governments?

With a volume of more than $56 trillion at the end of 2019, sovereign bonds represent 48% of the global bond market. However, despite its size and the exponential growth in investors’ desire for the integration of ESG factors, the sovereign debt market seems to be less developed than other asset classes.

In particular, there are four myths surrounding the application of ESG to government bonds that I would like to analyse:

- The asset class is risk-free, so the importance of ESG integration for these securities is limited;

- ESG factors do not drive the performance of sovereign bonds, which comes mainly from economic policy and economic growth;

- ESG engagement is not possible with sovereign issuers – given countries’ fiduciary duty to their citizens, investors in its debt have less influence than stockholders or corporate debt investors do on companies;

- Compared with corporates, it is more difficult to apply an ESG framework to sovereigns.

I might agree with the last point above, which arises most of the time from various ethical questions that appear in practice when integrating ESG. There are some inconsistencies that need to be refined if a solid and credible approach to ESG sovereign analysis is to be achieved. Many would object to investing in a company that produces nuclear weapons, and such an issuer would be excluded under most formal ESG screenings. But should an ESG-screened fund be able to invest in a country that buys nuclear weapons? Should US Treasuries be excluded from an ESG-integrated portfolio given that the death penalty is allowed in some states? And how should oil-exporting countries score from an ESG perspective? Difficult questions indeed, that highlight that the investment industry is still towards the beginning of its journey to contributing to a more sustainable economy – but that does not mean that there is no way to apply ESG analysis to sovereigns today, or for our industry to drive change in government behaviour.

Therefore let’s focus in depth on the first three arguments and go beyond the blunter, exclusions-based questions above.

Myth 1: Sovereign debt is risk free

To say that government bonds are risk free is daring. Yes, governments might have some tools to reduce their direct default risk and to pay off their nominal liabilities: more precisely, a government can increase taxes to raise revenues or can increase money supply (with the consequent increase in inflation and devaluation of its currency). Both these tools have consequences which ultimately mean investors end up with a sovereign debt real payoff differing from the nominal promise. For domestic-debt holders, when taxes or inflation rise they see the purchasing power of their returns diminished; for foreign-debt holders, the risk comes mainly from foreign-exchange movements and the worsening of growth that derives from pressure being put on household disposable incomes.

Besides, if we can take one thing from the Eurozone crisis of 2011 it is that what is considered safe can change fairly quickly from one day to the next. With global debt at record levels, it’s more crucial than ever to ensure that a country is run in a way it can prosper. Take for instance the example of Italy. Debt to GDP is predicted to increase to 160% this year (much higher than the Maastricht euro convergence criterion of 60%), while Italy will soon have more absolute debt than Germany, despite its economy being half the size. Still, Italian credit spreads have continued to tighten. Why? Because the creditworthiness of an issuer really depends on its funding costs more than anything else. For Italy, the cost of financing its public debt is largely a function of its relationship with Europe. It is clear then that political risk (the “G” pillar in ESG) can change the perception and market pricing of risk even for a developed nation.

This leads me nicely to—

Myth 2: ESG factors do not drive sovereign performance

As with most other asset classes, ESG factors may not be the main performance driver of sovereign bonds. This does not mean that they don’t matter when trying to achieve better risk-adjusted returns however: risks are intensified for sovereigns with fewer financial buffers.

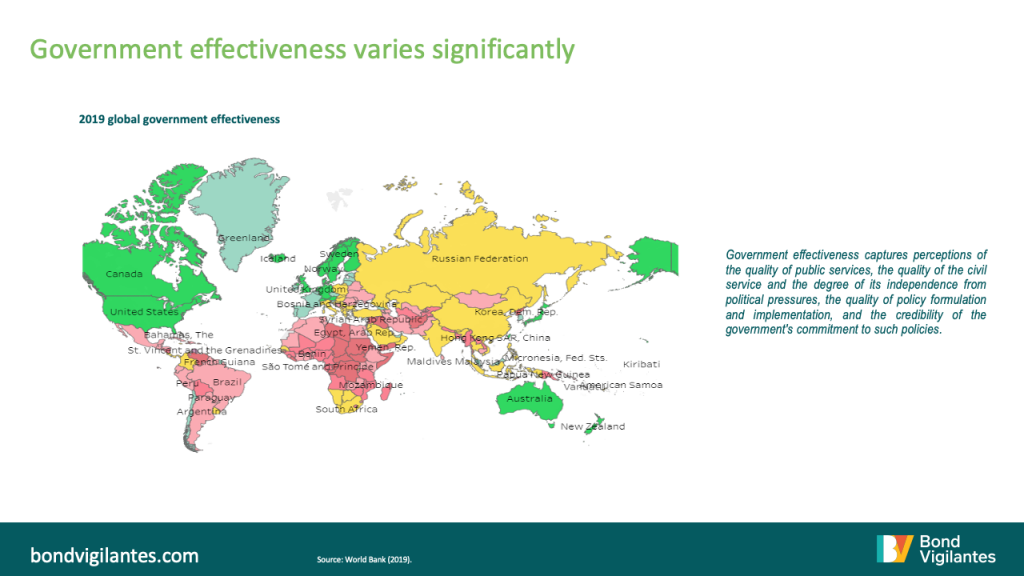

Credit rating agencies have already acknowledged environmental issues and the growing effects of climate change as having increasingly negative credit implications for issuers without adequate adaptation and mitigation strategies. Social factors are relevant too, as social conditions and voter dissatisfaction can have political repercussions, including rising populism. And governance issues have always been considered to be one of the most material concerns affecting debt sustainability: think about institutional stability, the quality and independence of central bank membership and of finance ministers, the level of corruption and the rule of law. Looking at these factors more closely, it is interesting to see how even some countries in Europe do not score very highly on indicators measuring the strength of the “G” pillar (see below).

Myth 3: ESG engagement is not possible with sovereign issuers

When integrating ESG, active managers like to prove they can engage with issuers and that the successful integration of sustainability factors is not just a matter of excluding certain names. However, the problems one might expect in trying to engage with sovereigns on ESG factors are becoming less of an issue as ESG demand gains importance in the financial markets. Governments are becoming increasingly aware of the significant growth in ESG requirements from debt holders. In the same way they hold traditional roadshows and presentations for investors covering macroeconomic themes, they now address ESG issues in meetings. Brazil and Indonesia have recently met groups of ESG fund managers to address concerns on environmental protection regulations potentially leading to more deforestation.

Besides, ESG commitments are proving to be an efficient way for countries to access finance. In recent years, demand for green bonds has outstripped supply as many thematic green funds struggle to find investments. Last October, we saw Egypt (with a B credit rating) become the first Arab country to issue a $750 million green bond. The bond was five times oversubscribed and, for the first time, Egypt succeeded in reducing its pricing margin to reach a negative new issue premium of 12.5 basis points (see the blog my colleague Greg published in October).

Indeed only a few days ago the World Bank published a guide to help public debt managers improve their engagement with investors on ESG topics. The guide outlines how sovereign debt investors use ESG information in their investment strategies, how debt managers are engaging with sovereigns and how engagement can be improved. It is plain to see that ESG is rapidly changing the financial industry and that governments are already aware of the many benefits they can derive from ESG engagement.

How do ESG scores correlate with credit ratings?

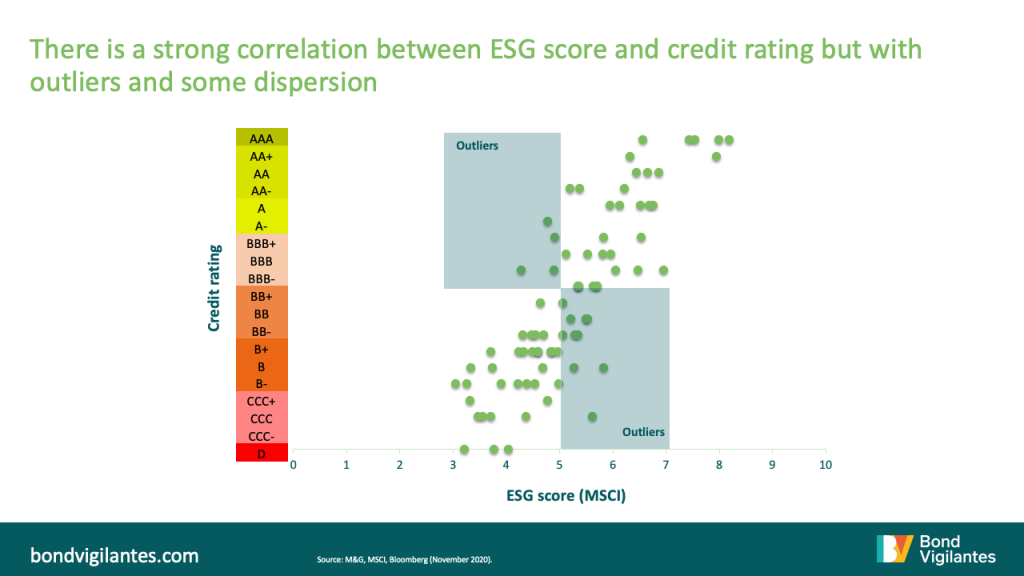

If ESG scores are measuring an issuer’s risk, can we simply look at the issuer’s credit rating? In part, yes, but that doesn’t give us the full picture. Generally there is a strong correlation between ESG scores and sovereign credit ratings, albeit with some outliers and dispersion (see chart below).

This shows that, while ESG scores can provide a useful starting point for bond investors as they bring a useful structure to the ESG comparison of sovereigns, we must also acknowledge that part of the ESG sovereign methodologies is capturing long-term competitiveness and sustainability factors (such as social progress, inequality, level of education, resource governance and standard of living). While such drivers are relevant for the creation of value in a country, they might not drive bond valuations with a shorter maturity profile. Therefore, it is paramount that fixed income investors consider the time horizon of an investment alongside the materiality of ESG factors. Identifying material ESG factors over appropriate time horizons is complicated, but crucial for bond investors in order to assess fully the risk and reward of a sovereign bond investment.

In a world in which zero or negative rates are the new paradigm in sovereign bond markets, the asset class is one which presents investors with an asymmetric downside risk. This makes it more important than ever to integrate ESG into sovereign risk analysis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox