Bravo Yankee Papa – piloting a new course

Summary: The past year has seen a dramatic economic downturn across the globe. We all know why the policy response to COVID-19 was to limit human interaction. GDP measures human interaction, and therefore GDP collapsed. In the article below we will put the monetary policy response to combat this into its historical context and discuss the future course of monetary policy.

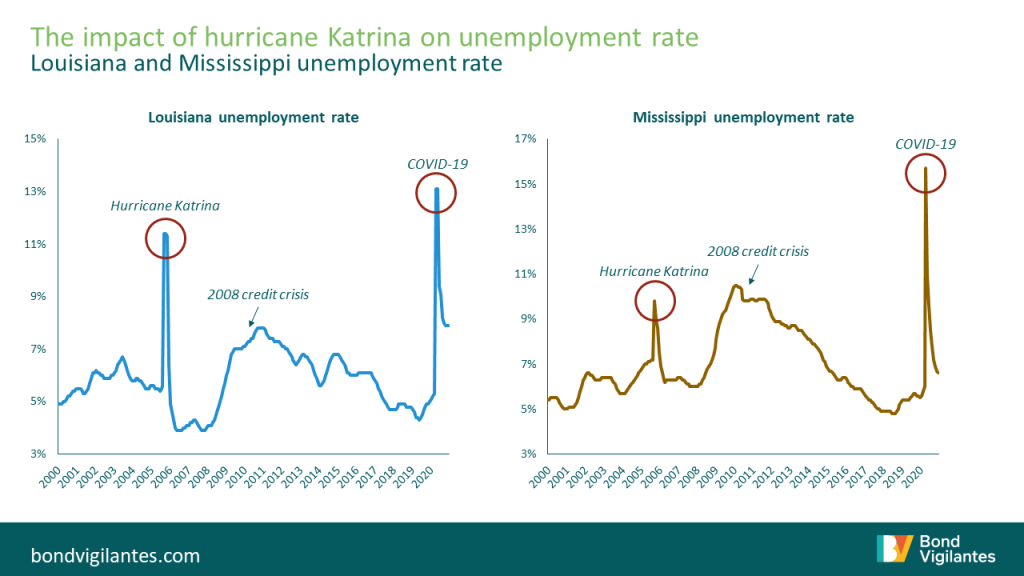

The economic collapse we saw last year mirrors that of a natural, not economic, catastrophe. This can be seen by comparing the sharp spike and rebound we saw in data from last year (for example in unemployment) to other natural events in the past (see chart below).

Source: M&G, BLS, Bloomberg, December 2020

A sharp drawdown and a quick bounce back

The response to these historic state-wide disasters has been to mobilise emergency resources and fiscal expenditure to provide relief and to facilitate the rebound. The contemporary response this time round has had to be on a far larger scale due to the length and national/global nature of the pandemic. The medical intervention to care for those affected and provide ongoing protection via vaccination has been combined with a record-breaking fiscal and monetary response.

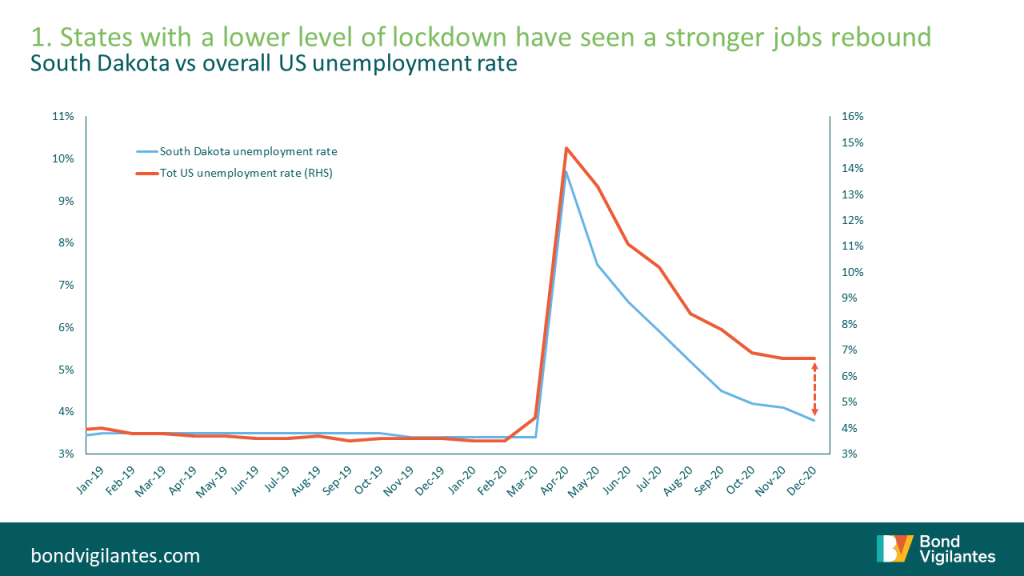

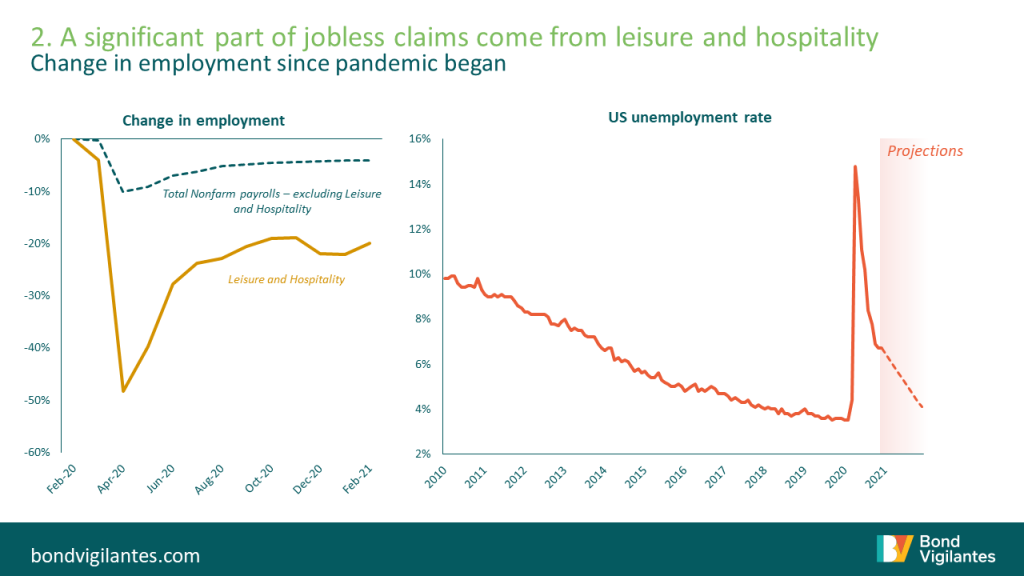

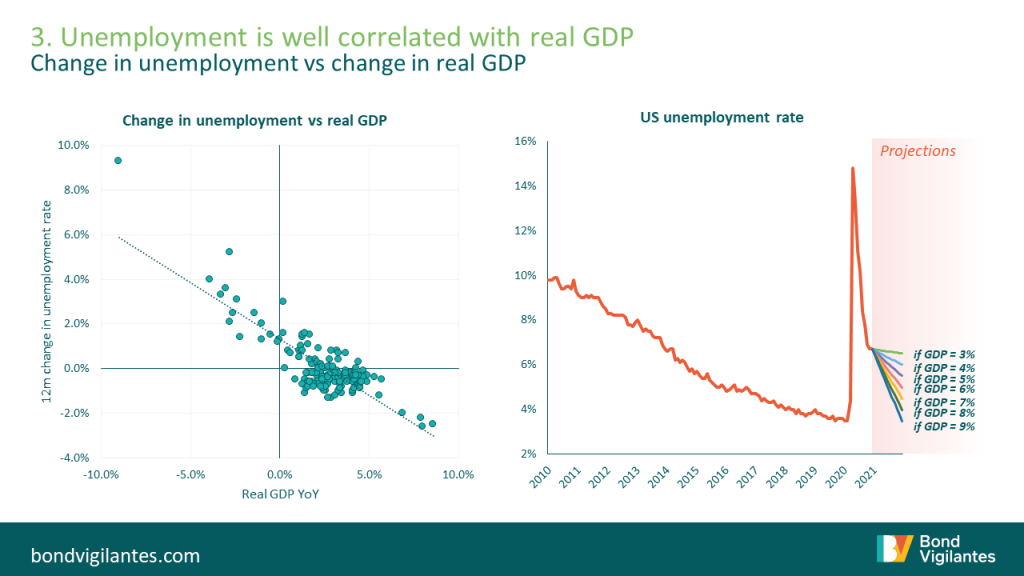

As we come out of lockdown, we can attempt to plot a guide to the recovery in a variety of ways. We can look at states that had a lower level of lockdown as a guide to what might happen when public health policy intervention is removed (see chart 1 below); we could simply model that all those who lost their employment in the leisure and hospitality return to work (chart 2); or we can plot likely employment based on various rebounds in GDP (chart 3).

Source: M&G, BLS, Bloomberg, December 2020

Source: M&G, BLS, Bloomberg, February 2021. Using Nonfarm payrolls

Source: M&G, Bloomberg, December 2020

These simple “rebound” models point to a potential return to around 4-5% unemployment this year. The latest OECD real US GDP growth projections for 2021 is 6.5%. This level would be consistent with an unemployment rate at 4.7%. This GDP outlook is very positive for credit risk and traditionally would point to a tightening of policy. This time, however, things are different.

Bravo Yankee Papa

Monetary policy in the US has been led by three individuals over the last few years: Bernanke (Bravo), Yellen (Yankee) and Powell (Papa). Bernanke came to the fore of the public imagination with his comments on helicopter money, Yellen considered this approach and touched on its use, while Powell has gone full throttle and has rightly executed a fully-loaded helicopter drop given the scale of the crisis.

The Bernanke helicopter drop was a theoretical proposition of what to do at the limits of monetary policy, Yellen took us to the limit of monetary policy and Powell deployed the policy full scale. Like all monetary policy, helicopter money works with a delay. We know that interest rates take circa 18 months to have an effect in the real economy, but what is the delay for helicopter money? I would postulate it is very short given that the marginal propensity to consume is high. There will be some delay though. US citizens are once again receiving their electronic cheque in the post. They will be able to spend it on certain things (essential items, stocks, Bitcoin) but they will find it harder to spend it on others (travel, eating out and any other COVID-restricted activities). This causes a delay: think of it as a helicopter drop of cash but the shops are closed.

The Fed is completely aware of the chain of events they have set in order. They are not focusing on the likely outcome of their policy however, but are waiting for the data to appear:

“The fundamental change in our framework is that we’re not going to act pre-emptively based on forecasts for the most part and we’re going to wait to see actual data. I think it will take people time to adjust to that and to adjust to that new practice, and the only way we can really build the credibility of that is by doing it.” Fed Chair Powell, 17 March 2021 via Bloomberg (19 March)

Why this change from proactive to reactive policy? The success of driving inflation to a consistently low level reveals the difficulty in which the Fed finds itself in trying to act at the zero bound. Inflation hovering just above zero is a danger for monetary policy, and therefore the Fed needs to run inflation at a higher level for a persistent length of time in order to regain monetary flexibility.

Conclusion

Central banks’ aiming for low inflation is an understandable goal, but monetary authorities have always realised that this is not without its risks. Bernanke acknowledged this with his helicopter comments, Yellen was well aware of this and was determined to push inflation expectations higher, while Powell is the one who faced the zero bound and has had to do the helicopter drop. Neither he nor his successors want to be faced with only this as a policy option going forward. To get out of this situation, the economy needs to be run hot.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.