ESG-labelled ABS: a (very) brief history of the market

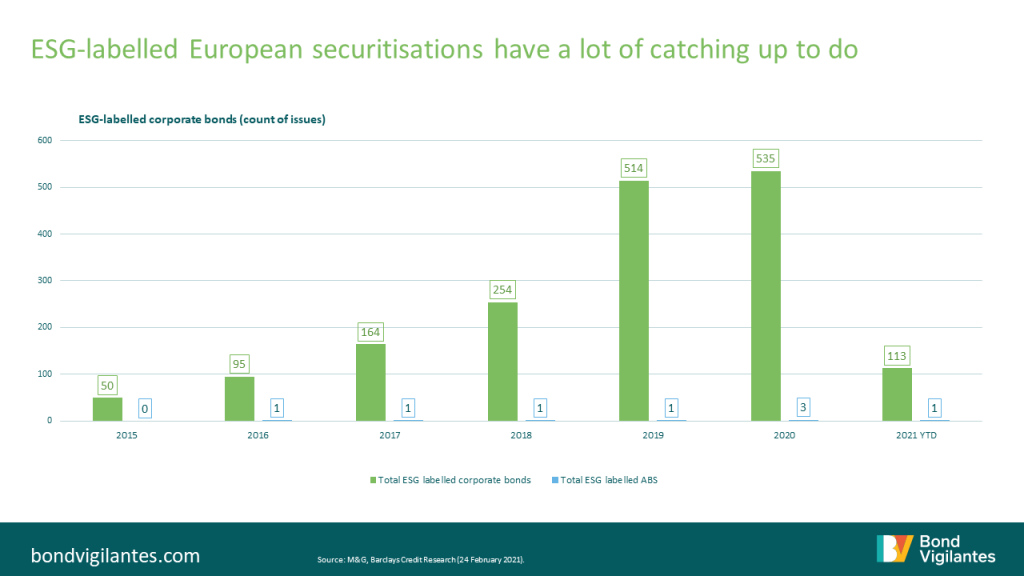

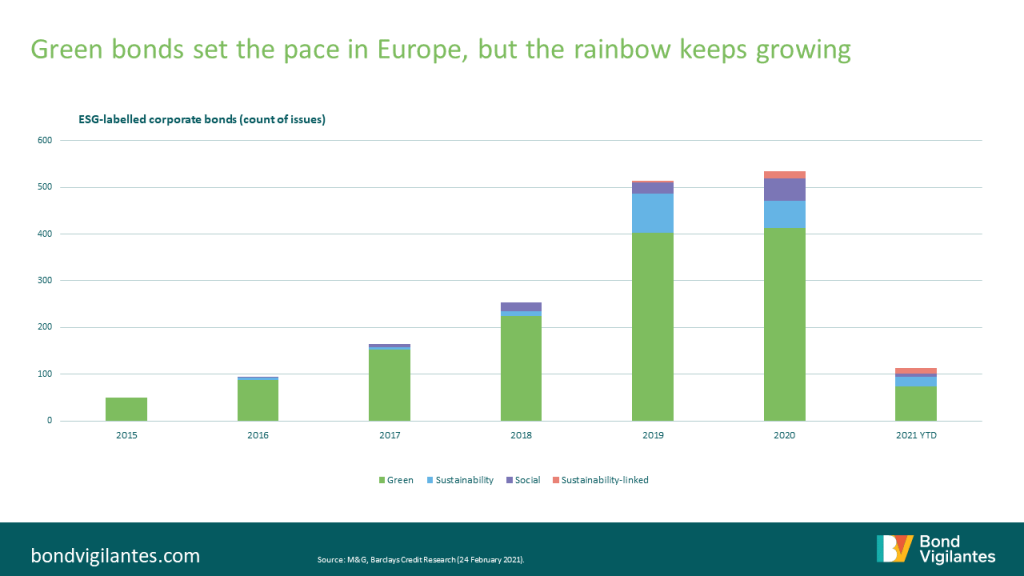

As my colleague Mario pointed out in his excellent recent blog, not only have we seen a huge rise in ESG-labelled corporate bond issuance across Europe in recent years (over 1,700 bonds and counting) but also an ever-increasing rainbow of different types of ESG bonds (green, blue, transition, social, sustainability-linked).

In contrast, the European Asset Backed Securities (ABS) market has seen eight issues. No, not eight different types and no, not eight in the last year. Just eight securities issued. Ever.

Yes, since 2015, there have been only eight European asset backed securities issued that have gone the extra mile and come to market with the confidence to declare and evidence their green or socially-positive credentials. And the first four were from the same issuer (take a bow Obvion, you changed the game with your Green Storm Dutch RMBS deals).

Issuance then “exploded” in 2020 with three new deals coming to market including another green RMBS deal, this time backed by Portuguese mortgages. We also saw two first of their kind deals, a green Commercial Mortgage Backed Security (CMBS) backed by a highly energy efficient office in France and a social CMBS backed by a portfolio of social housing properties in the UK.

This year has seen another first. The first-ever social RMBS, Gemgarto 2021, arrived in early February backed by a pool of UK mortgages designed to offer UN SDG-aligned accessibility to housing for underserved areas of the population such as those later in life, the self-employed and younger borrowers. I believe this deal is a landmark in many ways, signposting how socially responsible financing and the avoidance of predatory lending practices can benefit the wider community. This might have been the first such transaction but, given that the senior tranche of the deal was almost three times oversubscribed, I don’t think it is likely to be the last.

So that’s a brief history of the embryonic ESG-labelled European ABS market – but why has issuance been so muted so far?

In my view, there are two primary reasons:

- A lack of green collateral – there just aren’t enough truly green assets out there (yet) to collateralise in order to create more green issuance. In the UK, the largest country of origin for RMBS deals in Europe, over 80% of current housing has an energy rating of C or below (A is the highest rating; G is the worst). The vast majority of all passenger cars, another common asset used within securitisations, in the EU are not electrically chargeable. This will change but it will take time. There is also competition for collateral with private debt markets – most green infrastructure projects, such as wind farms and solar parks are privately financed.

- A lack of standardisation – as with the corporates market, green comes in different shades. There is no clear standard defining what “green” is. Does a mortgage have to be issued on an energy efficient house to qualify? What about loans taken out to retrofit energy inefficient housing with solar panels, more efficient boilers and insulation? At present, there are more questions than answers in this space.

You’ll notice that I’ve focussed on green issuance here. That’s because, in the corporates market, green issuance has tended to dominate.

However, perhaps given the impediments to green ABS being issued, it could be a social or an all-together different type of bond which comes to set the pace for ESG-labelled issuance in ABS. Could sustainability-linked asset-backed securities bridge the gap, with asset pools linked to minimum threshold percentages (e.g. at least 50% of mortgages should be energy efficient or else there is a coupon step-up)? Or will we finally see ESG automotive ABS join the party? Perhaps it will take a third party organisation, or broad industry consensus, to lay out clear guidance for the market and encourage issuers and buyers to coalesce around a common set of standards before the ESG ABS market can achieve take off velocity.

To conclude, ESG-labelled ABS are not likely to form a significant part of the European market any time soon, but that doesn’t mean that 2021 won’t be a record year: there’s plenty of time for a few more firsts!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox