What does Blockchain Technology mean for Consumer Banks?

Summary: In pursuit of economic growth and inflation targets, the heavily indebted world seems unable to raise interest rates or reign in the unprecedented rate of bond purchases. This money printing has seen a debasement of currency, the US dollar in particular, and also accelerated newsflow (and price action) of enterprise currencies. Digital currencies are no doubt a hot topic, with Bitcoin dominating the narrative. Citibank recently published a comprehensive report on the adoption of Bitcoin, with other Wall Street banks also publicly declaring demand from clients.

The focus of this blog, however, is not to discuss the virtues or pitfalls of Bitcoin but rather to look at the powerful blockchain technology underpinning these de-centralised networks. In essence, blockchain technology use nodes in a network to reach consensus on a transaction and add it to a publicly distributable ledger in immutable form.

The real power of this peer-to-peer network is removing the need for intermediaries – and that means greater efficiency and lower cost. Perhaps the second best known cryptocurrency, Ethereum, is powered by so-called Smart Contracts, executable programming code that uses traditional asset prices, FX rates or even the weather when settling transactions. A fledgling ecosystem has emerged using these Smart Contracts, commonly referred to as “de-fi” (decentralised finance). It is growing in its use cases and sophistication, with protocols for borrowing/lending, insurance, mortgages and more.

It feels like an important inflection point for the world of finance as the disruptors claim a new world order, while vested incumbents talk of bubbles and a lack of utility. Let us look at the implications for the traditional finance system (“trad-fi”) from two perspectives – Blockchain Technology and Central Bank Digital Currencies (CBDC).

Blockchain Technology

To give some scale to this new marketplace, the total market capitalisation of cryptocurrencies is approximately $2 trillion, according to Coingecko – a similar order of magnitude to President Biden’s recently-approved stimulus bill of $1.9 trillion. Notable incumbents like Paypal and Visa have been among the first to embrace blockchain technologies, and transactions can now be settled in cryptocurrency on their networks. Mastercard is close behind.

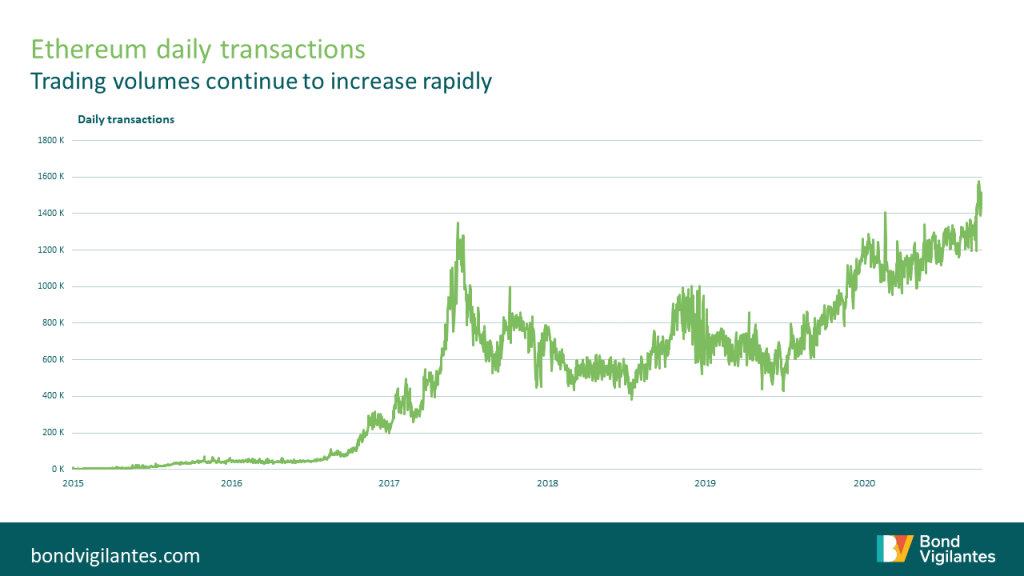

It is difficult to quantify the impact de-fi could have on bank or payment company profitability. If we look at some of the indicators on these networks, however, they reveal considerable growth that has the potential to develop into a structural trend. Transactions remain minute in comparison to traditional payment rails but, looking at the volumes on the Ethereum network as one example, they continue to increase rapidly (see chart below).

Source: Etherscan.io (Accessed 29 April 2021).

In response to the this growth, venture capital investment is quickly growing in the space: according to CB Insights, year-to-date VC investment in blockchain start-ups is $2.5 billion, higher than the total investment seen in all of 2020. Coinshare also reported record inflows into digital asset investments: $4.5 billion in the first quarter of 2021, up from $3.9 billion in Q4 2020. Clearly, cryptocurrencies are experiencing growth – but what does this mean for trad-fi?

An element of bank profitability looks vulnerable. With blockchain technology, millions of transactions can be disintermediated for very low cost, in a fraction of the time. A good example is cross border remittances: these are very expensive (with fees sometimes up to 12%) and can take 3-4 days to complete. These new markets also allow for greater financial inclusion for the unbanked, requiring only a smart phone and ID to participate. They are more accessible too – open 24 hours a day, 7 days a week.

With new markets also comes opportunity. Goldman Sachs recently announced that they were re-opening their cryptocurrency trading desk. The notable corporate treasury adoption seen in recent months is a good example of this opportunity for revenue, with the likes of Tesla and MicroStrategy adding billions of dollars of Bitcoin to their balance sheets.

Central Bank Digital Currencies (CBDC)

A number of central banks are exploring the feasibility of launching their own CBDC: their efficiency, transparency and lower costs demonstrate the value proposition of the technology. China is the first country to have launched its own state-backed digital currency, with a domestic pilot of the e-Yuan underway in several cities ahead of possible wider adoption in 2022. Christine Lagarde also suggested recently that a potential Euro CBDC could be with us within four years. It is worth stating that CBDC are designed to work in parallel with the existing trad-fi system, with both having the backing of the state. Policymakers have a delicate balance to strike with the introduction of CBDC to ensure the protection of consumer banks’ funding and profitability.

Blockchain technology provides a compelling tool for policymakers to unlock some of the inefficiencies within trad-fi. The US government’s recent pandemic response of sending cheques to citizens is a good example of how antiquated the current trad-fi system is. CBDC powered by blockchain technology could allow for instant payments to citizens within days rather than weeks.

It has been widely reported that, with pent up demand, a proportion of these stimulus cheques have found their way into financial markets – creating asset, but not real inflation. CBDC can be programmed to optimise how these cheques are spent, ensuring it is spent in line with government policy so as to create the maximum benefit for the economy. For example, the government could provide a further 5% subsidy if the cheque is used on education of the workforce, prevent cheques from being spent in certain sectors or impose an expiration date to help bolster spending.

These low-friction efficiencies can be taken to the extreme. CBDC would allow for peer-to-peer networks without the need for intermediary banks. This would represent a seismic shift in trad-fi, given its potential to keep huge amount of deposits out of the trad-fi system, and would greatly affect banks’ funding levels. This is a highly unlikely model for the distribution of CBDC, but it is a possibility worth considering.

The further digitisation of money is inevitable

The Covid pandemic has only accelerated our continued transition to a digital world – from working from home and digital entertainment (see the recent Roblox IPO of $38bn!), to how we make transactions (with many merchants not accepting cash to prevent physical contact). Blockchain technology has immense potential to revolutionise industry: it has been compared to what the internet did for information sharing, Amazon to commerce and Spotify to music.

With unemployment in the US and Europe still high (albeit showing a strong recovery), uncertainty around the re-opening of many going-concerns in the hospitality, retail and leisure sectors remains very real. It is difficult to see wage inflation in the short term with this slack in the labour market, and therefore hard to see central banks taking away the punch pool anytime soon. Consequently, banks will be unable to raise rates on deposits for some time, and a large proportion of savings products in trad-fi remain relatively unattractive. This continuation of favourable financing conditions will keep fuelling demand for alternative assets, with cryptocurrencies a likely beneficiary.

With the likely race to the bottom for cost and efficiency, it is difficult to see consumer banks being able to protect the status quo. Instead, they should embrace this technology and build out services to retail customers, as well as wholesale and prime brokerage markets, or risk losing market share to the disruptors. My bet is the powerful blockchain networks are here to stay!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox