Data surprise?

Summary: Normally we refrain from commentating on individual pieces of data, but there has been a streak of interesting, unpredicted and significant economic prints over the last week. What has the economics profession got wrong this time?

The shocks:

- Payrolls job creations: 218,000 vs consensus 933,000

- JOLTS job openings: 8,123,000 vs consensus 7,500,000

- CPI YoY: 4.2% vs consensus 3.6%

Of the three shocks, two traditionally point to a strong rebound (more job openings and higher CPI) one to a weak rebound (lower job creation). Let us examine the labour market data since that is the area the Fed is currently focussing on with its desire to get employment back to pre-pandemic levels.

At first glance the data seem to disagree: how can it be that people not returning back to work, yet there are many jobs to be filled? The two sets of data do not conflict, however: when generating the near 1 million consensus for Friday’s payroll report, economists’ forecast was based on the growing economy. The JOLT jobs opening report confirms that view, in that the missing numbers on the payroll consensus data simply appeared in the JOLTS report: the payroll (job creations) report missed consensus by -700,000, and the JOLTS (job openings) report by +600,000. The two sets of data show the economic surveys were accurate with regard to the current state of the US economy – it is growing on track. Maybe the economists should simply have revised their forecast on the JOLTS data up given the payrolls shortfall!

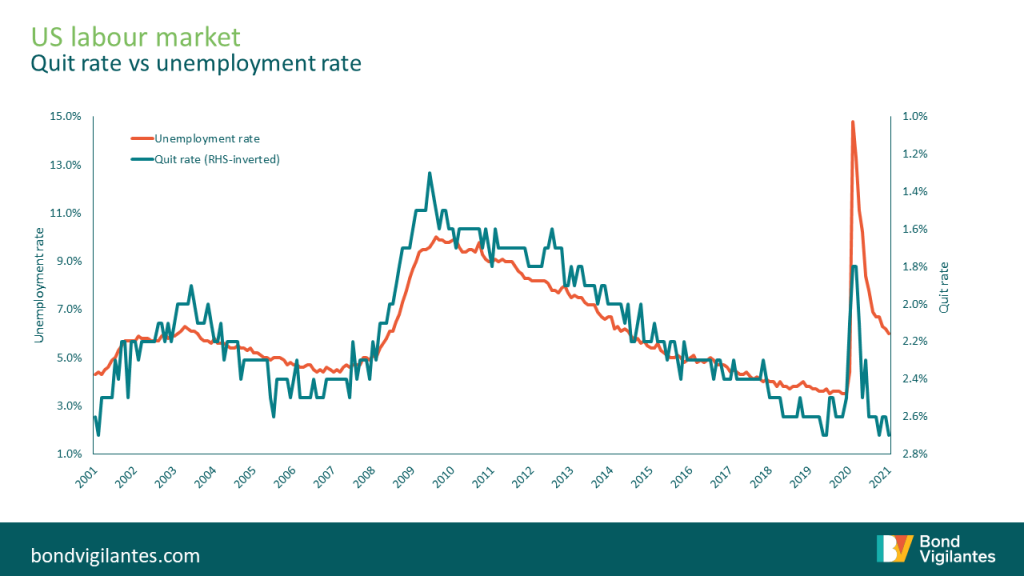

The surprise is that there seems to have been a change in the reaction function of labour to the job openings that are out there. One way of looking at the labour market is the voluntary quit rate, which we show below versus employment. As you would expect, the quit rate is a function of workers finding a better job and so goes up the tighter labour markets get. The current quit rate, as you can see from the chart below, is actually in line with what you would expect at full employment.

Source: M&G, Bloomberg, 30 April 2021 (latest data available)

The reports show nothing other than an economy on track – or maybe a little hot if anything given this week’s CPI print.

Based on the data snapshot we have, it appears that the labour market is behaving as if it is at full employment. This has been postulated by many to be the result of the extension of a generous unemployment programme, understandable health concerns discouraging the return to work, or a lack of social support infrastructure (e.g. closed schools). These will eventually all come to an end – though, while they persist, there could be a breakdown in the traditional link between demand and supply of labour.

The reopening is very stimulative, fiscal policy is very stimulative, monetary policy is very stimulative, but if the labour force remains unstimulated then demand will exceed supply with inflationary consequences.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox