As the ECB moves closer to tapering PEPP, credit investors should not yet be concerned – here’s why

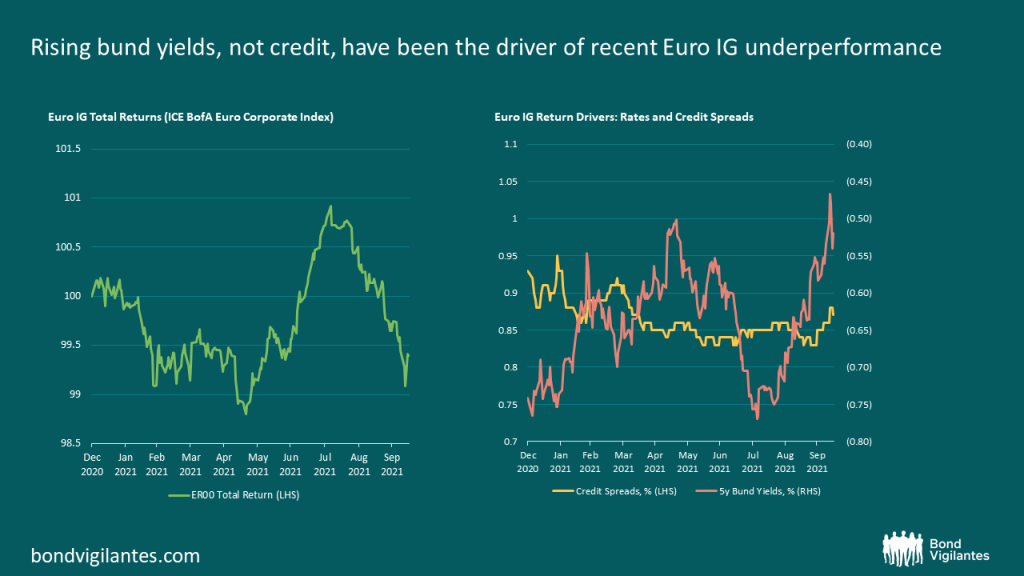

Summary: September marked a sore point for European credit investors as investment grade bond returns moved back into negative territory[1], unwinding most of the positive performance built up over the summer months (see chart below – left). Separating this into the two primary performance drivers of corporate bonds – government yields and credit spreads – it is rising bund yields that have been the dominant driver while credit spreads have remained conspicuously stable (see chart below – right). So stable in fact that spreads have been stuck in a 3 basis point range for many months (between 83 and 86 from April to the end of September).

Source: M&G, Bloomberg (15 October 2021) – LHS: ER00 index.

The rise in bond yields is not particularly surprising as markets and the ECB start putting greater emphasis on upside inflation risks. Moreover, in its September meeting, the ECB announced it would be slowing the pace of monthly asset purchases from the Pandemic Emergency Purchasing Programme (PEPP) and there is a growing expectation that, in the December meeting, President Lagarde will announce the end of PEPP in March 2022. What will happen to credit spreads when PEPP ends, and does this signal the end of the ECB’s support for corporate bonds? Let’s start by allaying some initial concerns.

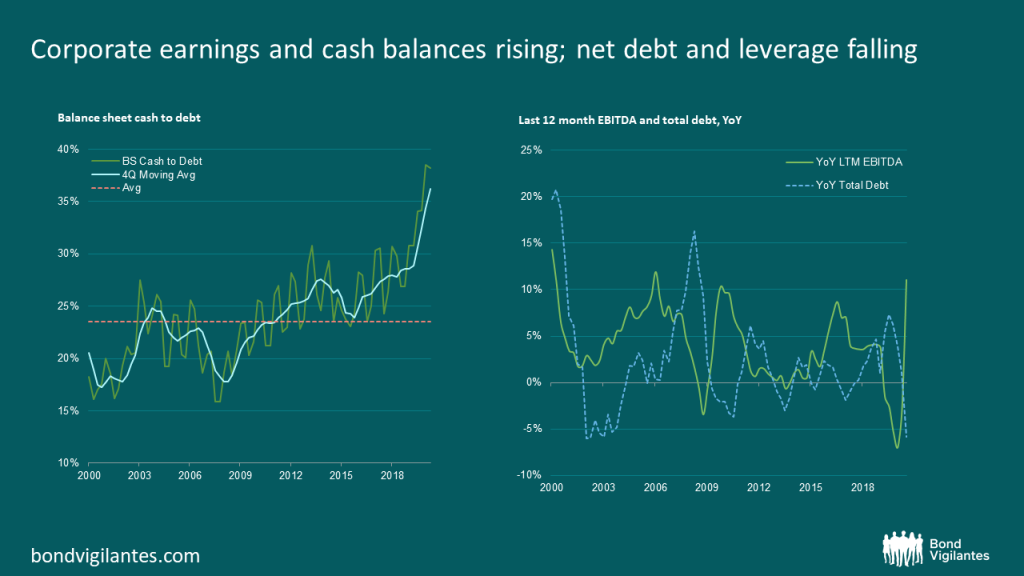

First, the PEPP was always intended as emergency/temporary QE during the coronavirus pandemic and the subsequent fallout experienced across markets in the first half of 2020. We have come a long way since those troubling months. Vaccines have been rolled out successfully across Europe and, while case numbers have been sticky, hospitalisations and death rates have remained encouragingly low. Moreover, economic data has been solid, corporate earnings and cash balances have been steadily rising and net debt and leverage have been steadily falling. As a result, the removal of this stimulus seems appropriate. And to be clear, this does not mean that PEPP will start selling its holdings, but rather that no new bonds will be added except when investing proceeds from maturing bonds.

Source: Morgan Stanley Research (Max Blass et al., October 2021), Bloomberg, company data

The second point to note is that corporate debt purchases are not a significant component of the PEPP. Of the PEPP’s approximately €70bn asset purchases during September, only circa €1.7bn (2.5%) was used to purchase corporate bonds on a net basis. This compares to €5.2bn of net corporate bond purchases from the Corporate Sector Purchase Programme (CSPP – which was launched in November 2019 and forms part of the ECB’s Asset Purchasing Programme or APP). Admittedly, there has been a downward trend in PEPP monthly corporate bond purchases but I would not take this as a negative signal that commitment is waning. Rather, it reflects the fact that the CSPP has been enough to keep corporate financing costs at very accommodative levels. One needs only to look to single-A and BBB Euro corporate spreads to see how far they have tightened since April 2020. In addition, primary supply is lower than last year and has been very low over the summer months (in considerable contrast to 2020), so it is reasonable to expect declining volume trends.

Source: ECB (September 2021).

Third, expect the existing APP (and by implication, the CSPP) to pick up some of the slack in order to avoid a cliff edge drop in stimulus when PEPP ends. Some analysts are forecasting a doubling of APP monthly purchases from €20bn to €40bn and we should expect the ECB to keep all options open, putting a premium on flexibility. For instance, there is talk of the APP moving into the joint assessment framework which will allow the ECB more freedom to modulate monthly purchases as required.

Notwithstanding the risk of a black swan event, the primary considerations for European credit markets are neither the tapering of PEPP nor the high near-term inflation prints that are being driven by supply shocks and rocketing gas prices. Instead, investors should be keenly focused on the ECB’s medium term inflation forecast (2023 and beyond) which acts as a more persistent inflation measure. This will drive the timing of interest rate lift off and APP tapering. Currently, the ECB’s medium term inflation forecast sits at 1.5%, coincidently exactly the same level as when CSPP was initiated back in November 2019. This is still some way off the ECB’s 2% target and nowhere near meeting the triple lock requirements set out in the Strategic Review. And it goes almost without saying that the ECB’s past record at generating persistent inflation has not been good.

Taking this all into account, I do not have any immediate concerns over the retirement of PEPP, nor do I see a near-term risk that the CSPP will be tapered. Spreads may have found a floor and we may see investment grade spreads start to grind wider in some areas, particularly for those issuers that are rates-sensitive or looking to increase debt to fund activities such as M&A. But how wide can spreads go when supply next year is expected to be lower again (as discussed above, corporates are generally very well-funded) and there appears to be ample money looking for yield? Until the euro area medium term inflation forecast moves measurably higher, expect ECB support for corporate bonds to remain significant.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox