Small business, big deal – a look into peripheral SMEs

It should come as no surprise to any investor that European banks are still too large. Despite having reduced their balance sheets by around €2.4tn since 2011, they continue to have the world’s largest asset base, with an aggregate balance sheet size circa 3.3x the Eurozone’s GDP. Further balance sheet contraction can be expected in the coming years as the European banks strive to recapitalise their balance sheets to conform to stricter Basel-III norms.

Whilst the ECB’s LTRO (long-term refinancing operation) liquidity injections and OMT (Outright Monetary Transactions) programme have arguably suppressed interest rates and helped debt capital markets, they have also anaesthetised bank lending to corporates, particularly in peripheral economies where the transmission mechanism of current accommodative policy continues to be broken.

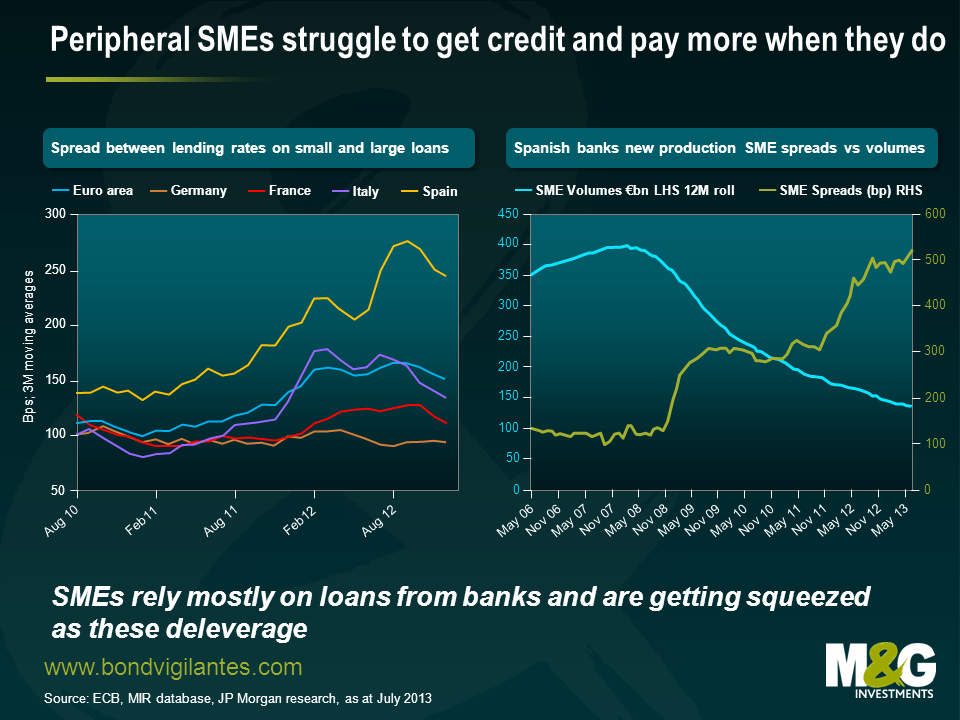

Small and medium businesses are crucial to the European economy. However, SMEs are facing severe financing problems of late, particularly those in peripheral Europe. Not only has credit availability dried up for these companies in the last five years, but those lucky enough to get access to credit are doing so at a significantly higher cost. As shown in the chart below, southern European companies are paying a 2-3% interest premium over their continental peers.

Looking at countries like Spain or Italy, the situation becomes particularly acute. To understand the scale of the problem we should look at the importance of small and medium sized firms in these countries. Italian or Spanish SMEs are responsible for 75-80% of job creation, compared to 50% in the US and 59% in the UK. Furthermore, SMEs and micro companies in these countries represent 99% of total national businesses and generate around 60% of GDP. However, their lack of access to capital markets makes them reliant on banks for borrowing.

ECB interest rates are currently as low as they have ever been. Yet, Spain is one of the European countries with the most punitive corporate financing costs. This is a problem that has often been described as the “diabolical loop” between the Sovereign and corporate sector.

We have previously discussed how the Spanish government is dangerously indebted and accumulates a high fiscal deficit. Such a situation naturally has important consequences for Spanish banks – investors know that if loan delinquencies start to rise, banks have a slim chance of being bailed out by their sovereign. A risk premium is therefore warranted, which is also passed on to the corporate sector in the form of higher financing costs.

The Spanish economy is undergoing a painful recession and the state of its corporate sector is a clear reflection of this. SMEs are deteriorating rapidly, as credit taps are running dry, companies have stopped hiring and have been forced into restructuring their businesses in order to remain competitive vs their continental European peers. As delinquency rates rise, banks’ risk premiums continue to soar and the economic situation deteriorates further. Reduced corporate activity diminishes fiscal revenues for the sovereign, worsening the country’s fiscal deficit and we are then back to square one. The diabolical loop starts again.

Whilst the UK launched the FLS scheme last year aimed at stimulating lending to the real economy, Spain could be running short on time to deal with a problem of potentially larger consequences. Spanish SMEs are the true back-bone of the economy; they are primarily responsible for the country’s wealth and economic growth. Therefore, reinstating credit access while allowing banks to re-size and heal is critical for economic stabilisation. Until this happens, it will be difficult for Spain and other peripheral countries to exit recession.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox