2017 investment grade review – a rising tide lifts all boats

Let’s be honest, 2017 won’t go down in history as the most exciting year for investment grade (IG) credit markets. IG credit spreads have moved more or less in one direction only: lower and lower. Still, there are valuable lessons to be learnt. Here are our key takeaways.

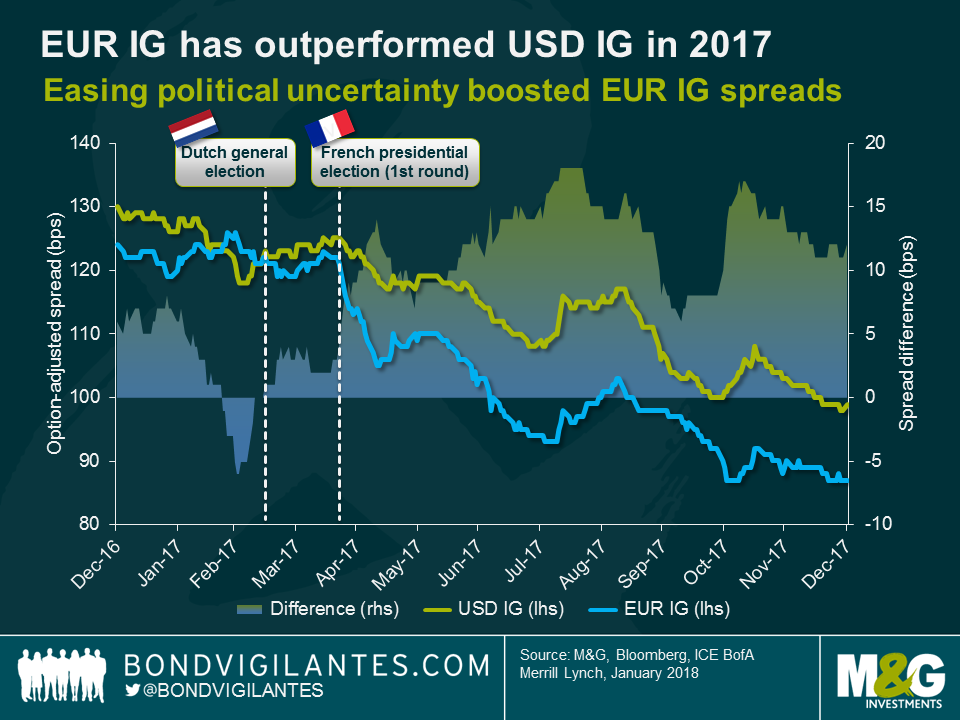

Positive mood swing in Europe drove EUR IG outperformance vs USD IG.

Back in early 2017 the logic was as follows: After the Brexit referendum in the UK and Donald Trump’s electoral victory in the US, populist anti-establishment movements would likely gain momentum in continental Europe too and exert strong centrifugal forces on the Eurozone and the European Union. Consequently, EUR IG credit spreads initially struggled and underperformed against USD IG spreads in the first two months of the year. However, sentiment around European risk assets took a sharp turn for the better when political risks subsided with the Dutch and French election results. After Emmanuel Macron’s victory over Marine Le Pen in France, EUR IG credit spreads were off to the races. Over the course of the whole year they tightened by 37 bps, outperforming USD IG spreads (31 bps tighter). Moreover, EUR IG credit was of course also supported by the European Central Bank’s Corporate Sector Purchase Programme. GBP IG spreads had a good year as well (26 bps tighter) but underperformed against USD and EUR IG, which isn’t overly surprising considering the lingering uncertainties around Brexit.

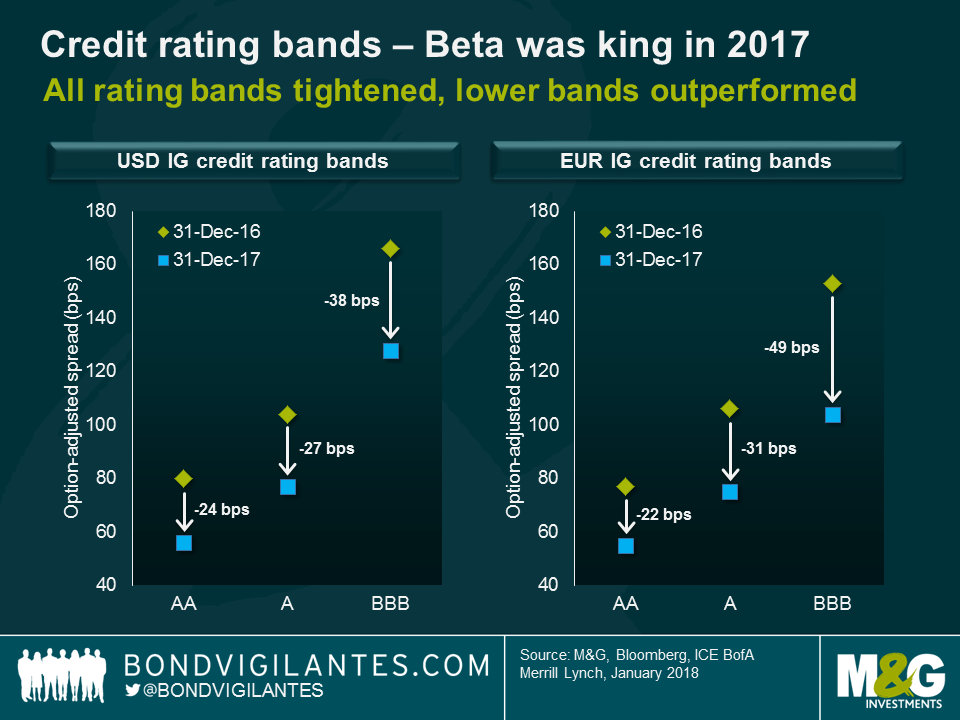

High-beta credit positions, such as lower credit rating bands, generally outperformed.

In the “risk-on” year 2017, high-beta credit strategies generally outperformed low-beta approaches. Consequently, while all USD and EUR IG credit rating bands exhibited spread tightening, BBBs outperformed Single-As which in turn outperformed AAs. It is worth highlighting that EUR BBBs had a particularly strong year, tightening by 49 bps. And within the EUR BBB rating band again the highest-beta segment, the BBB- category, showed the strongest tightening (70 bps).

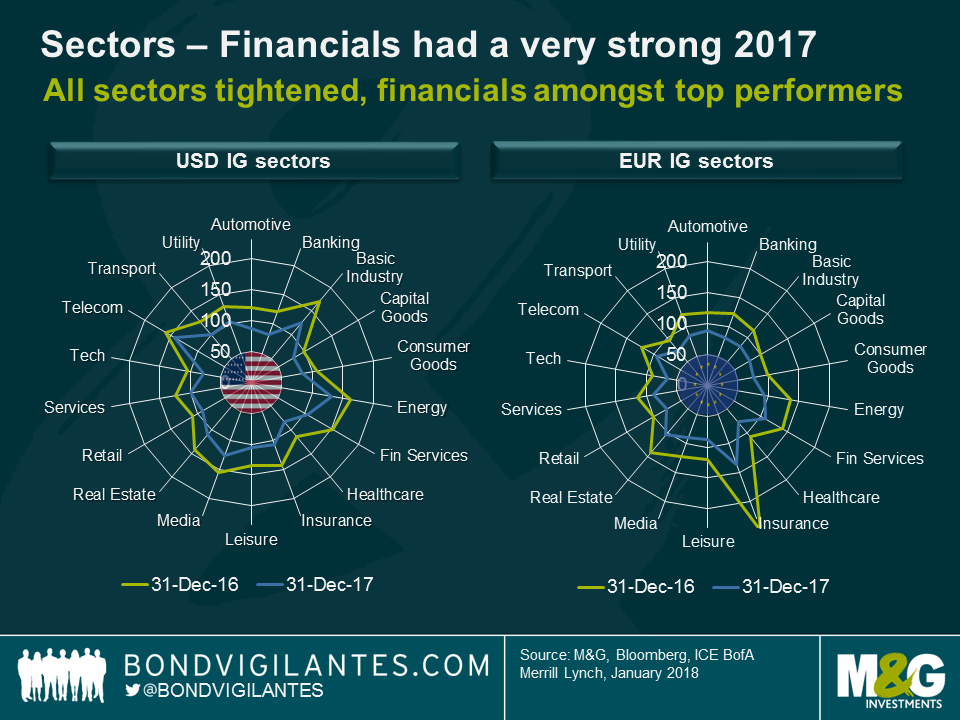

All sectors showed spread tightening; financials in particular had a very strong year.

One of the most remarkable features of IG credit in 2017 is that the spread of every single sector has tightened over the course of the year, both in USD and EUR IG. Financials had a particularly strong year. Banking spreads tightened by 39 bps in USD IG and by 41 bps tighter in EUR IG. Insurance spreads finished the year 35 bps lower in USD IG and were the stand-out performer in EUR IG with a whopping 113 bps tightening. The EUR IG insurance segment contains a very high proportion of subordinated and junior subordinated bonds (c. 64% combined, as of 31st December 2017), which as higher-beta instruments benefitted significantly from the bullish risk-on market sentiment. Apart from financials, other cyclical sectors performed strongly in 2017 too, namely basic industry (44 bps tighter in USD IG, 33 bps tighter in EUR IG) and energy (32 bps tighter in USD IG, 42 bps tighter in EUR IG). Some of the more defensive sectors, e.g., capital goods (19 bps tighter in USD IG, 21 bps tighter in EUR IG) and consumer goods (22 bps tighter in USD IG, 23 bps tighter in EUR IG), tightened less meaningfully.

2018 outlook

Given how tight credit spreads have become, what can we expect from IG corporate bonds in 2018? While a repetition of last year’s strong performance doesn’t seem particularly realistic, there are reasons to stay invested in IG credit. Economic growth and company profits are robust in most parts of the world. Corporate default rates remain at ultra-low levels. Although many central banks have begun to gently reduce stimulus, monetary policies are still very accommodative compared to previous cycles.

That being said, I would not expect a smooth ride to ever tighter credit spreads. Volatility could easily pick up due to a number of lingering political risks – Italian general elections, Brexit negotiations and US mid-term elections, just to mention a few. Therefore, scaling back credit risk by switching into higher credit quality and more defensive sectors or by buying protection on credit default swap indices to reduce credit market beta, seems prudent at this point. There will likely be better buying opportunities for IG credit over the course of the year. Finally, as pure credit market beta is now less attractively priced than one year ago, outperformance this year may well be primarily driven by fundamental credit analysis and idiosyncratic bottom-up stock picking.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox