Operation normalise

The Fed has basically used three major themes in response to the financial crisis from a monetary point of view:

- Lower short term rates

- Quantitative easing

- Operation twist – an attempt to flatten the yield curve

The Fed has communicated that it now expects the first move in normalising rates as the economy recovers will be to increase short term rates. Personally I think there are other alternatives.

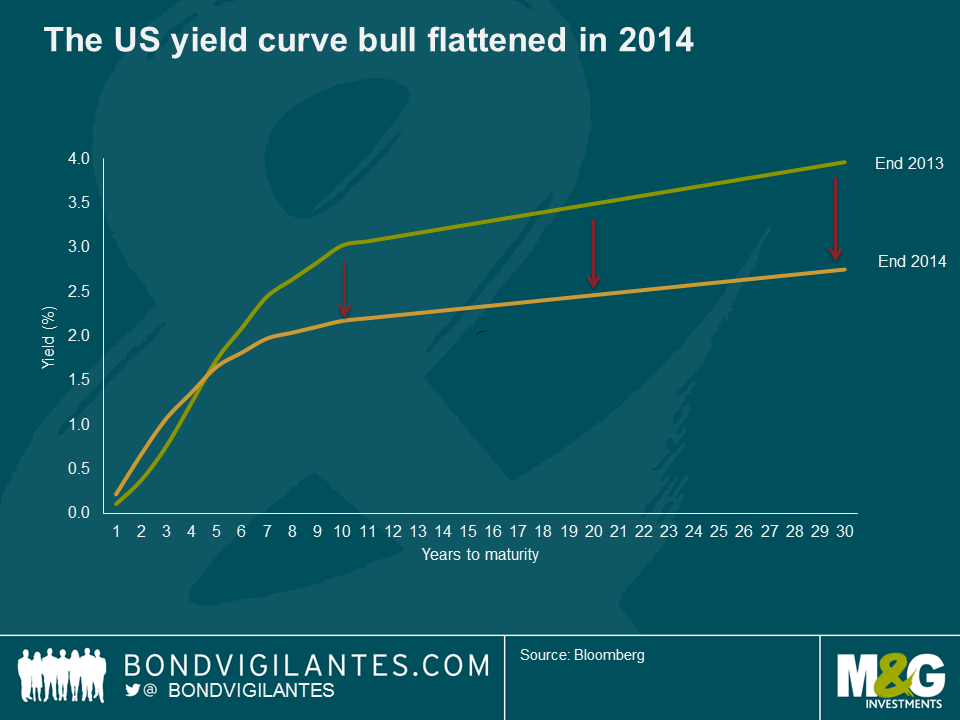

Firstly, looking back at 2014, we can see it was a year of further monetary easing. This was done primarily through QE, which ended in the autumn, and also through a bull flattening of the yield curve, as illustrated below.

The process the Fed is currently discussing is one of raising short rates first (reversing theme 1), and then looking at reversing the other monetary actions at a later date. This need to remove easy monetary policy is well documented and there is a significant focus on how the Fed will tighten post the financial crisis.

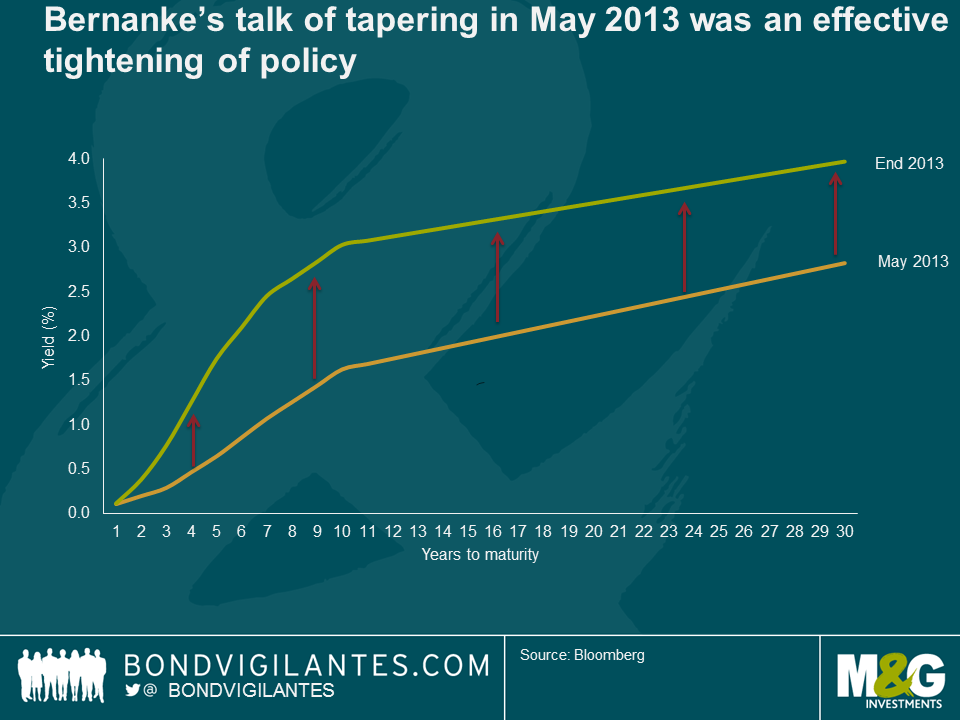

An early move with regard to tightening was engineered with the taper tantrum of May 2013. The below graph shows the yield curve ahead of the Fed’s signalling and where it was as at the end of 2013. This was an effective tightening of policy as discussed here.

This tightening has been unwound in 2014 as already mentioned. Surely one option open to the Fed is to normalise the curve as opposed to pushing up short rates ?

Firstly, I have always thought that monetary tightening should logically follow the reverse pattern of monetary easing. This would mean reversing operation twist, then QE, and only then pushing short rates higher. Removing any QE inspired asset bubbles seems logical to me.

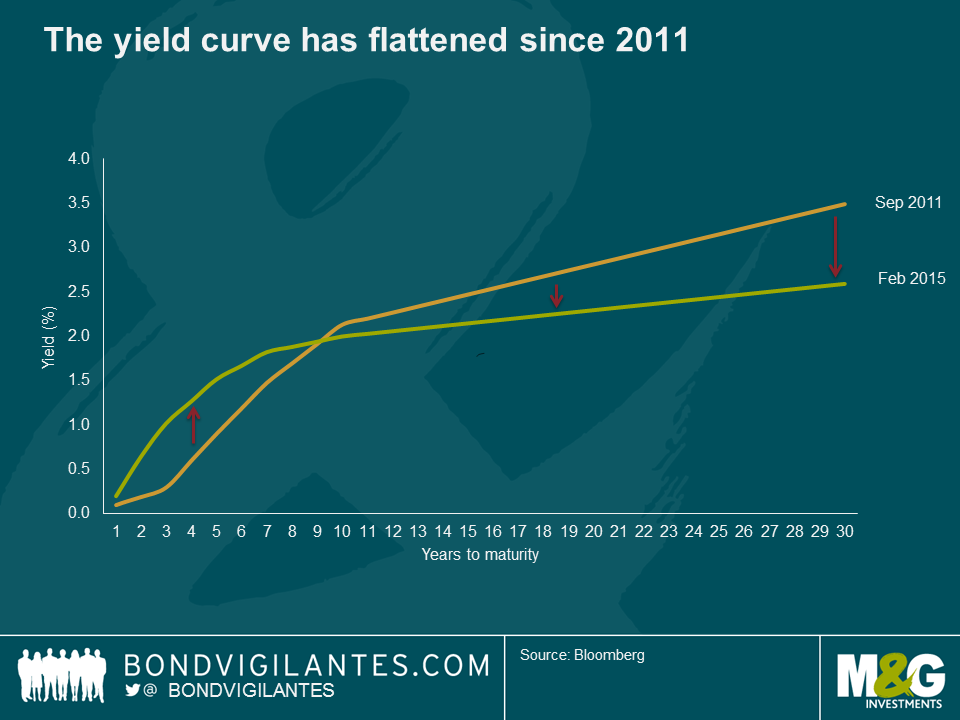

Secondly, the Fed has acknowledged with operation twist in 2011 that the shape of the yield curve matters. When we look at the yield curve before operation twist and now, we can see the dramatic flattening of the curve, partly inspired by operation twist. Surely it makes as much sense to normalise the curve as a policy option as it does to put short rates up? Indeed p7 of this IMF paper on unconventional monetary policy suggests the term premium is currently distorted by around 100 basis points as a result of QE, although monetary policy and economic conditions outside of the US are surely also pushing the term premium lower. The Fed should consider selling long dated securities and buying shorter dated ones. This would also have the side effect of reducing the potential profit and loss impact on the Fed’s balance sheet, while making the eventual unwinding of QE more manageable as the shorter dated assets mature in an orderly manner.

Thirdly, by simply reversing QE, the Fed would further reduce the balance sheet risks as described above. This in turn would then make conventional policy tightening through raising short rates more practical and normal by reducing the risk of flattening (inverting?) the yield curve. Also if the Fed, like other central banks, wishes to look through the short term effect on inflation of a falling oil price, then surely leaving short rates where they are and pushing up longer rates by reversing QE makes sense economically. After all, the Fed has focused on forward guidance verbally and physically for a number of years, why should they stop now ?

When conducting pre-crisis monetary policy, the main central bank tool was short rates. Since the crisis other weapons have had to be used to achieve economic goals. In moving back to conventional monetary policy the Fed should look to remove unconventional measures from the market place ahead of or alongside conventional rate hikes, not after them.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox