So Much for the January Effect!

January was a shocker. European high yield fell by 4.6%, the worst month since July 2002. This is particularly alarming considering that there weren’t actually any defaults. Meanwhile the US high yield market fell by a more modest 1.4%, not as bad as last November, but still the worst January since 1990.

Much of the weakness in high yield can be attributed to the sharp falls in equities, because the two markets are fairly closely correlated. The DAX fell by 15% in January, while the S&P 500 fell by 6%. The underperformance of the DAX no doubt has something to do with the underperformance of European high yield.

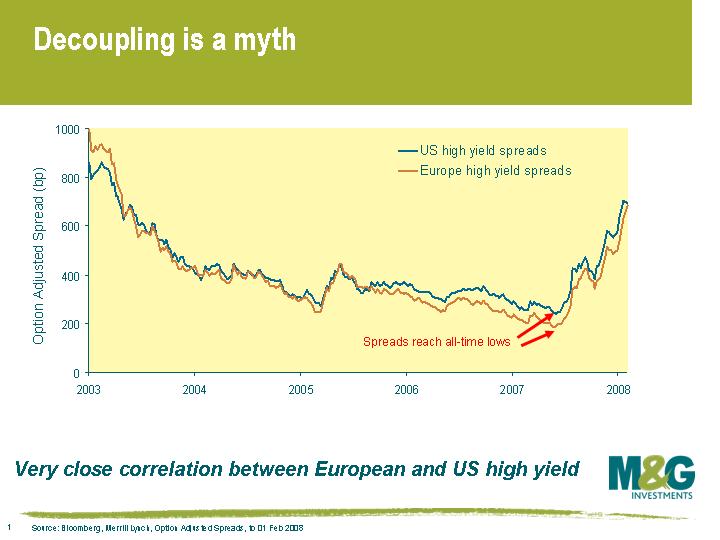

European underperformance was probably also due to the European high yield market having got slightly out of synch with the US in 2006-07. As the chart shows (click chart to enlarge), US and European high yield spreads have historically tracked each other very closely. In 2006-07, however, US high yield spreads crept above European high yield spreads, and the European high yield market had a bit of catching up to do.

European underperformance was probably also due to the European high yield market having got slightly out of synch with the US in 2006-07. As the chart shows (click chart to enlarge), US and European high yield spreads have historically tracked each other very closely. In 2006-07, however, US high yield spreads crept above European high yield spreads, and the European high yield market had a bit of catching up to do.

Sentiment in the high yield market remains poor, and the lack of risk appetite and the drop in demand for high yield bonds has meant that there has not been any issuance in the European high yield market for six months on the trot. However, European BB rated bonds now yield 5.5% over government bonds, and having contended for some time that high yield was an expensive asset class, I believe we have now reached levels that can be described as fair (or dare I say it, ‘attractive’) value.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox