2017 High Yield Review – Another Solid Year

Good performance after an exceptional 2016

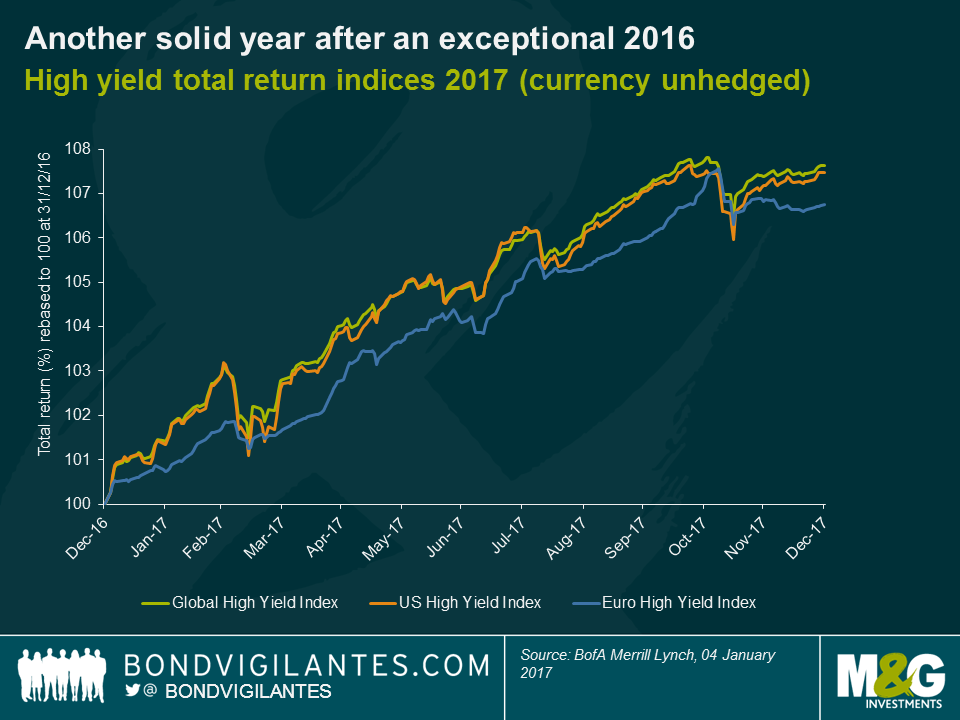

2017 was another good year for high yield investors with the global high yield index delivering a total return of 8.0% (in USD terms), albeit this was less exciting than the 16% achieved in 2016. The US continued to outperform Europe but at a far more modest rate compared to 2016, with a 7.5% local currency total return vs Europe’s 6.7%, although much of this can be attributed to the difference between US and Eurozone interest rates. For instance, a fully USD hedged portfolio of European high yield would have returned 8.9%. Global floating rate high yield bonds returned 4.7% in USD terms over 2017 reflecting their lower beta characteristics relative to conventional fixed rate high yield.

Sector winners and losers

Looking at the 7.5% total return in the US, the top 3 performing sectors were Utilities (+11.6%), Banking (+10.8%) and Chemicals (+10.6%) driven by a combination of continued strength in the domestic economy and in the case of the small Utilities sector some credit friendly M&A. In contrast, the worst 3 performers were Consumer Products (+0.3%), Super Retail (+1.3%) and Cable & Satellite (+4.6%) reflecting the persistent erosion of traditional retail profitability in the face of the secular shift toward online retailers (a.k.a. the “Amazon effect”), whilst Cable & Satellite saw underperformance on the back of concerns that the sector has seen peak subscriber growth as non-traditional platforms start to gain meaningful share in the media market (a.k.a the “Netflix effect”).

Within Europe, financials outperformed significantly posting a 9.1% gain in EUR terms, with non-financials modestly lagging with a 6.1% total return. This was a reversal of the trend in 2016, reflecting the bounce back in the sector after some bondholder unfriendly recapitalisations of Italian banks that year. 2017 was a far more benign year for financial risk. Indeed the riskiest bank debt (AT1 / COCO’s) posted a 12.9% return, even after an effective 100% loss for Banco Popular AT1 bondholders during the year.

Rating bands performance

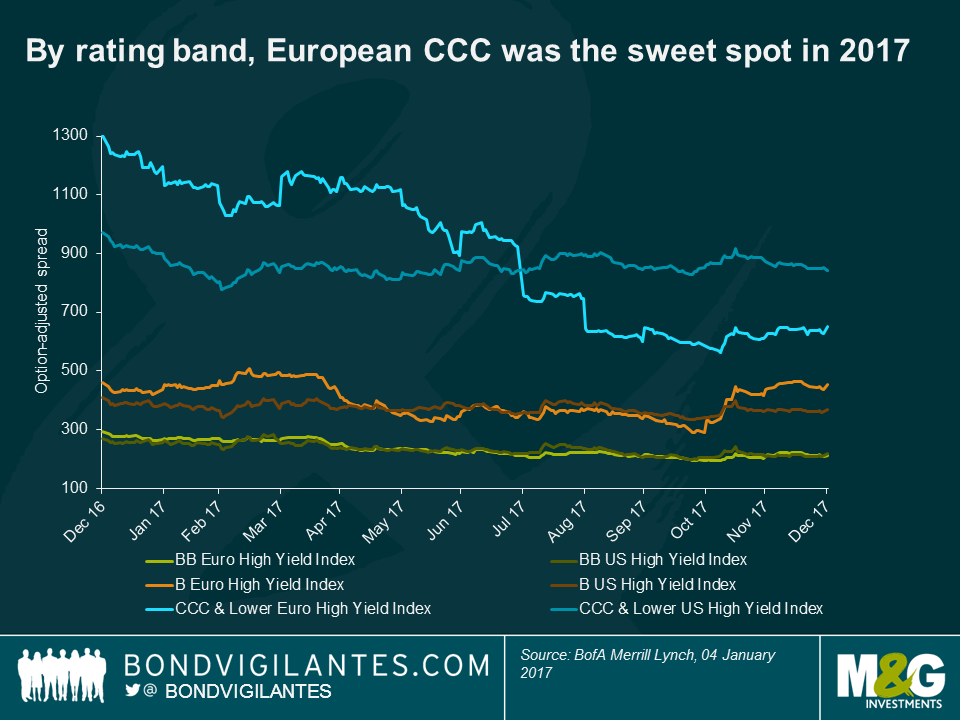

On rating bands, the European CCC segment was the clear outperformer with a total return of 13.8% and the pick-up on the CCC spreads vs the single B sector collapsing by 643bps through the year to only 197bps compared to 840bps in January. In contrast, the European single-B index only returned 5.8% with spreads vs European BB actually widening over the year by 74bps to 242bps. The European BB segment returned a solid 6.6% with spreads tightening by 83bps. This is an unusual move as historically single-B’s have tended to outperform BB’s in a rallying market. Part of the reason could be due to the market technical in the wake of the ECB’s QE program – the “spill-over” from investment grade spread performance will have been most noticeable in the BB rated part of the credit market.

In the US, performance was more consistent across rating bands with the spread on all rating categories tightening over the year and a more measured CCC vs single B spread differential than in the European market (YE17: 472bps vs 197bps).

Default rates

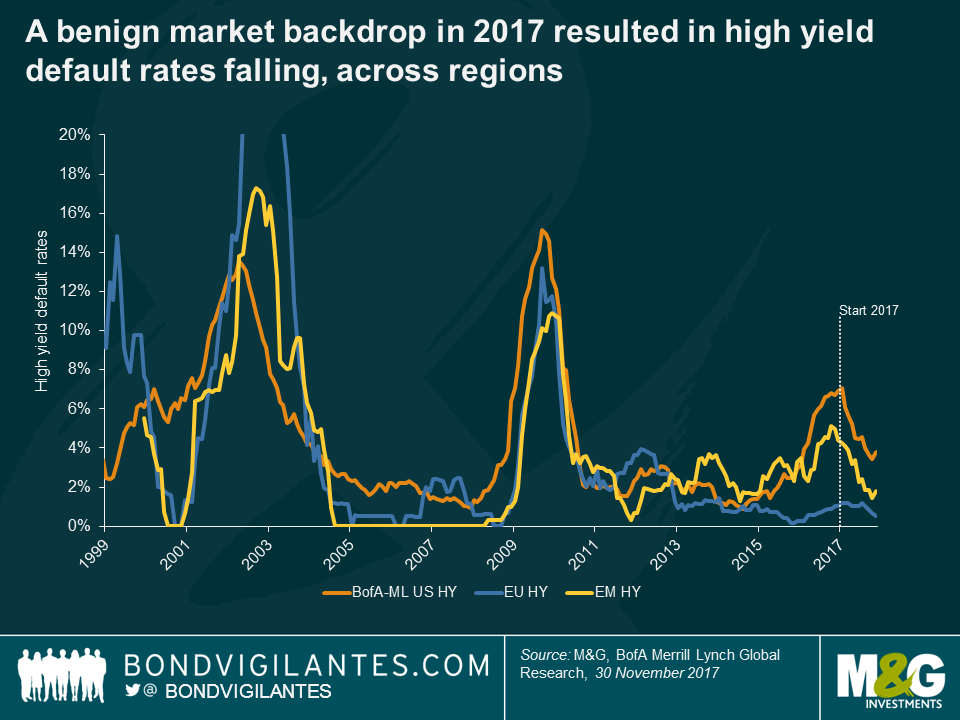

Given a benign market backdrop, default rates (as measured by Bank of America Merrill Lynch) fell over the course of 2017 to 3.8% in the US at the end of November 2017 (YE16: 6.9%) and only 0.5% in Europe (YE16: 1.0%). The big fall off in default rates in the US was widely expected as the financial distress in the energy sector rapidly receded. Nevertheless, Energy was still in the top 4 defaulting sectors in the US (alongside Utilities, Media and Retail). Notable bankruptcies included Avaya, Toys R Us, Gymboree, and some Energy/Utilities names, such as Petróleos de Venezuela SA, GenOn Energy and Seadrill.

In Europe, the defaults were rarer and more idiosyncratic in nature including issuers such as paper producer Norske Skog, Croatian food retailer Agrokor, the oil services group CGG, and airlines Air Berlin and Alitalia, (NB the 2 airlines did not have public credit ratings rated and so were excluded from the 0.5% European default rate).

2018 Outlook

So what next for the high yield markets? There is little doubt that underlying economic conditions are as favourable as they have been for many years. Synchronised global growth that has the potential to drive corporate top lines and profitability is good news for the high yield market. This should help support credit spreads and could even push default rates lower (more so in the US than Europe). However, our view is that credit spreads already largely discount this benign scenario and we are seeing little scope for material spread tightening from this point forth – a lot of good news is already in the price. Nevertheless, in relative terms, the high yield markets remain attractive for income seekers with the US market yielding 5.1% and the European market yielding 2.4% (in local currency terms), hence without a major change to the fundamental outlook, the asset class still has its attractions. What we do see, however, is further underlying shifts within the market – the continued ripple effect of technological and social disruption to traditional industries. 2017 saw the “Amazon effect” really start to bite. Could the “Netflix effect” gain momentum in 2018 ? Will we be talking about the “Tesla effect” by the end of the year? All very pertinent questions for active high yield managers in 2018 and beyond.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.