The toxic French economic cocktail: weak growth, poor competitiveness, fiscal tightening.

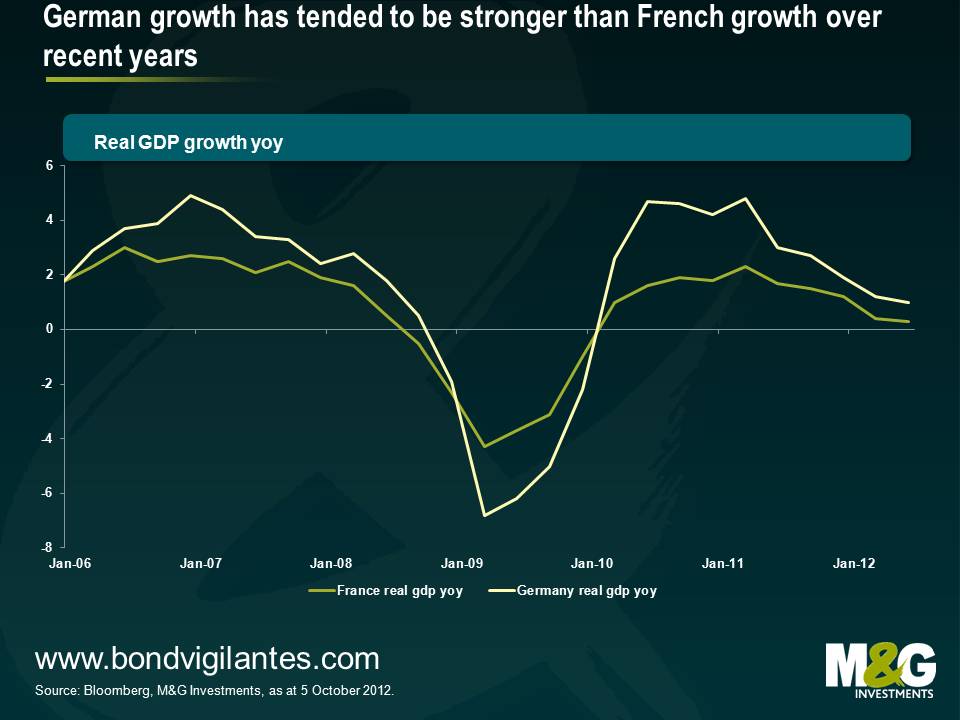

Since the start of 2011 French economic growth has been extremely disappointing, falling from an annual rate of nearly 2.5% to just 0.3% in the second quarter of this year. Of course the whole Eurozone has seen weakness over the period, but French growth has lagged that of the “core” over the period. German GDP growth was at or above 2% for all but the last two quarters, and now stands at 1%. Purchasing Managers’ surveys for September show more divergence, with more falls in French manufacturing and services, whilst the German surveys strengthened.

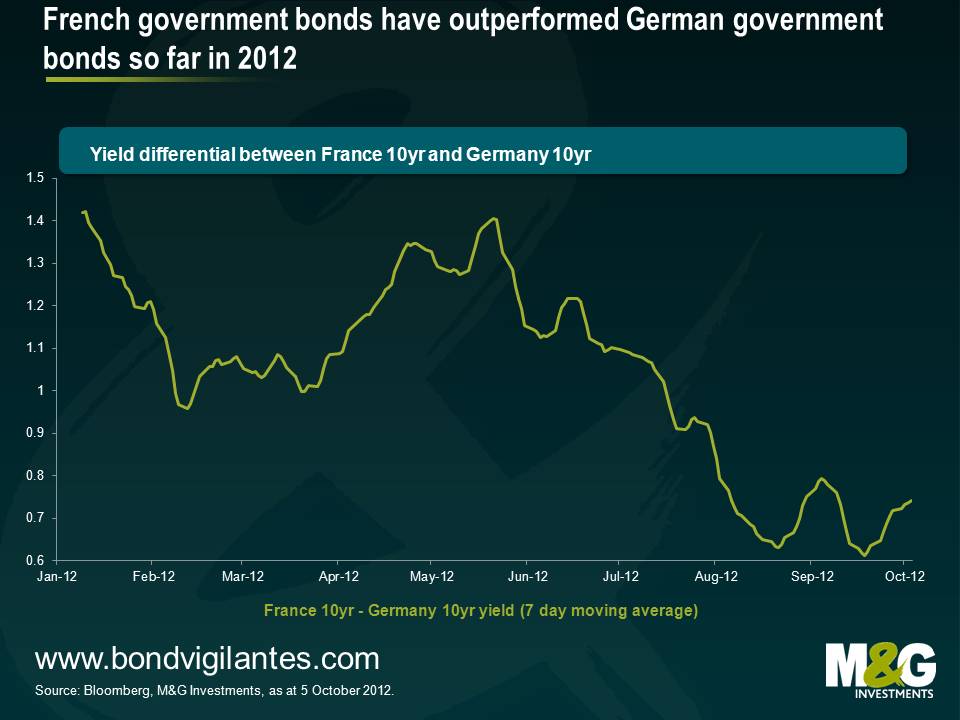

Of course, it could be worse – Greece, Portugal, Spain, and Ireland have experienced much weaker economic growth and, perhaps most damaging, higher rates of unemployment. Spanish unemployment has risen from 8% in 2007 to 25% today, with youth unemployment over 50%. The French jobless total stands at “just” 10.3%. And the other big difference is that the bond markets believe that France is part of the core, not part of the periphery. Looking at 5 year CDS rates (the cost in basis points to insure a sovereign bond against the risk of default), France trades at 110 bps per year, compared with Ireland at 300 bps, Italy at 325 bps and Spain at 370 bps. And whilst this is still much wider than German CDS at 54 bps, since May the spread between German and French government bonds has narrowed significantly, from over 1.4% to 0.75%. Part of this reflects the perceived reduction in general Eurozone default/breakup risks following ECB president Draghi’s assertion that he will do whatever it takes to save the Euro and his plan to buy short dated government bonds of nations in distress, but this relative improvement also coincides with the election of Francois Hollande in May, when he became the first leftwing French president in two decades.

Hollande was elected on a platform of putting up taxes on the rich. He also pledged to cap France’s budget deficit. As such last week’s Draft Budget Law (PLF) for 2013 did not surprise the French population – there will be a fiscal tightening made up a third from household taxes, a third from corporate tax rises and a third from spending cuts. Goldman Sachs estimates that the tax take as a percentage of GDP will rise from 44.9% to 46.3%. But even this relatively aggressive tightening of fiscal policy (and the projections are based on GDP growth higher than many believe is possible, especially in light of that same fiscal tightening and a climate of austerity) doesn’t prevent debt/GDP from rising above 90% in 2013. Remember that 90% is the level that Rogoff and Reinhart say delivers significant damage to an economy’s ability to grow. But if the fiscal austerity “works”, France should be moving towards a balanced budget within 3 or 4 years.

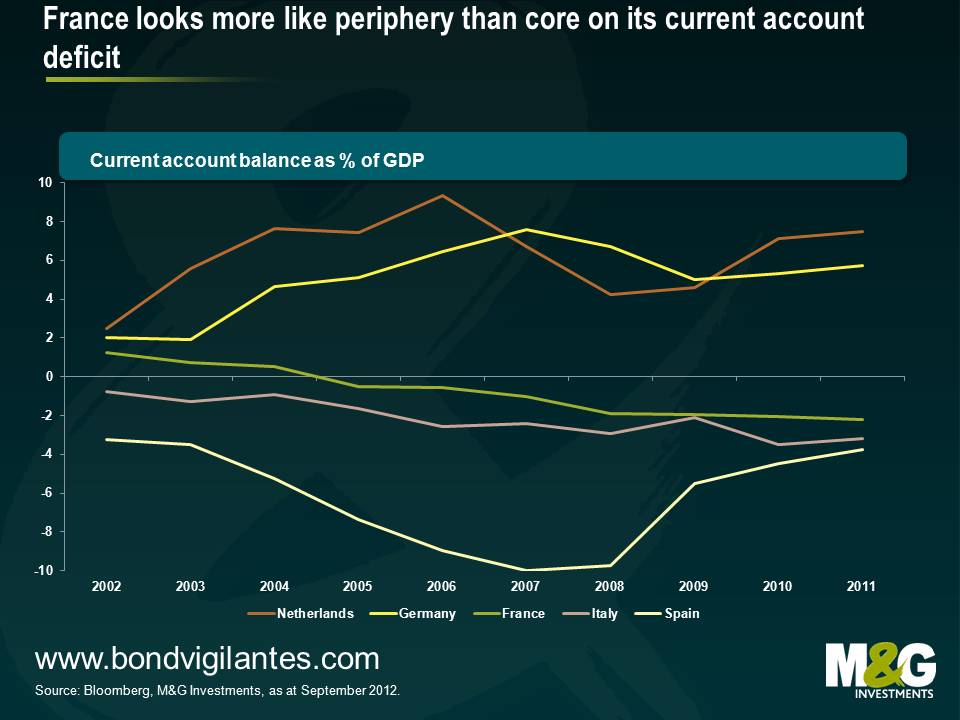

But back to the ability of France to grow its way out of a fiscal hole. Competitiveness is something that continues to worry us about the economy. The French current account is sharply in deficit, looking more like Spain or Italy than the “core” of Germany or the Netherlands (but not looking as bad as the UK’s current account deficit of 5.4%, the most important reason we think that the pound is massively overvalued).

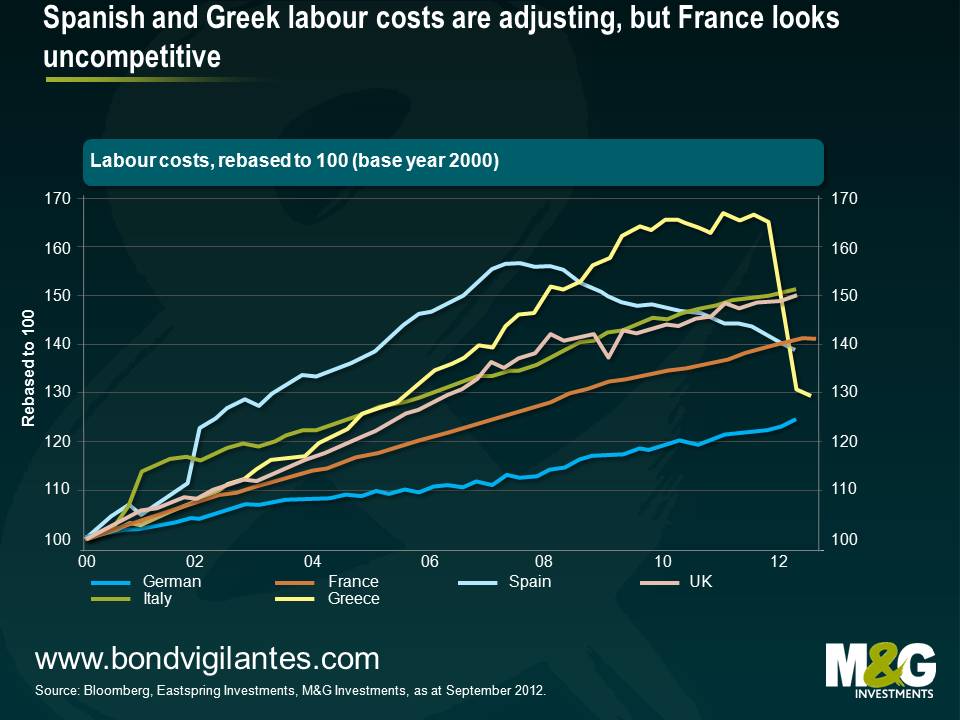

In a typical economic model, a country with a current account deficit like this would devalue its currency to help its exporters. The single currency zone of the Eurozone doesn’t allow this to happen, so instead an internal devaluation has to occur instead. Since the creation of the single currency, the German economy has outperformed, with strength in exported goods leading that strength. This was no accident – post the collapse of the Iron Curtain, German companies had come to agreements with trade unions (a kind of neo-corporatism in which the government, companies and workers are social partners in a capitalist framework) to have wage restraint and thus keep German manufacturing from heading east to the cheaper labour supply. It meant that in the 12 years since the creation of the single currency, German labour costs rose by less than 25%. In Greece they rose by 65%, Spain 55% – and in France by 40%. Relative to Germany then, French labour costs had risen by 15% more, a significant deterioration of relative competitiveness within the core of Europe.

It’s clear that the “internal devaluation” is occurring in Greece and Spain, with labour costs falling sharply (as unemployment rockets). I’m not arguing this is positive – in the medium term it will stimulate exports as factories relocate in lower cost regions, but in the nearer term the drag this will have on Spanish and Greek growth could be medicine that kills its patient. But if there is capital to invest in plant, equipment and people in Europe once, and if, uncertainty fades, would it go to France, or to lower cost, restructured Spain?

And aggressive, publically stated austerity doesn’t appear to be a policy with great results – look at the UK where we’ve done less than 10% of the spending cuts that the coalition have planned, yet the psychological impact on the economy has been severe, and since the credit crisis began the UK economy has underperformed not just the US (where they did some good old Keynesian fiscal stimulus) but also the Eurozone, which is widely regarded as an economic disaster area here despite it having outperformed us by about 2% of GDP over the period (and having a lower debt/GDP level too, if you took the region together as a whole).

So the challenges to the French fiscal outlook are enormous – delivering growth (or defaulting) has always been the most successful method of reducing government indebtedness, and even an optimistic 2% per year real growth rate (pencilled in by the government from 2014) doesn’t deliver a significant reduction in the debt to GDP ratio – certainly the 40% to 50% level that we used to associate with a AAA rated economy seems a long way away. It may be that the aggressive tightening in French government bond yields to those of AAA rated (for the time being) Germany has gone far enough. There are plenty of economic and social buy-in risks to come for France – let us not forget that Spain’s Rajoy was also elected on a platform of fiscal consolidation, and it took less than a year for its population to change its mind about that.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox