QE reaction – the Grand Old Duke of York

It seems the Bank of England has been acting as the Grand Old Duke of York – gilt yields had been marched fairly close to the top of the hill a week or two ago, with 10 year gilt yields getting close to 4% (back to levels seen in November) and 30 year gilt yields reaching 4.6% (about the same as in July 2007). Now they’ve just marched some of the way down again. 10 year gilt yields initially tumbled 0.16% lower yesterday (a 1.2% price gain), and 30 year gilt yields dropped 0.25% lower ( a 3% price return), although gilts have since given back a small amount of these gains.

The reason for this sharp rally is that the 10000 or so men and women who closely follow the Bank of England’s every move thought that it would pause its asset purchase scheme, or at least not extend it by much. The decision announced yesterday that it would purchase an additional £50bn of government and corporate debt therefore came as a surprise to most.

Why did the BoE extend the programme? You can see the full release here, but the reasons cited were that the UK “recession appears deeper than previously thought”, “slack in the economy is likely to grow for some while yet”, “financial conditions remain fragile”, and “lending to business has fallen and spreads on bank loans remain elevated”.

But at the same time, “there have been increasing signs that output in the UK’s main export markets is stabilising”, “financial market strains have eased and banks’ funding conditions have improved a little”, “the pace of contraction has moderated”, “business surveys suggest that the trough in output is close at hand” and “credit conditions may have started to ease”. So make of that what you will.

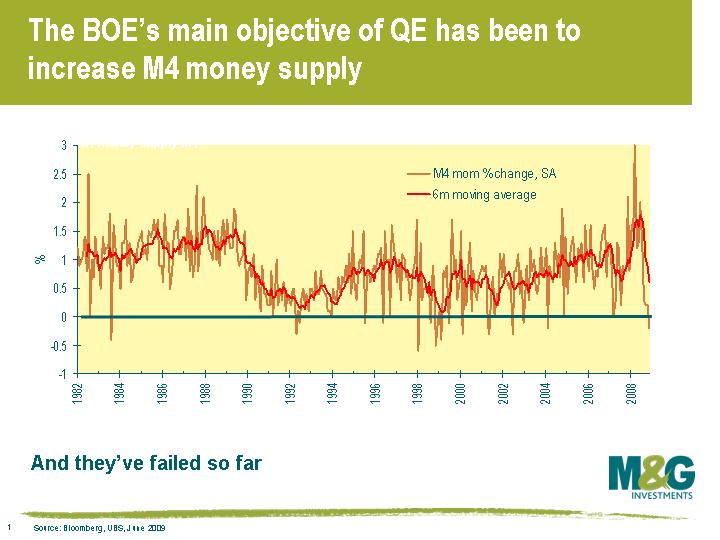

Not everyone’s been anticipating the end of QE, and among the people who deserve a hat tip is UBS’ Roger Brown, who showed us the chart below on Tuesday. He pointed out that the Bank of England’s main aim has been to increase M4 money supply. When the BOE initially got permission to begin QE, M4 money supply stood at £2trillion. The BoE is targeting money supply growth of 7.5%, and that’s why the BOE originally sought permission to buy £150bn of assets. However, M4 money supply growth has in fact been dropping rapidly in the past few months, and was negative in June. On this measure, therefore, QE has been a failure, and Roger Brown therefore argued that more QE is likely (although he stressed that this didn’t make him a long term bull for gilts – QE extension would just delay the enormous gilt market puke that is surely going to happen at some point). Why hasn’t QE worked? There’s a bit of a clue in Lloyds’ recent results – end December 2008, it had £7.5bn of ‘cash and balances at central banks’, and by the end of June 2009 it had over £60bn.

In fairness to the BoE, though, everything they said in the release above is entirely true. The UK and global economy remains in a very fragile state. The BoE is walking a tightrope – do too much QE and the result will be growth in the short to medium term, but accompanied with runaway inflation, which will be very bad for longer term growth as rates are hiked and government bond yields soar. Do too little QE, or implement the exit strategy too soon, and the result would be an acceleration of the downturn and further pressure on the vulnerable banking sector.

The noises coming from MPC members in recent weeks have been occasionally confusing, but maybe the title of this blog is a little harsh. But better to be the Grand Old Duke of York than the Pied Piper, or we’re all in trouble.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox