In search of satisfaction – our analysis of the BoE press conference

Listening to the Bank of England Quarterly Inflation Report press conference – the first with Mark Carney steering the ship – a song immediately sprung to mind. The song was written by a former student of the London School of Economics, Sir Michael “Mick” Jagger with his colleague Keith Richards in 1965. There is no better way to analyse the current thinking of the Bank of England than through one of The Rolling Stones best songs, (I Can’t Get No) Satisfaction.

“I can’t get no satisfaction”

The new BoE Governor began with the positive news that “a recovery appears to be taking hold”. This wasn’t news to the markets, as more recently we have seen a remarkably strong string of economic data. However, the very next word in Mr Carney’s introduction was “But…”. What followed was, in my opinion, the most dovish sounding central bank policy announcement since the darkest days of the financial crisis.

Carney firmly announced his arrival as the global independent (excluding BoJ) central banking community’s uber-dove through the acknowledgement of a broadening economic recovery in the UK, and then making explicit that the BoE remains poised to conduct more, not less, monetary stimulus. Until now, these two conditions were considered by bond markets to be pretty much incompatible.

“’Cause I try and I try and I try and I try”

Carney told us that the BoE will maintain extreme monetary slack (in terms of both the 0.5% base rate and the £375 billion of gilts held) until the unemployment rate has fallen to at least 7%. He went even further than this, stating the MPC is ready to increase asset purchases (QE) until this condition is met. However, there are two conditions under which the BoE would break the new, explicit link between monetary stimulus and unemployment: namely, high inflation and threats to financial stability. Did the new governor have to put these caveats in place because other members of his committee would only agree to the announcement if they were mentioned?

“Supposed to fire my imagination”

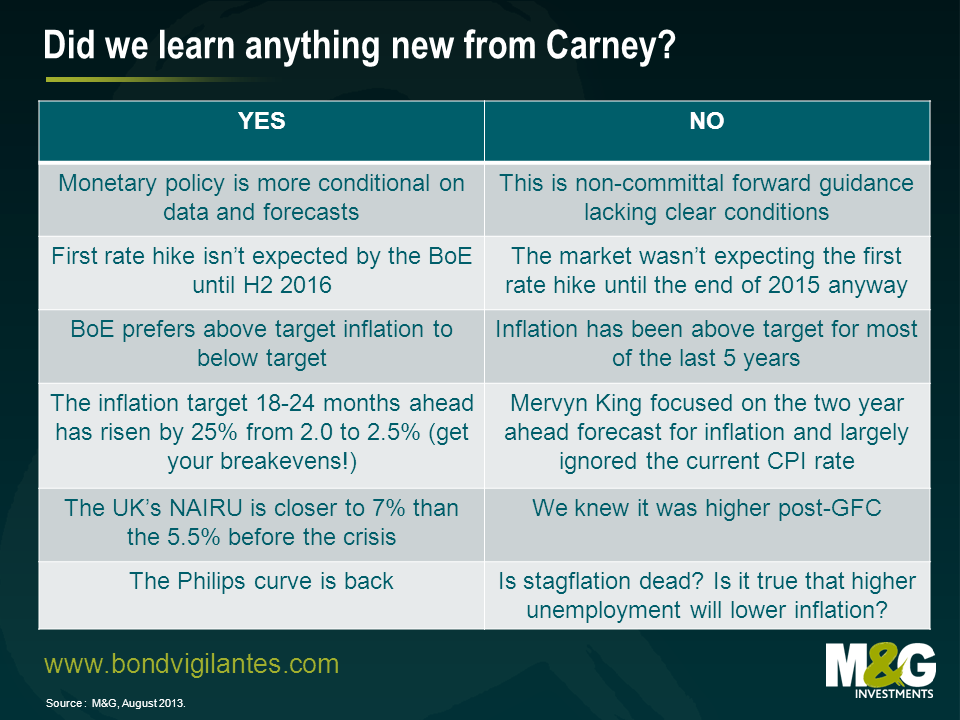

The new framework announcements were broadly in-line with what we were expecting. In that respect, the Governor’s major announcement was not too much of a surprise. The market agreed and there was a relatively muted response. Carney was supposed to fire our imaginations, so the question is – did we learn anything new? The “yes” and “no” arguments are outlined in the below table.

“When I’m watchin’ my T.V. and that man comes on to tell me how [the economy should] be…

The market suspected Mr Carney would bring in some forward guidance, but I think the most interesting implication of this announcement today is that he felt the need to do something, but did not feel the need to increase asset purchases through QE. Mervyn took on the first part of Friedman’s equation, the supply of money. This was not inflationary as the transmission mechanism was broken, and the cash was hoarded and not released into the real economy. Could Carney be the governor to focus on the second part of the equation, money velocity? Forward guidance is designed to give individuals and companies the confidence to borrow in order to spend or invest. If they do, velocity will return as the transmission mechanism repairs. I believe we are considerably less likely to see an increase in QE under the new governor.

If forward guidance does not have the consequences Carney intends, and my belief that he is more focused on the transmission mechanism than his predecessor, what might Carney do next? At that point, he might increase schemes akin to Funding for Lending, and hand banks cheap funds at the point at which the banks release the loans to borrowers. This way, banks are heavily incentivised to lend at levels that are attractive to individuals and companies.

“He’s tellin’ me more and more, about some useless information”

Carney told us that if and when unemployment reaches 7%, policy will start to tighten. But then he stated that if inflation exceeds 2.5% on the BoE’s shocking 2 year forecast (is this a rise in the inflation target?), or if inflation expectations move beyond some unannounced bound, or if financial stability is under threat, then he might have to break the newly explicit link between unemployment and monetary policy. And then he stated that even if unemployment hits 7%, this will not trigger a policy change, but a discussion around one.

I don’t think we actually got pure forward guidance, but a pretty muddled variant thereof. Bond markets are rightly unsure as to how to react, and have struggled for a satisfying interpretation. All we can really take from the BoE is that they will need to be sufficiently satisfied that the UK economy has reached escape velocity before hiking rates or reversing policy.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox