Mortgages and monetary policy in the US and UK

The cost of new mortgage borrowing and payments on outstanding household debt can have a large impact on the rate of growth of an economy. For this reason, central bankers are interested in the transmission mechanism of monetary policy. It has been shown that interest rates can have a stronger influence on an economy where there are a high proportion of variable rather than fixed-rate mortgages. Whilst there are well known differences in the mortgage markets of the US and UK in terms of the proportion of fixed versus variable mortgages, some interesting trends have developed post-financial crisis.

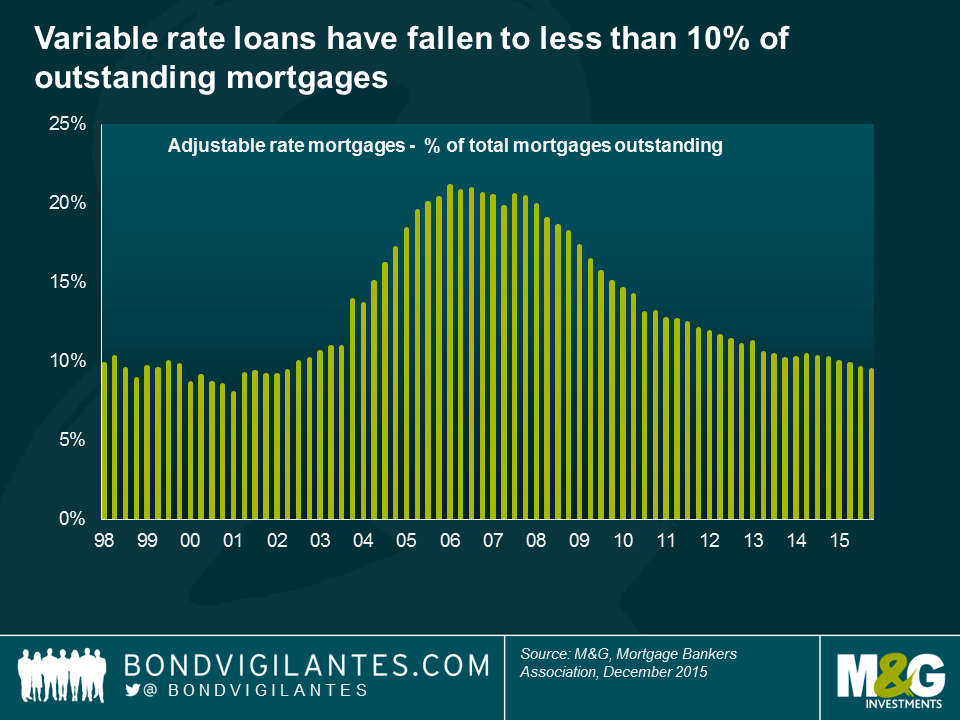

The US mortgage market is now more fixed rate in nature than it has been in a number of years, with variable rate loans falling from more than 20% of outstanding mortgages in 2005 to 2008, to less than 10% now. The average maturity of US mortgages is just over 23 years, owing to the dominance of 15 year and 30 year fixed rates mortgage products. The realised duration of US mortgages tends to be much shorter than this, as the loans are fully pre-payable. However, if we start to see higher yields and higher mortgage rates, these mortgages will be much longer dated than they have been in years.

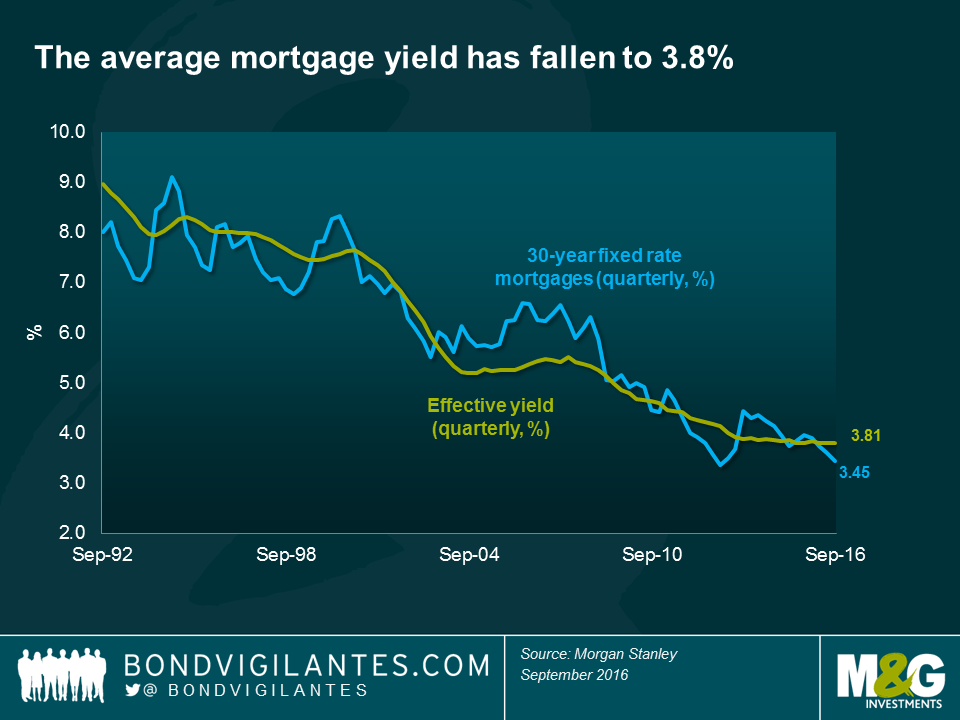

Not only has the proportion of fixed mortgages been increasing, but the average mortgage yield has fallen to 3.8%, a level not seen before in the historic data. In essence this means that the average US mortgage borrower has a 23 year fixed rate mortgage on a rate of only 3.8%.

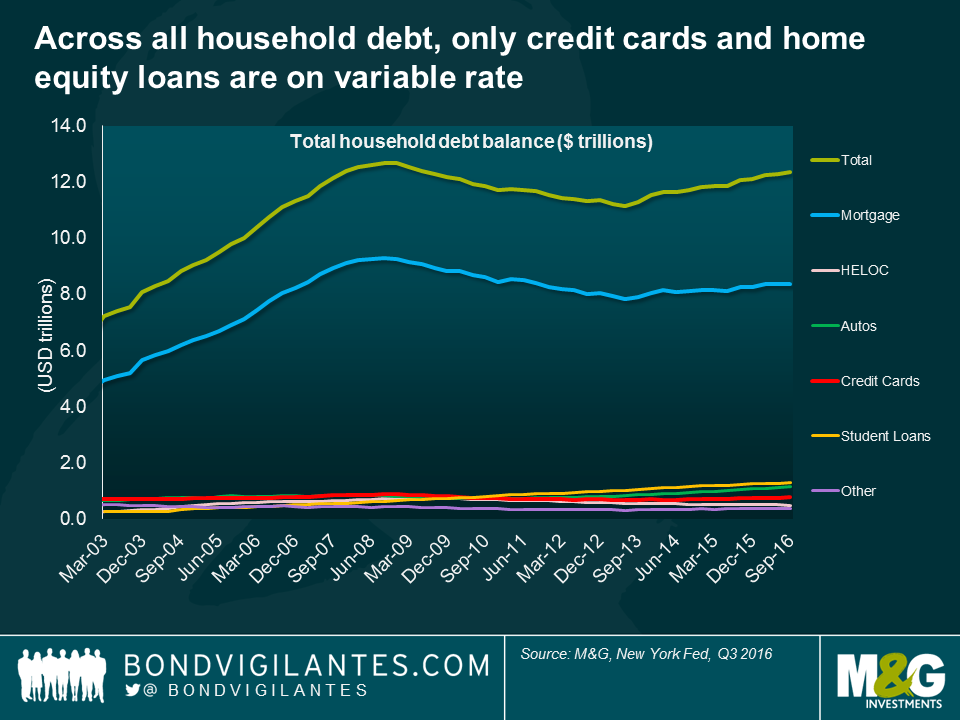

Taking it a step further, across all US household debt, it is only credit cards and perhaps home equity loans that are on variable rates. Thus around 90% of all household debt is on fixed rates. This long dated, fixed, and very low rate mortgage market has implications for the transmission mechanism of monetary policy in the US, meaning that the Fed Funds rate is a blunt tool to slow down the real economy as it takes a longer time for the force of higher interest rates to be felt.

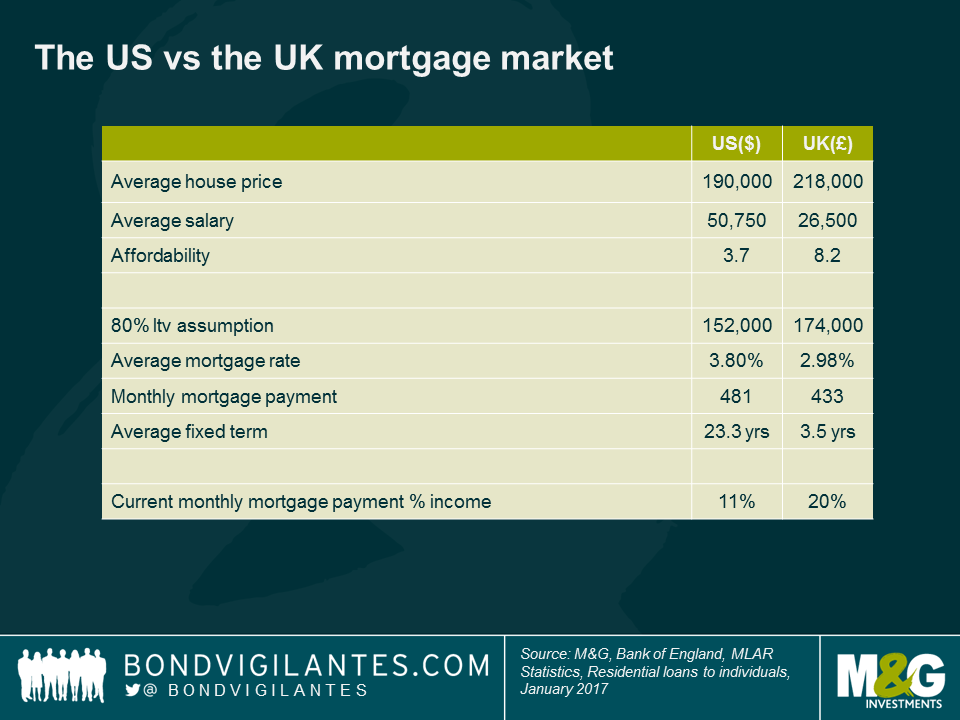

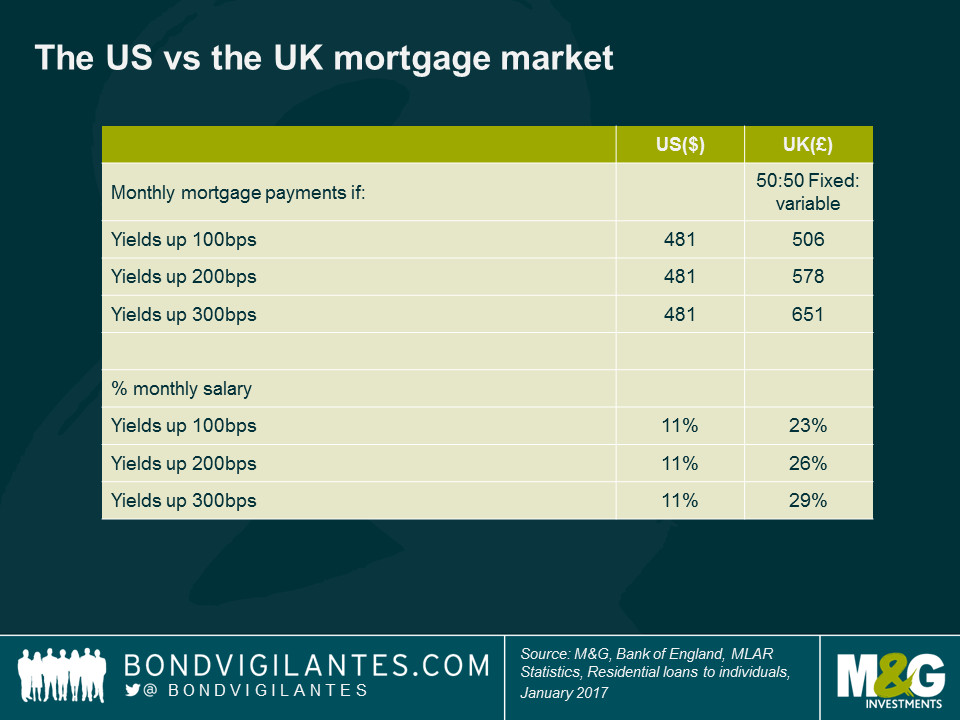

In contrast, in an economy such as the UK that has a fewer proportion of fixed rate loans and much shorter dated fixed rates offered, monetary tightening would be felt much sooner, as the household sector sees more income directed towards servicing loans with less left over for spending. To draw out the contrast between the two mortgage markets, I’ve made some simple assumptions with regards to average house prices, salary etc. At first glance, if we assume 80% loan to value ratios in both markets and take average mortgage rates across both markets, it appears that the two markets require similar monthly payments of $481 versus £433 per month. However, as the simplified affordability measures suggest, this is misleading. As a proportion of the average monthly salary, the US borrower pays just 11% on mortgage payments, compared to 20% in the UK.

Arguably the biggest difference lies in the differing average mortgage terms, 23.3 years in the US versus 3.5 years in the UK market. The impact of this difference, on the monetary policy transmission mechanism, can be further investigated under the assumption of rising rates. To do so, I have assumed constant mortgage margins and a UK mortgage market with 50% variable rate and 50% fixed rates (with fixed mortgages split between 2 year and 5 year terms).

The benefits of fixed rates at low levels in the US are plain to see. For every 1% rise in mortgage rates, the average UK borrower sees 3% more of their monthly salary sucked in to servicing the debt.

In actuality, my assumptions have been generous to the UK market in two key areas. Firstly, I have assumed that the mortgage rate increases occur quickly, so that those on 2year or 5year fixed rate mortgages, stay fixed, rather than reaching the end of the fixed rate and resulting in borrowers having to either re-mortgage to prevailing fixed rates, or take the standard variable rate. And secondly, I have assumed that the variable rate is today the same as the average mortgage rate in the UK (2.98%). A quick search online shows that it is probably more like 4%, or higher.

Though this work has many assumptions and is therefore very subjective, the implications are nevertheless clear; the monetary mechanism and the potential ramifications on consumption differ widely between the two countries. Through UK rate tightening, demand and consumption would adjust relatively quickly. The US household sector at this point in time however is much less sensitive to rate moves, and rates may need to increase higher – or the monetary policy time lag may be considerably longer – than is currently priced in.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox