El Niño is coming. What are the effects on GDP, commodity prices and inflation?

Whilst economic forecasters are currently concerned about falling oil prices and the implications for global growth, weather forecasters worry about the impact an El Niño weather event could have on global weather patterns. In August, America’s National Oceanic and Atmospheric Administration (NOAA) said there is a 90% chance that the current Niño event will continue through the remainder of the year, and an 85% chance that it will last until April 2016. This could result in temperatures 2°C higher than average, or more. Bill Patzert, a climatologist with NASA’s Jet Propulsion Laboratory in La Cañada Flintridge, has described the current Niño event as “Godzilla El Niño”.

Could such an extreme weather event have macroeconomic consequences? The short answer is yes. Economists Paul Cashin and Mehdi Raissi from the International Monetary Fund together with Kamiar Mohaddes from Cambridge University investigated the effects of El Niño events on growth, inflation, energy and food prices in a recent IMF working paper.

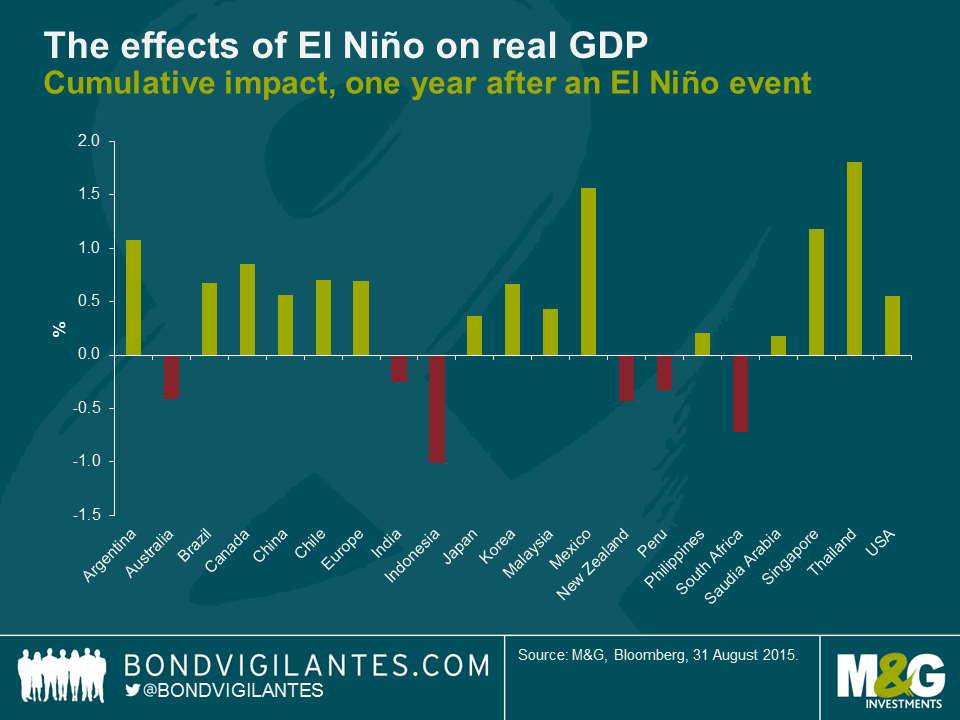

Using an econometric model and a sample of twenty-one countries, Cashin, Raissi and Mohaddes find that the economic consequences of El Niño weather events are large, statistically significant and common across different regions. The results of the analysis are below.

Countries impacted detrimentally by El Niño from a growth perspective are Indonesia, Australia, and New Zealand. El Niño causes hot and dry summers in Australia resulting in a higher number of bush fires and reduces wheat exports, resulting in higher wheat prices. In New Zealand, lower agricultural output is expected as the country attempts to deal with both floods and drought. Drought in Indonesia is harmful to the local economy and would likely result in higher global prices for commodities like coffee, cocoa, and palm oil. The authors also note that the extraction of nickel (Indonesia is the world’s top exporter) will become more difficult as mining equipment relies heavily on hydropower. South Africa will also be hit by drought, resulting in lower agricultural production.

Some countries growth profiles may actually benefit from an El Niño event. For example, droughts in the northern parts of Brazil could drive up global prices for coffee, sugar and citrus. However, the negative impact of this is mitigated by increased rain in eastern Brazil, leading to higher agricultural production. More importantly, trade spillovers with other Latin American and developed nations suggest a positive overall effect on Brazilian economic growth.

In Mexico, El Niño is associated with fewer hurricanes on the east coast bringing stability to oil production. For the United States, wet weather is expected in California (which may end four years of drought). This will benefit crops of limes, almonds and avocados. There could be warmer winters in the Northeast, increased rainfall in the South, and a decrease in the number of hurricanes that hit the East coast. Singapore benefits from an increase in trade as demand increases in the developed world.

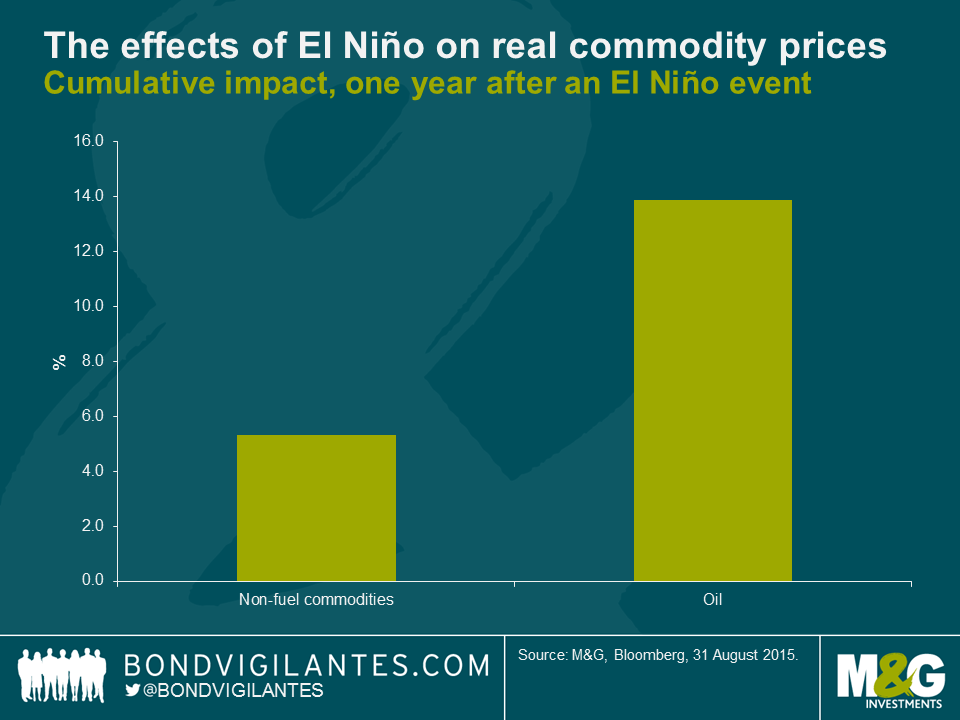

Turning to the effects of on commodity prices, Cashin, Raissi and Mohaddes note that the higher temperatures and droughts following an El Niño event, particularly in Asia-Pacific countries, not only increases the prices of non-fuel commodities, but also leads to higher demand for coal and crude oil as lower electricity output is generated from both thermal power plants and hydroelectric dams. In addition, farmers increase their water demand for irrigation purposes, which further increases the fuel demand for power generation and drives up energy prices. The authors confirm that crude oil prices (as a proxy for fuel prices) sustain a statistically significant and positive change following an El Niño shock.

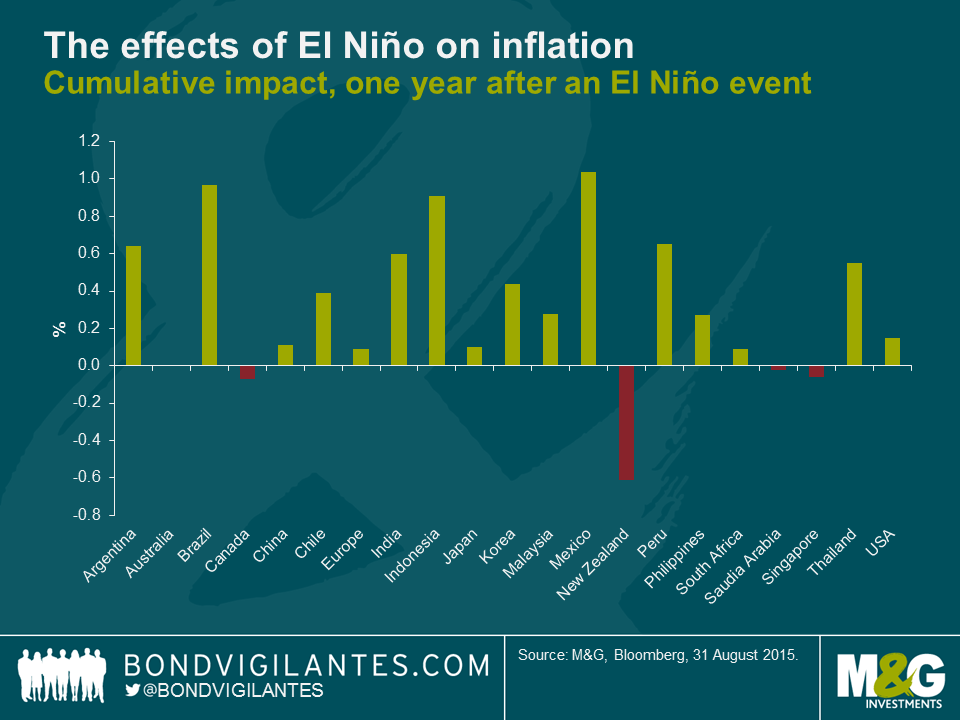

Higher non-fuel commodity and oil prices will likely result in higher global inflation levels. Those countries that are most affected by rising inflation levels that are the result of El Niño are Mexico (+104bps), Brazil (97bps) and Indonesia (91bps). These large effects are a result of the high weighting of food in the CPI basket of these countries. Inflation in the US and Europe increases by only a small amount (14 and 9 bps respectively) according to the econometric model.

Extreme weather conditions have the ability to restrict the supply of agricultural commodities, create food price inflation which leads to higher overall inflation, and generate social unrest in those countries where food represents a substantial portion of the consumer basket of goods and services. While Australia, Chile, Indonesia, India, Japan, New Zealand and South Africa face a short-lived fall in economic activity following an El Niño weather shock, the United States, Europe and China actually benefit (possibly indirectly through third market effects) from such a climatological change.

If the “Godzilla El Niño” takes hold as the NOAA expects, the global economy will likely be hit by short-run inflationary pressures, as global energy and non-fuel commodity prices rise. But it will be important to understand the effects will differ across regions, with some economies actually benefiting with an increase in demand and higher economic growth.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox