UK inflation falls, but potentially worrying signs

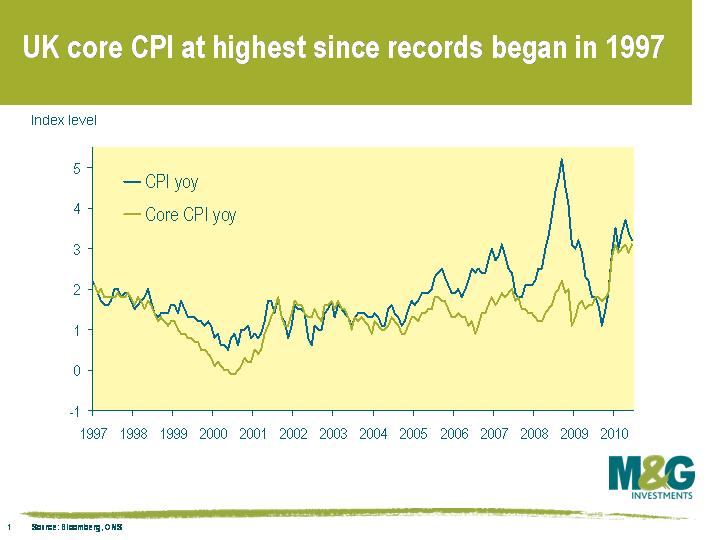

The good news was that UK CPI fell from 3.2% to 3.1%. The less good news was that this was 0.1% higher than expectations and remains above the 3.0% upper bound (inflation hasn’t been below 3% since December last year). The worrying news was that the Core CPI measure, which excludes food, alcohol, tobacco and energy prices, jumped 0.2% to 3.1%, and was 0.3% above expectations. Core inflation strips out the more volatile elements of inflation, and if you believe these elements are temporary in nature, then it provides a ‘truer’ picture of inflation. This is the highest core inflation rate since records began in 1997, although it’s a rate that’s been equalled twice already this year. This chart shows CPI versus core CPI since 1997.

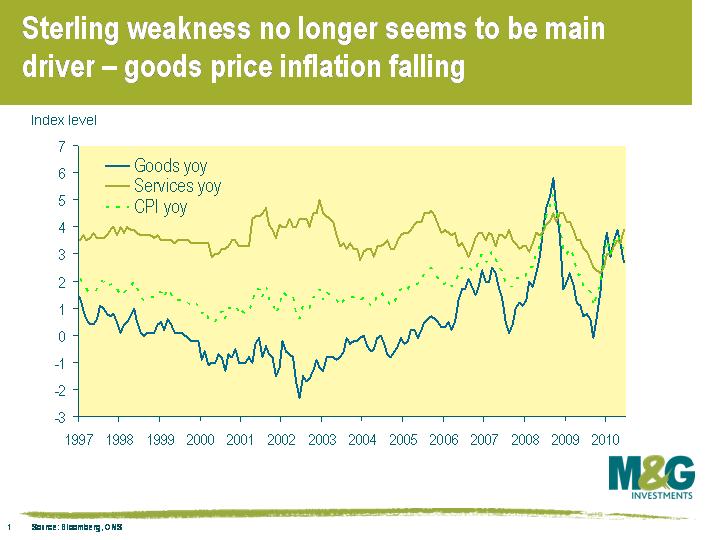

The reason for inflation coming in higher than expected was down to the services component (see chart), which is also a bit worrying. Goods price inflation (currently 55% of the CPI bucket) had been the main driver of the UK inflation rate, with part of the reason likely to have been the lagged effect of sterling weakness (see previous blog here). However, an increase in the services component (45% of CPI) suggests that inflationary pressure is beginning to come from domestic sources rather than international sources.

This does seem to lend some support to the MPC’s chief hawk Andrew Sentance, who has today again argued that spare capacity in the economy is not as large as was previously supposed. As explained from page 9 of his speech today, unemployment is lower than has been seen at this stage of previous cycles (and labour demand may be picking up), companies have adjusted quickly to lower levels of demand and are not reporting significant spare capacity, and wage growth has exceeded expectations. “As spare capacity has not exerted much downward pressure on inflation so far, so there must be a high degree of uncertainty about its future impact”.

Does this mean that we can look forward to a series of interest rate rises soon? Unlikely. Andrew Sentance was the only member to vote for a rate hike in June, and in today’s speech, even he concluded that he is not in favour of a sharp rise in interest rates, favouring “a gradual rise in the Bank Rate which would be aimed to avoid destabilising confidence through a sudden policy lurch”. The majority of MPC members also need to agree with Sentance, which may be tricky if the rumours that Mervyn King believes that the ‘Bank rate will stay low for four years‘ are true. Furthermore, we have little idea yet how the UK or global economy will react to the huge fiscal tightening that is coming, which leads me to believe that even if inflation does rise further through the remainder of this year, UK interest rates are unlikely to rise until economic growth follows a similar trajectory.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox