Chart of the day – emerging market bonds vs high yield bonds

Emerging market sovereign bonds have had a fantastic run. Since the beginning of 2003, Russian government bonds have returned 78%, while Brazil has returned 172%. Ecuadorian government bonds have returned a massive 253%. But we’re not interested in historical returns, we’re bothered about future returns. Are emerging market bonds good value now?

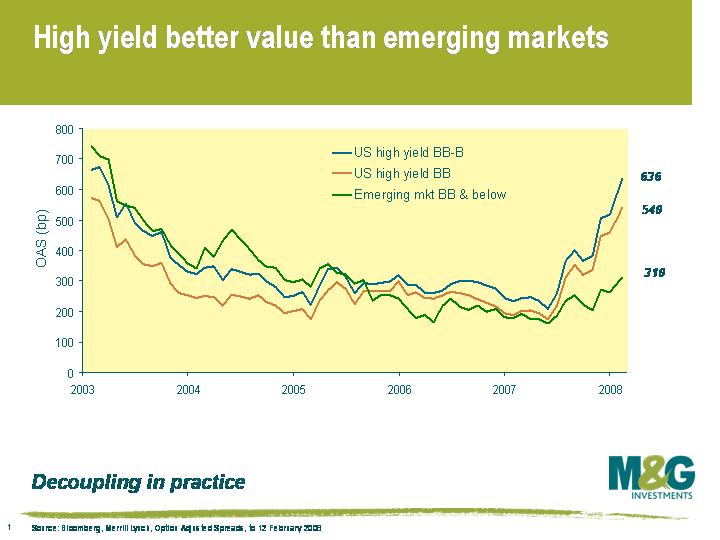

This chart shows the spread (ie the excess yield over US Treasuries) on emerging market bonds versus US high yield corporate bonds. I’ve compared an emerging market index against a US BB rated high yield index and a US BB&B rated high yield index. Based on the credit rating breakdowns, you’d expect the spread on the emerging market index to sit somewhere between the two US high yield indices.

As the chart shows, emerging market bond spreads followed the two US high yield indices fairly closely from 2003 up until the credit crunch, but the markets have significantly diverged since last summer. The average US high yield bond now pays about a 6% yield over a US Treasury, while emerging market sovereign bonds have hardly budged and only yield about 3% over US Treasuries. In fact the premium for investing in junk rated emerging market bonds is now about the same as investing in US BBB rated corporate bonds.

This looks to me like investors buying into the concept of ‘decoupling’, and as I argued here in December, I don’t believe in it. The emerging market economies will not come to the rescue of the global economy. Some investors seem to have forgotten that governments do actually default – in the last 10 years alone, we’ve seen the default of Argentina, Dominican Republic, Ecuador, Moldova, Pakistan, Russia, Ukraine and Uruguay. If anyone is still not convinced that governments default, then I thoroughly recommend skim-reading a paper from Reinhart et al – some great stats on pages 8-12: Spain defaulted 13 times between 1557 and 1882, France defaulted 8 times between 1550 and 1800 (debt restructuring “was often accomplished by simply beheading the creditors”) and Venezuela has defaulted 9 times since 1824.

I anticipate significant spread widening in emerging market bonds. The M&G Emerging Markets Bond Fund is positioned defensively, and currently holds 14% in US Treasuries and 6% in German bunds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox