Who owns government bonds these days?

The IMF recently released a working paper entitled “Government Bonds and Their Investors: What are the Facts and Do They Matter?” which helps shine a light on whether a change in the investor base in recent years has had an impact on yields. One of the key trends since the onset of the crisis has been a shift in the ownership of government bonds from foreign holders back to domestic holders. This can partly be explained by the various forms of quantitative easing that central banks have embarked on and a move by banks to hold more government bonds.

The IMF find that an increasing share of non-resident investors is associated with lower yields. The econometric results show that an increase (decrease) in non-resident investors by 10 percentage points is associated with a reduction (increase) in 10-year government bond yields of between 32 to 43 basis points, whereby the effect is closer to 66 basis points for euro area countries. With that finding in mind, let’s look at the proportion of non-resident holdings of government bonds across the countries.

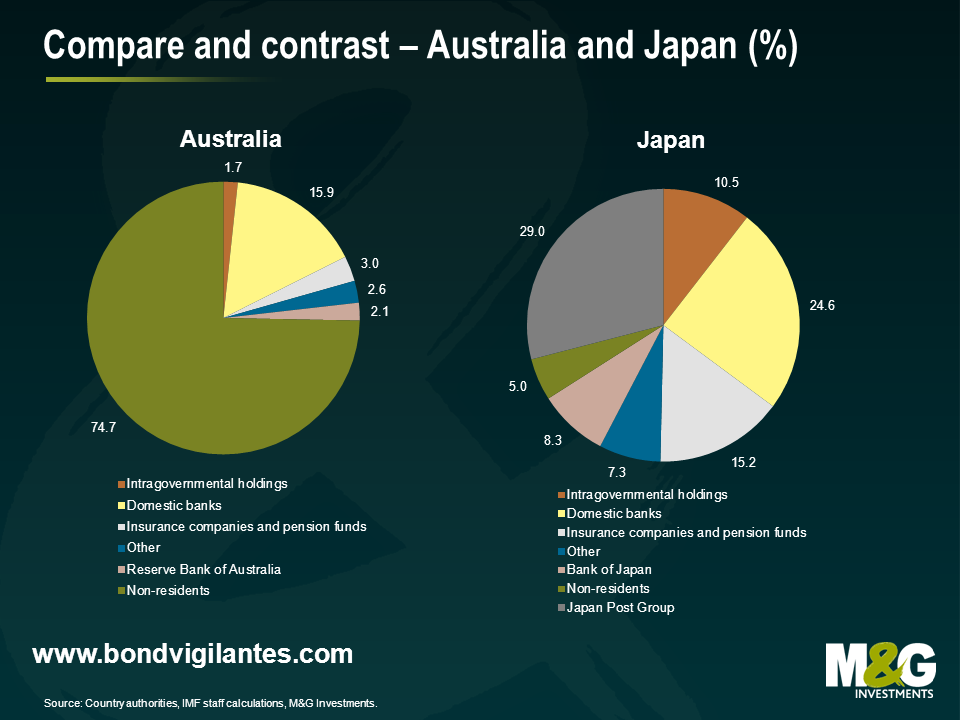

The first chart looks at who owns the government debt of Australia and Japan. We have written before about our concerns about the amount of Australian debt that non-resident investors own. For us, this is worrying as heavy foreign ownership of government bonds can be very dangerous, particularly when this is combined with a country running a current account deficit (i.e. the country is reliant on capital inflows from abroad). Non-resident holdings of AGBs has risen from around 30% in 2000 to over 80% today. In contrast, Japan has a very low share of non-resident holdings. This domestic investor base is mostly the result of pension savings and a strong home bias. The large domestic investor base has been associated with the low and stable yields despite very high debt.

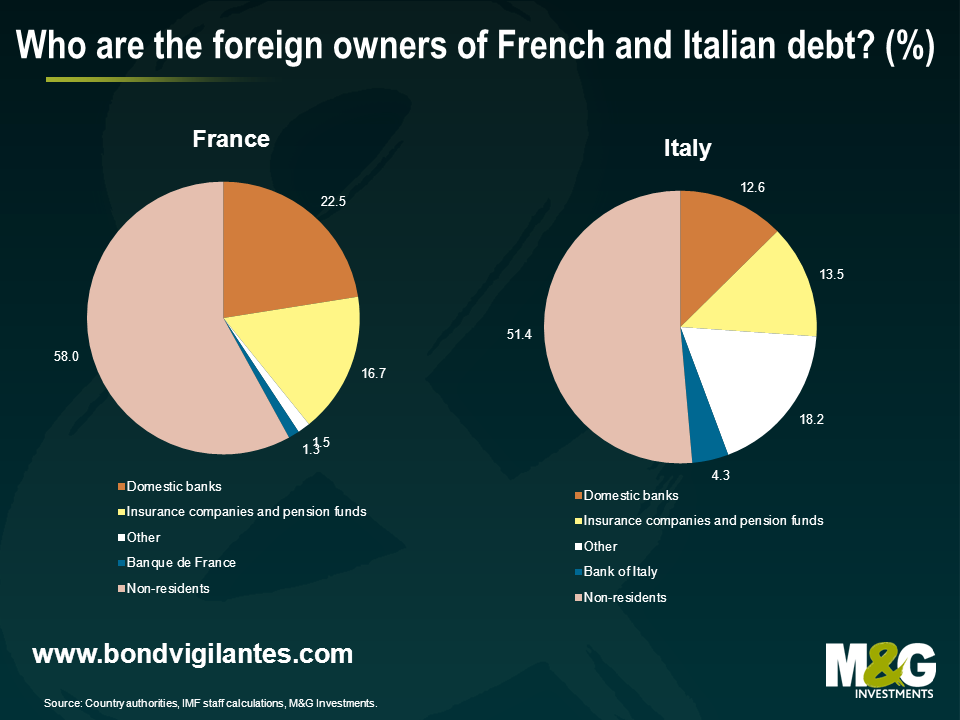

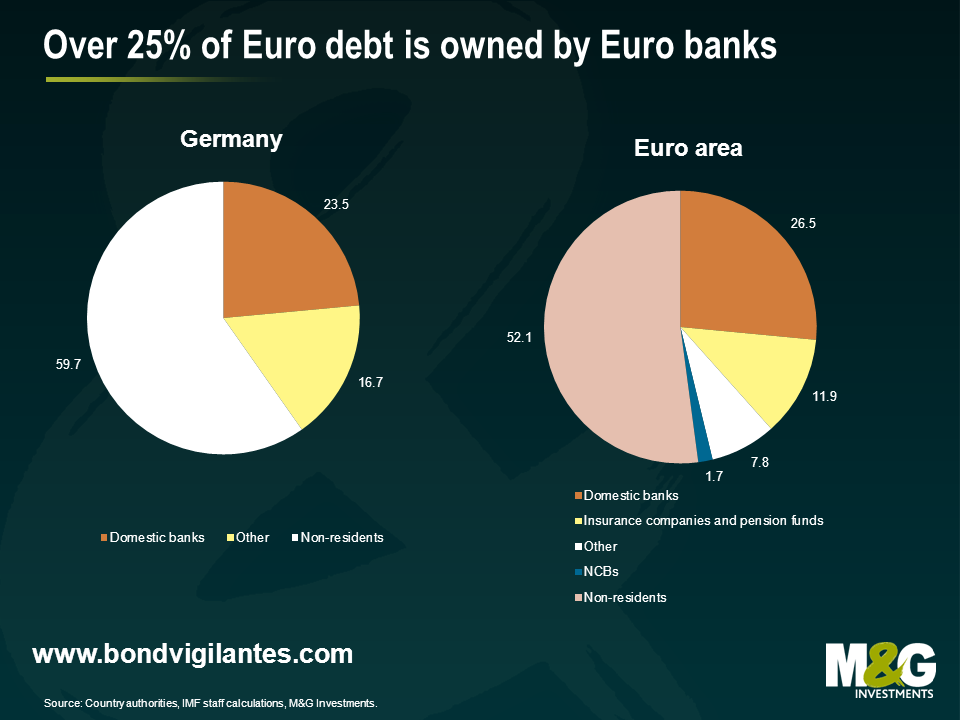

In many countries, non-resident holders make up the largest share of the investor base though this has fallen somewhat in recent years. This is particularly the case for euro area countries. Aggregating the data for individual countries across the euro area, about one quarter of the outstanding debt is held by euro-area residents other than the issuing country, while another quarter is held by residents outside the euro area. Despite the apparently very high share of non-resident holdings in the euro area, on aggregate the euro area depends less on foreign buyers than the United Kingdom or the United States.

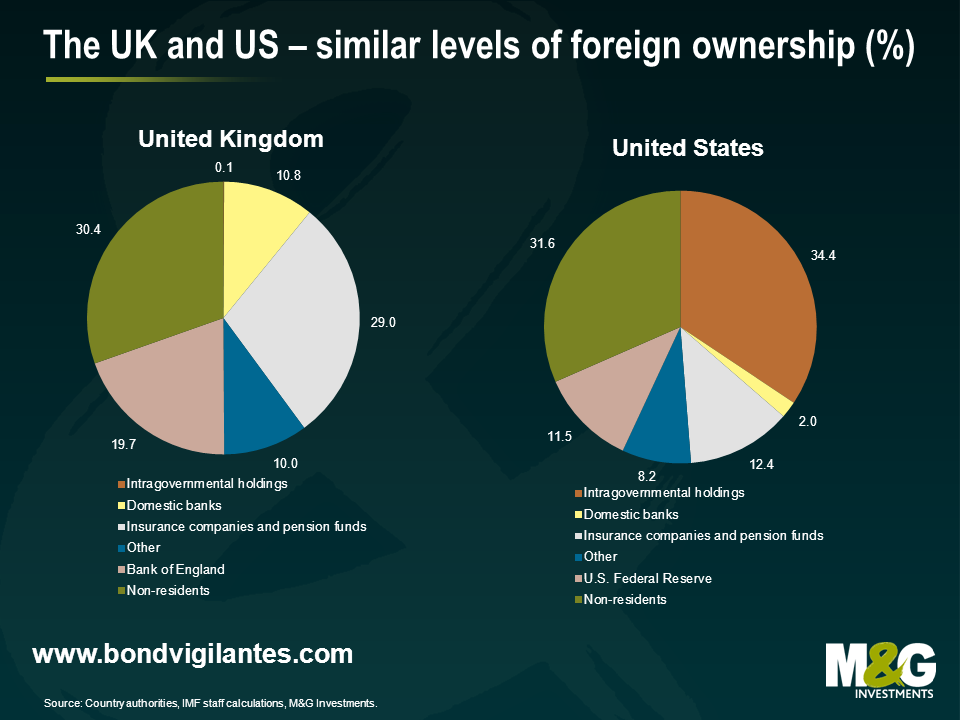

Whilst the UK and US show similar ownership proportions for non-residents, there is a large difference in the proportion that domestic banks, insurance companies and pension funds own. In the United Kingdom, long term yields declined following the increase in pension funds’ holdings of gilts. This portfolio shift, in particular into ultra-long gilts, has been attributed to changes of U.K. pension fund regulations with the aim of reducing the maturity mismatch between assets and pension liabilities. In the US, the large proportion of intragovernmental holdings can in-part be attributed to the Social Security Trust Fund which holds about 20 percent of outstanding U.S. Treasuries.

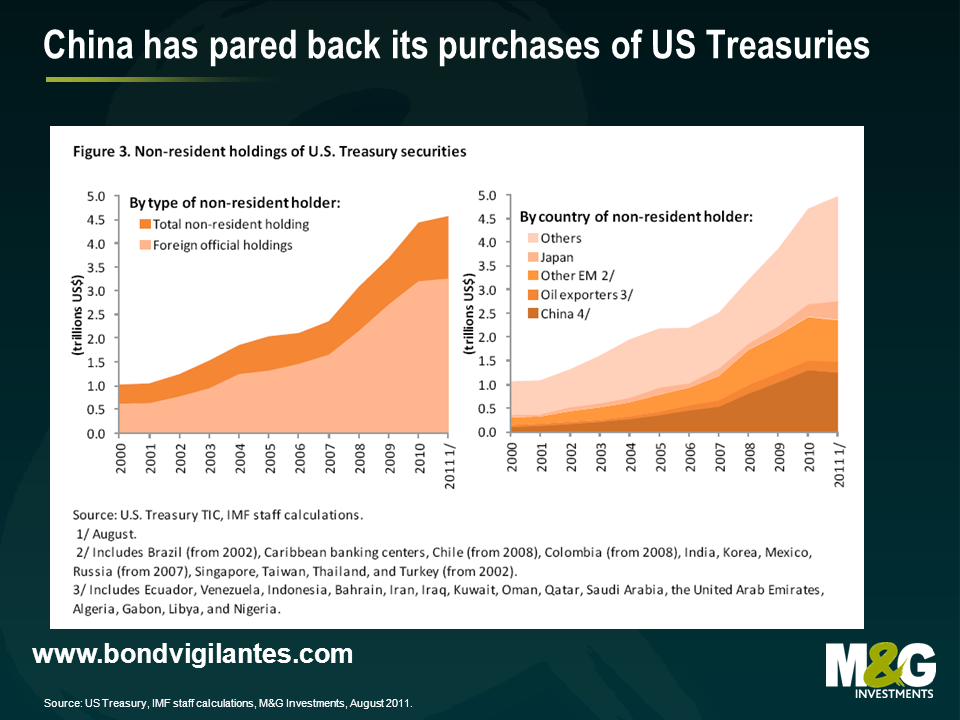

The other interesting data in the IMF paper was on non-resident holdings of US Treasuries. The total amount of US government debt owned by China, the Oil exporters and other EM has been falling since 2010. That said, as at August 2011, non-residents owned almost $5.0 trillion of US Treasuries.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox