Will the Bank of England’s latest banking sector policies promote lending to the real economy?

Guest contributor – Mark Robinson (Financial Institutions Analyst, M&G Fixed Income Team)

The Bank of England recently announced two new measures focussed on the banking sector, which are primarily designed to improve monetary policy transmission from banks to households and corporates and, indirectly, are probably intended to stimulate loan growth. In this blog post, I’ll examine these actions more closely, and assess the likelihood of their success.

Firstly, a quick primer on the new measures: the Term Funding Scheme (TFS) allows banks and building societies to borrow four year money at “close to” the BoE base rate. Banks must maintain or increase lending volumes; else face a penalty funding cost of at most base rate + 25 basis points. There is, therefore, more than a hint that this arrangement is, indirectly, intended to encourage the banks to keep lending. The Monetary Policy Committee estimates that initial drawdowns could, theoretically, be as much as £100bn, funded by money creation as part of the Asset Purchase Facility.

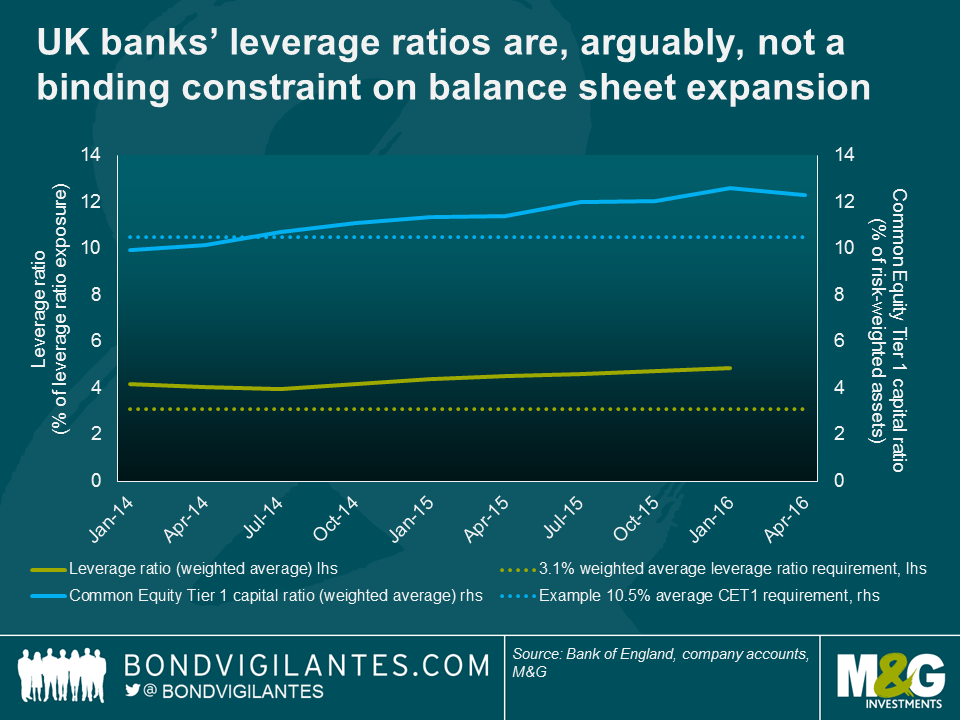

The second new measure is the exclusion of central bank reserves from the leverage ratio exposure calculation. This comes into place with immediate effect and, in theory, could encourage banks to increase leverage going into the expected economic downturn. Conscious of this risk, the BoE’s Financial Policy Committee will consult on the leverage ratio next year, and will likely increase the requirement (or its buffers) so as to neutralise the impact of the initial relaxation. Why go through this process at all, then? To remove the effective leverage penalty of holding central bank reserves, and therefore encourage the banks to use the TFS in the first place. The leverage ratio is also not a binding constraint on bank lending, something that can be illustrated using the following graph.

In the above chart, the important illustration is the difference between each curve and its respective minimum requirement (represented by the dotted lines). At an average of 4.9%, the major UK banks’ leverage ratios are already a fairly significant 58% above the average requirement of 3.1%. In comparison, the average 12.3% common equity capital level is only 17% above an assumed 10.5% requirement. The straightforward conclusion is clear: leverage, although arguably high, is not a binding constraint on bank balance sheet expansion, nor on lending. Any constraint on lending comes partly from a lack of high quality equity capital, relative to the higher risk-weighted capital requirements. Therefore, as the FPC also highlight, relaxing the leverage requirement won’t encourage an increased supply of bank loans, but measures such as relaxing the capital requirements (e.g. the removal of the counter-cyclical capital buffer, as announced in the July Financial Stability Report) should be a little more effective.

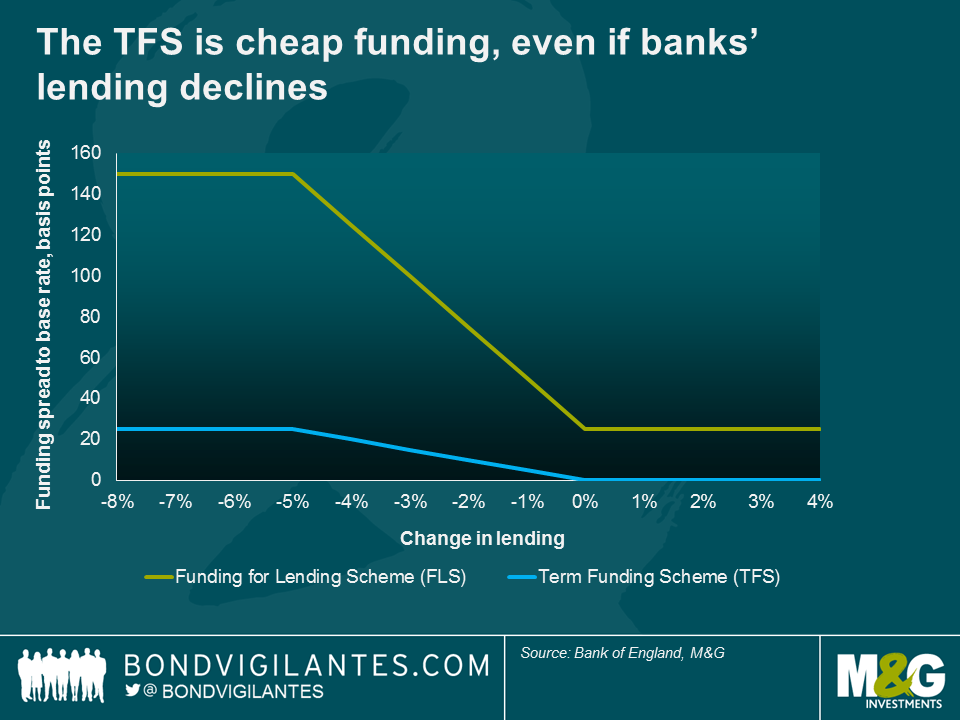

Having established that the leverage ratio adjustment seems to be designed almost entirely to encourage banks to use the TFS, let’s take a better look at this facility and its potential users. A closer examination raises a couple of problems. Firstly, we know from the major banks’ disclosures and liquidity coverage ratios that they already have fairly large amounts of cash liquidity on their balance sheets, which they are unable to put to work as loans; in part, because of the capital constraint mentioned above. The FPC highlight that the major UK banks have £350bn in central bank reserves alone, plus additional cash deposited at other financial institutions, and high quality government bond holdings. Therefore, unless they are able to quickly roll off older, more expensive funding, the UK banks simply might not want or need the extra TFS cash on offer. Secondly, as per the chart below, the penalty is not large for a bank that uses the TFS, and subsequently allows its lending to decrease: being charged base +25bp for four year funding is still cheaper than issuing a covered bond in GBP (the benchmark sterling four year swap rate is at 44bp at the time of writing), and retail savings of this tenor would cost a bank about 1.5%. On the plus side, as per the MPC’s main intention, if banks use the TFS, the monetary policy transmission mechanism should be more effective, since banks (especially small banks and building societies) have less of an excuse not to pass on the rate cuts to borrowers whilst being able to preserve their net interest margins. Lower loan rates naturally have an important positive spillover effect to consumption and confidence.

And it is this confidence that is key to the other essential element of the lending equation: the demand for loans from corporates and households. Here, the picture is weak, with the BoE’s own credit conditions survey portraying a drop in the perceived demand for corporate credit, even before the EU referendum result. Data points since then indicate falling production and confidence levels, which will likely cause loan demand to fall. The previous Funding for Lending Scheme didn’t receive much in the way of usage in its latter, SME lending, guise, with banks anecdotally citing a lack of demand for SME loans as reason not to draw down on the scheme. And, as Jim blogged about here, the BoE’s corporate bond purchases will likely make it more desirable for large corporates to borrow from the bond market; potentially reducing the demand for bank loans further still.

In summary, there are persuasive arguments that both the supply side and demand side of bank credit provision remain suppressed. As well as focussing on new banking sector policies and their implications, it’s equally important for us to keep asking the bigger picture questions: from a financial stability perspective, is it wise to indirectly encourage the banking sector to increase lending going into an economic downturn? Is the UK economy too reliant on credit, and does it need a structural adjustment, rather than its banks being used as a policy tool? Or, if the authorities don’t want to tackle the economy’s credit binge, should they do more to encourage direct or indirect lending to consumers and SMEs from asset managers and insurers instead of banks? These are questions that may become more pressing as monetary policy, and banking sector credit creation, start to reach their limits.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox