Cracks appearing in Euroland

Jean-Claude Trichet at the European Central Bank has the same headache as Ben Bernanke and Mervyn King. Economic growth is set to slow sharply, at least if Tuesday’s ZEW survey of Eurozone growth expectations is anything to go by. Weakening growth would normally mean lower interest rates, but the ECB’s hands are tied because European inflation leapt to 3.7% in May, the highest rate since June 1992.

Trichet’s recent tough talk suggests that the ECB will hike rates to pull back inflationary expectations, and the European bond market has responded by pricing in at least two rate rises by this time next year. Higher interest rates will help bring eurozone inflation down, but it will also put the weaker eurozone countries under a lot of pressure.

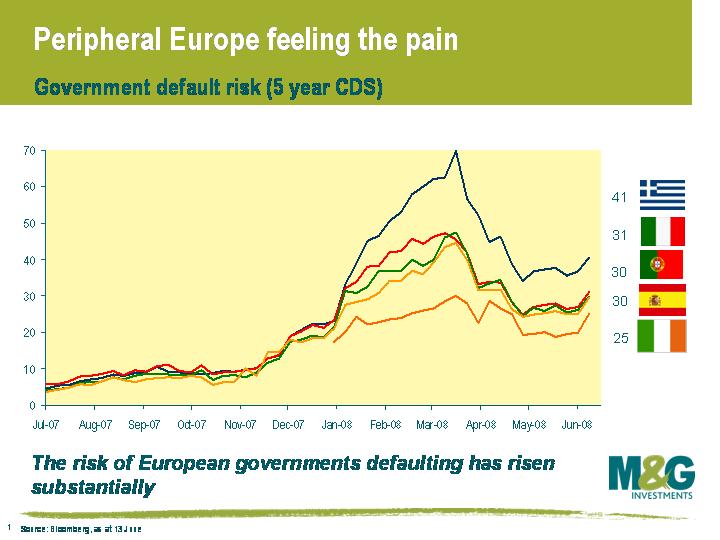

Add into the mix Ireland’s ‘no vote’, and it’s clear that there are some big challenges ahead for Europe. As this chart shows, the default risk of the PIIGS (Portugal, Italy, Ireland, Greece and Spain) has started creeping up again. In fact, there are already signs that euro notes aren’t homogenous any more – notes printed in Germany appear to be carrying more value than euros printed elsewhere.

The breakup of the euro is still very unlikely, but just an increase in the perceived risk of the currency failing has big implications. For example, if Italy decided it would be beneficial to drop out of the euro and introduce a new lira, then you can be sure that Italian government bonds would have a much bigger risk premium relative to German bunds, and companies such as Telecom Italia won’t be trading where they are now. What we’ve seen in the past few months is that the bond market is starting to price in this risk.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox