Investment grade credit spreads spinning wider

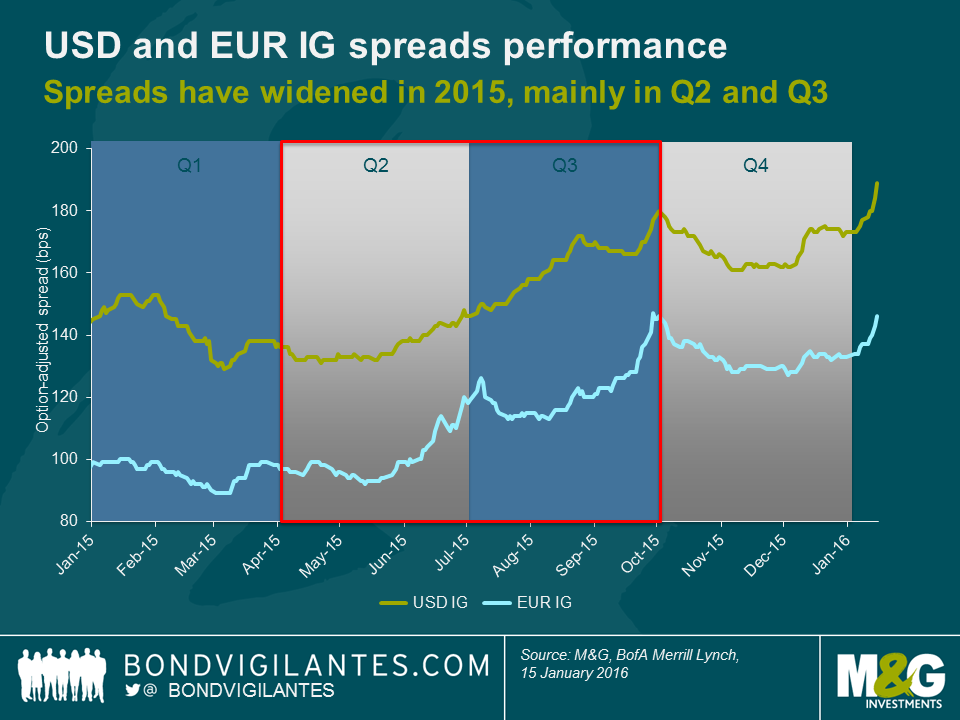

We recently blogged about the uninspiring performance of many fixed income asset classes in 2015. Investment grade (IG) corporate bonds certainly had a tough year as credit spreads trended wider, both in the USD and the EUR market. Taking a look at option-adjusted spread (OAS) levels, USD IG credit (+29 bps) marginally outperformed against EUR IG credit (+36 bps) in 2015. In both cases periods of spread compression in Q1 and Q4 were short-lived and failed to offset substantial spread widening in Q2 and Q3 (see chart below).

The sell-off in Q2 and Q3 was caused by a combination of heavy new issue volumes and subdued demand for corporate bonds, as investors rushed into safe-haven assets after a string of “risk-off” episodes, mainly the Greek referendum, worries about China and other emerging markets and weakness in commodity prices. The latter two themes have so far been dominating news headlines in 2016 as well, and consequently IG OAS levels have gapped wider again in the first half of January (+16 bps for USD IG and +13 bps for EUR IG).

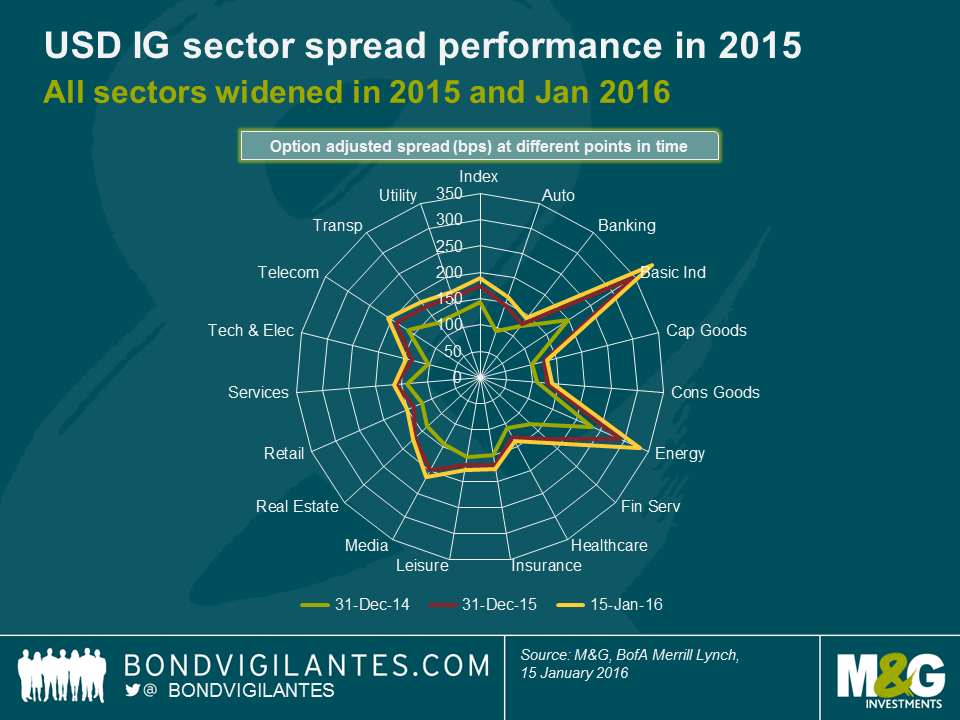

But is it fair to say that IG corporate bonds as a whole are now more attractively valued than at the end of 2014, or have overall bond index levels merely been driven wider by extreme spread moves within the commodity complex? To answer this question, we have to deconstruct bond indices into industry sectors (see chart below).

Unsurprisingly, the worst performing sectors in the USD IG universe have been energy and particularly basic materials which have widened on an OAS basis by 101 bps and 191 bps, respectively, from the end of 2014 until mid-January 2016. While these moves are certainly large, it is important to highlight that other sectors have sold off significantly over the same period as well, e.g., media (+72 bps), automotive (+67 bps) or financial services (+54 bps). In fact, the only sector that has widened by less than 20 bps is banking (+18 bps), which reflects that US banks are well-positioned in a rising rates environment. These numbers show that an across-the-board spread widening has taken place affecting every sector within the USD IG universe, albeit to varying degrees.

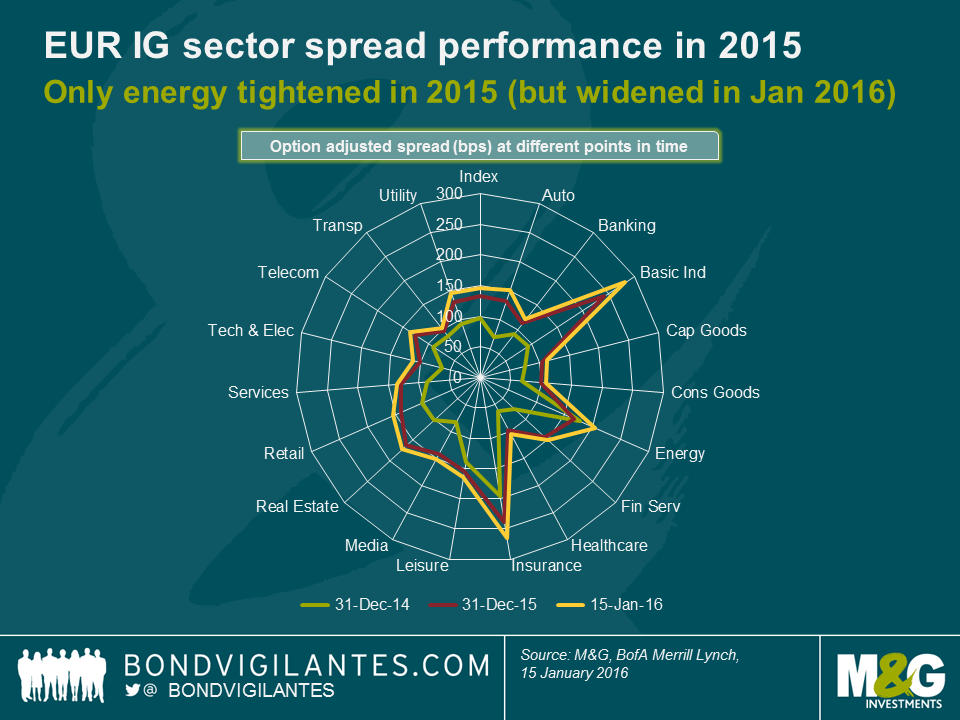

Just like in the case of USD IG credit, every sector in the EUR IG space (see chart below) has widened from the end of 2014 until mid-January 2016 on an OAS basis, with basic materials being by far the worst performer (+190 bps). This makes basic materials currently the widest sector in the EUR IG universe, even ahead of insurance (+70 bps), which used to trade at distinctly elevated spread levels compared to the rest of the index due to its high share of subordinated bonds and uncertainties around Solvency II legislation. The automotive sector has been the second worst performer (+82 bps), being hit by a slowdown in the Chinese market and the fallout from VW’s “diesel-gate” emissions scandal.

Interestingly, the EUR IG energy sector has performed very well (+27 bps) relative to its USD counterpart (+101 bps) from the end of 2014 until mid-January 2016. In 2015, it was in fact the only sector in both IG indices that exhibited OAS compression (-10 bps)! The reasons for this are twofold: First, EUR IG energy started 2015 at an already very high spread level (178 bps) relative to the EUR IG index (97 bps), from where it tightened meaningfully when the oil price temporarily rebounded in March and April last year. Second, the average credit rating of EUR IG energy is relatively high as it is dominated by AA and A rated issuers and contains far fewer BBB names than the USD IG energy sector. Thus, the widening of EUR IG energy spreads during the risk-off episodes in Q2 and Q3 2015 was dampened by a “flight to quality” of investors preferring higher- over lower-rated IG credits.

As described above, after a broad-based widening across all sectors, USD and EUR IG corporate bonds offer investors much higher credit spreads than at the end of 2014. In certain pockets of the markets, particularly for long-dated USD BBBs, current spread levels are exceptionally high for non-crisis times. So either we believe that recent market turmoil is just the beginning of something bigger, in which case we would expect IG credit spreads to continue to widen, or even to blow out to 2021/12 levels. Or we think that, despite certain global headwinds currently causing a risk-off sentiment across markets, developed economies are not going to enter a full-fledged recession any time soon. In that case EUR and USD IG corporate bond spreads would offer compelling valuations at the moment. Considering the strength of the US economy in general and as Richard wrote yesterday, its labour market in particular, in combination with modest economic improvements and accommodative monetary policy in Europe, we believe that the latter reading is a lot more convincing.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox