Reaction to S&P putting UK sovereign debt on negative outlook

This morning S&P announced that the outlook on UK’s long term sovereign credit rating was put on negative outlook. It’s important to stress that a change in rating outlook does not mean that a downgrade to AA is inevitable, but obviously the risk has increased (S&P say the chance is “one in three”). The primary reason for the change was that the “UK’s net general government debt may approach 100% of GDP and remain near that level in the medium term”. 10 year gilt yields initially spiked 13 basis points on the news, but have since recovered most of the lost ground.

In truth it’s a bit of a surprise that people were surprised. Firstly, it’s been clear for some time that the UK’s government debt is approaching 100% of GDP. Indeed the OECD were saying this back in March, as can be seen in the second chart in a recent comment on this blog (see here).

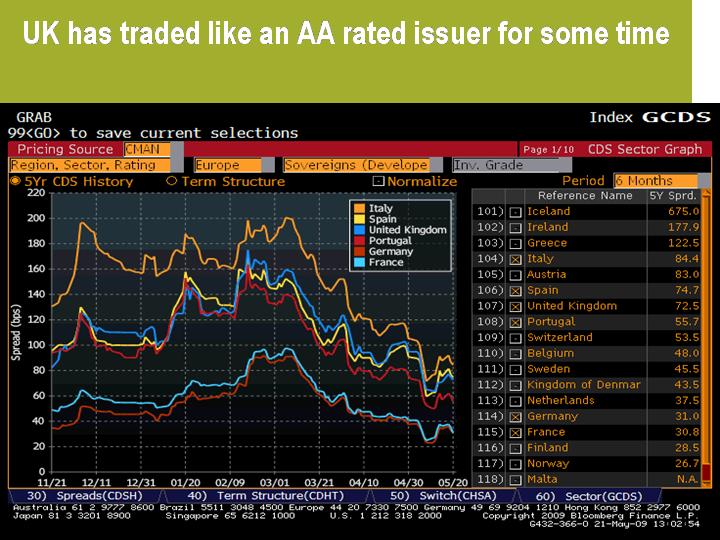

Secondly, as we wrote in October last year and more recently this February, the credit derivatives market has long been saying that the risk of default on the UK is broadly in line with an AA rated sovereign rather than an AAA rated one. This chart (data as at the end of yesterday) shows the 5 year CDS on a range of European sovereigns, and as you can see the premium for insuring against the risk of default on Germany and France (both rated AAA) has been considerably lower than the premium for the UK for quite a while. Since the end of last year, the implied risk of default on the UK has been more in line with AA rated issuers such as Belgium, Portugal and Spain. (Note that if the credit derivative market is anything to go by, Switzerland and particularly Austria may soon find their AAA rating under threat too).

Secondly, as we wrote in October last year and more recently this February, the credit derivatives market has long been saying that the risk of default on the UK is broadly in line with an AA rated sovereign rather than an AAA rated one. This chart (data as at the end of yesterday) shows the 5 year CDS on a range of European sovereigns, and as you can see the premium for insuring against the risk of default on Germany and France (both rated AAA) has been considerably lower than the premium for the UK for quite a while. Since the end of last year, the implied risk of default on the UK has been more in line with AA rated issuers such as Belgium, Portugal and Spain. (Note that if the credit derivative market is anything to go by, Switzerland and particularly Austria may soon find their AAA rating under threat too).

So does it matter if the UK does eventually get downgraded to AA? Judging by this morning’s very successful UK government bond issue, not much. The UK’s Debt Management Office issued £5bn of UK gilts maturing in 2014, and the issue attracted bids for 2.6 times the amount offered. This was impressive considering that, as RBC have pointed out, it was the biggest ever nominal amount of bonds sold in a single operation. Also, a credit rating downgrade doesn’t necessarily mean government bond yields will rise – Moody’s downgraded Japan to A2 in June 2002, which was lower than the credit rating of Botswana at the time, and that didn’t stop 10 year Japanese government bond yields getting to 0.4% in May 2003. And lastly, what do the credit rating agencies know anyway – as we’ve previously documented on this blog (see here), Moody’s rated Iceland Aaa until May 2008.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox