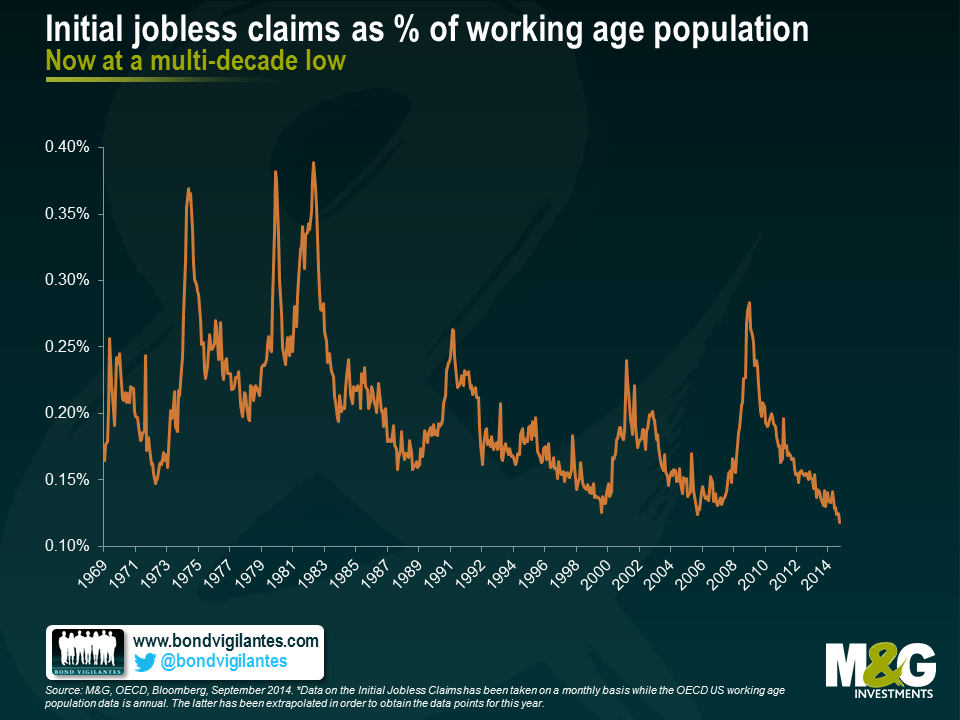

US Jobless claims as a percentage of the labour force is now at multi-decade lows

I blogged last year about the state of the US labour market and given the recent release of September’s initial jobless claims data, this seems like a good time to revisit these ideas.

US Initial Jobless Claims is an unemployment indicator which tracks the number of people who have filed jobless claims for the first time, representing the flow of people receiving unemployment benefits. The September headline figure of 288,000 is strikingly low and is the lowest reported month end figure since January 2006. Still, this understates the current strength of the labour market as when adjusting to take into account the working population, jobless claims as a percentage of the US labour force is now at multi-decade historical lows.

Initial Jobless claims data has been taken on a monthly basis whereas the OECD US working age population data is annual. Therefore what is particularly important to note is that the latter figure for 2014 is not yet available and so the 2013 data has been extrapolated and kept stale since year end. As a result, the graph is more conservative than reality since 2014 population growth to date has not been incorporated. If it were, the fall in this indicator would be even more pronounced.

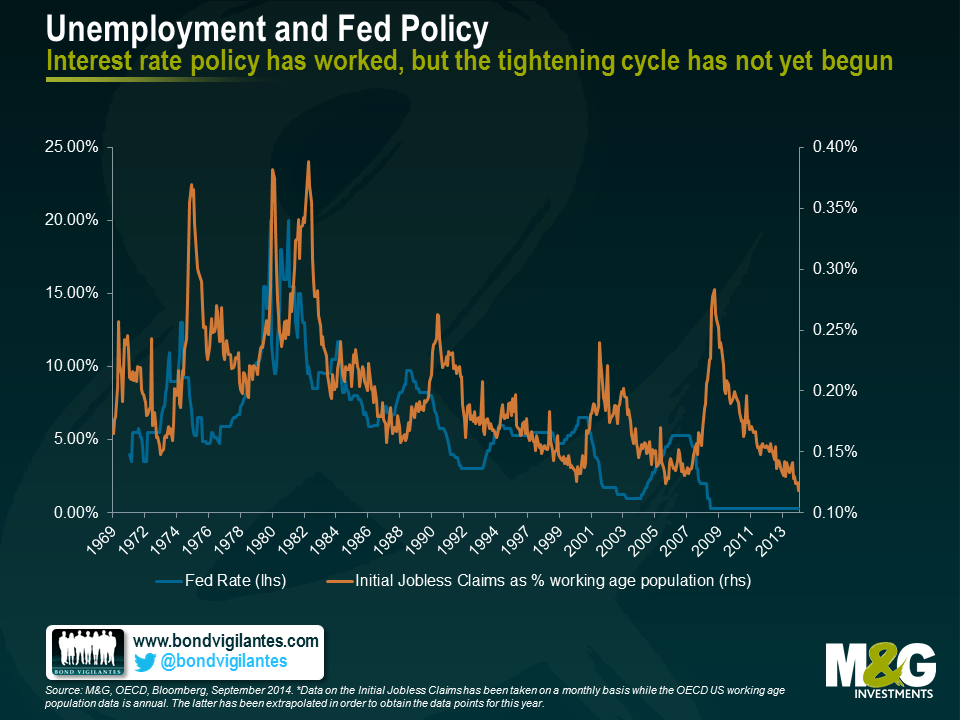

Traditionally monetary policy has worked with the Fed tightening as the economy picks up steam and jobless claims fall. What is remarkable today is that the Fed hasn’t even begun to tighten interest rates. In the past, the Fed would have already ended the tightening cycle by the time jobless claims fell to the levels we see today.

Time and again the Fed has stressed that rate decisions will be data dependent and on Tuesday and Wednesday next week the FOMC are due to decide on whether or not it ends its QE program. Given the above, it seems that the US economy is continuing its healthy response to the stimulus provided and momentum in the US labour force is gathering pace in a positive direction. With more people working and fewer claiming unemployment benefits, the downward trajectory of this indicator – as well as other labour market indicators – surely helps to paint a positive macro picture. However, the risk-off wobble in markets last week has left many questioning whether the volatility experienced will have any bearing on the QE decision. Considering however that the trigger was the underperformance of US Retails Sales data, it can perhaps be argued that this is a typically volatile number in itself and the data release therefore triggered an overreaction in bond markets (exacerbated by capitulations, technical trading level breaches etc).

If the FOMC is in agreement that the market response was overdone, one should expect their decision to be based on the fundamentals and the picture of an overall improving economy. If true to their rhetoric, markets should expect to see an end to asset purchases, right on schedule.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox